SK hynix has achieved their record-high quarterly sales in the second quarter. Operating profit also increased 55.6% compared to the same period last year. Even with a Russia-Ukraine war and global inflation, which are adverse factors, they still pull off good results. SK hynix is trying to overcome the market situation with plans to focus on LPDDR5 and high bandwidth memory(HBM)3, where the performance of second half of this year is unclear due to a decrease in shipments of information technology (IT) devices and smartphones causing decreasing demands of memory.

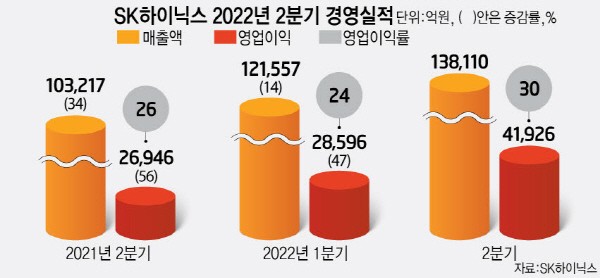

SK hynix held a business performance presentation on the 27th and announced that they recorded 13.811 trillion KRW in sales, 4.1926 trillion KRW in operating profit, and 2.8768 trillion KRW in net profit in the second quarter. This is the first time that SK hynix achieved a quarterly sale of 13 trillion KRW. Sales and operating profit increased by 34% and 56% compared to the same period last year. The operating margin was around 30%.

Such good performance was possible due to an increase in NAND flash prices and an increase in memory sales for servers. Although the average selling price (ASP) of DRAM declined due to the aggravation of the IT market environment from the impact of shrinking consumer sentiment due to concerns over inflation and economic recession in the second quarter, however, it counterbalanced by overall shipment growth and a stronger dollar.

Jong-won Noh, president of SK hynix, said, “By expanding sales of relatively strong demanding computing products, we have achieved a 10% increase in shipments. Sales from Solidigm also took a part in this achievement, a company SK hynix acquired recently.” Solidigm is Intel's NAND division and their main product is solid state drives (SSD) for business and enterprise. SK hynix's earnings reached a record high even excluding Solidigm's sales.

The view for the second half of the year is unclear. This is because memory demand could be significantly adjusted as shipments of PCs and smartphones have decreased, because consumer purchasing power has decreased due to inflation. Servers are also expected to try to deplete their inventories first by reducing corporate costs and reducing investment, which had strong demand in the first half of the year. President Noh said, “With reflected market uncertainty, the demand growth rate this year is expected to slow compared to the beginning of the year. The growth rate of DRAM is expected to reach around 10% and NAND around 20%. The shipment for the third quarter decreased compared to the original plan, we are planning to manufacture similar level as previous quarter.”

SK hynix plans to prepare a growth engine by focusing on making high-capacity of LPDDR5 and HBM3 product. Mobile LPDDR5 is expected to be adopted by flagship models of major new products in the second half of this year, therefore the proportion is expected to increase significantly compared to the first half. Sales of HBM3, which started mass-production in June and started supplying to Nvidia, are expected to accelerate in earnest.

President Noh said, “HBM3 will be combined with SK hynix’s new H100 (hopper graphic processing unit) and will be utilized in artificial intelligence (AI) based high-tech fields such as accelerated computing. We will solidify our position as the world’s number one and lead the high-performance premium memory market.”

By Staff Reporter Dong-jun Kwon (djkwon@etnews.com)