OLED Sales of 827 billion KRW last year

Stable customers such as LGD took a big role

Strengthening R&D… 900 research professional

‘Attention’ to expand their market base by ‘M&A’

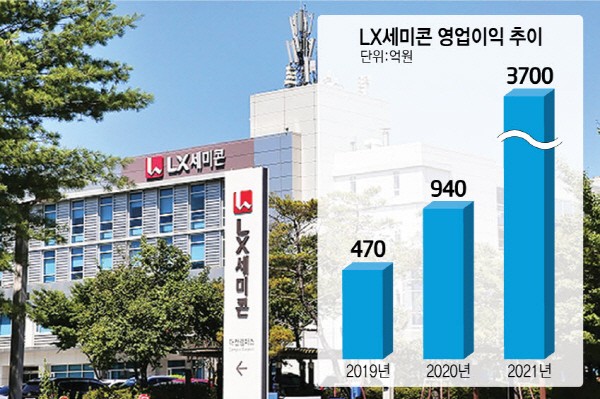

LX Semicon made a new record in the display driving chip (DDI) market last year. They also significantly narrowed the gap with the global the biggest and the second biggest DDI companies. This was possible by securing solid customer demand from domestic display companies. According to market research firm Omdia on the 7th, LX Semicon ranked as the third with an 11% share in the global DDI market last year. It increased by 0.9% points (P) from 2020, achieving the highest annual market share of LX Semicon. They surpassed Taiwan's Himax in 2018 to take the third place. At this time, they recorded 9% market share for the first time in their history and has been steadily rising. They are closely following Samsung System LSI and Novatek, the global first and second largest DDI companies.

The strong demand from LG Display took a big role, which is their largest customer in Korea. LG Display's large-scale organic light emitting diode (OLED) panel sales recorded 8 million units last year, up 70% from the previous year. It is expected to ship over 10 million units this year.

LX Semicon recorded 827 billion KRW in OLED DDI sales last year. This is an increase of 336 billion KRW compared to the previous year (491 billion KRW). This was the background of narrowing the gap in market share with Novatek, the second-largest DDI in the market. They succeeded in narrowing the gap in TV DDI market share between LX Semicon and Novatek by 2.7%P from 3.2%P in 2020 to 0.5%P last year.

The proportion of small and medium-sized OLED DDI sales is also increasing. They diversified their portfolio by raising the proportion of small and medium-sized DDI sales from only 22% in 2018 to 31% last year. This was the result of actively responding to the demand for information technology (IT) devices such as laptops and tablet PC.

They are also strengthening their DDI R&D capability. LX Semicon's R&D manpower exceeded 900 last year, which is the highest ever in their history. Last year, 300 new workers were hired. By accumulating technology, the company plans to raise the competitiveness of DDI for next-generation displays such as OLED. It is also gaining attention if they will expand the market base through mergers and acquisitions (M&A) strategies. Recently, LX Semicon jumped into the battle to acquire Magnachip Semiconductor. Magnachip is considered as a leading small and medium-sized OLED DDI company. Magnachip supplies products to Samsung Display. If LX Semicon succeeds in acquiring Magnachip, they will be able to secure new customers.

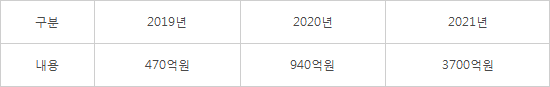

<Table> Development of LX Semicon sales

By Staff Reporter Ji-woong Kim (jw0316@etnews.com)