Pharmaceutical·Bio accepted 4 years ago

Majority opinion “Mandatory for SW industry growth”

Profitable for investment·loan for start-up·ventures

Expect spread in all field including game·educati

Whenever manufacturing companies uses facilities to produce products, they are recognized as facility assets. However, the activities of developers, or development costs, which account for the majority of software (SW) development values, are not recognized as assets.

SW companies have been requesting acknowledgement of accepting commercial SW development costs as intangible assets for several years.If commercial SW development cost gets recognized as intangible assets, this movement will not only be profitable in game or other SW industry, but can spread into whole intellectual property industry.

◇Commercial SW, only buyers were recognized as assets

If company A develops SW 'A-1' and sells it to company B, then company A owns the copyright. However, SW 'A-1' is not recognized as an asset of company A. On the other hand, if company B purchases SW 'A-1', it is recognized as an asset. Only purchased products are recognized as assets.

Young-sun Song, president of Korea Commercial Software Association said “In the manufacturing industry, the mockup of actual product before production is recognized as asset. If commercial SW development costs get recognized as intangible assets, not only in game SW, education SW, but expansion to all of other field including culture, art and knowledgeindustry.”

If development costs are recognized as intangible assets, it is advantageous for companies to receive investments or loans. This is because if the value of SW increases, the value of companies will also increase.

◇Pharmaceutical·Bio, recognized development costs as intangible assets from 4 years ago

It seems that commercial SW development costs into intangible assts will reference the cases from Pharmaceutical·Bio.

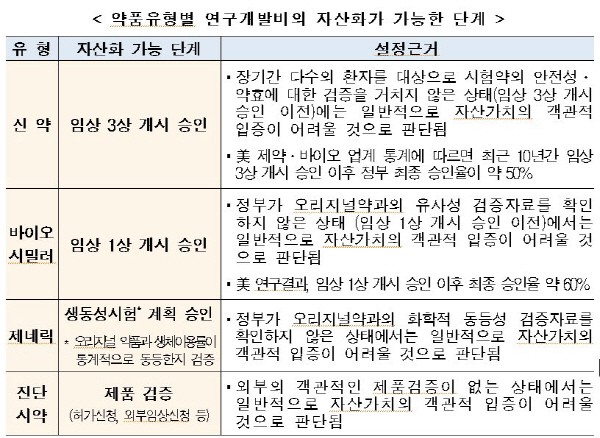

Financial Services Commission and Financial Supervisory Service accepted the opinions from the industry, announced ‘Supervision Guidelines for Accounting for R&D Expenses of Pharmaceutical·Bio companies‘ on the September of 2018.

International Financial Reporting Standards (IFRS)and Korean version of International Financial Reporting Standards (K-IFRS) have ‘Requirements for recognition of development cost as intangible assets’ but they do not have any specific details for each industry, they came up with guideline for Pharmaceutical·Bio field. It is the result of the long-standing demands from the companies.

The guidelines specified that technological feasibility should be judged in relation of pharmaceutical·bio R&D costs into assets. It is necessary to set a stage in which development costs can turn into assets (which has potential for technological realization) by taking into account the characteristics of each development stage, from the discovery of candidate substances, preclinical trials, phases 1, 2, and 3 clinical trials, to government approval applications by drug type.After the input cost for each project is reliably measured and presented, the accountant examines and supervises it, and the relevant financial institution supervises it.

◇SW valuation has to be expended and developed into the system

The majority opinion is that SW development costs recognized as intangible assets is necessary for the development of small domestic commercial SW companies and the SW industry. However, there are many voices that not only development costs are recognized as assets, but also evaluate the value of the product properly.

President of Korea Software Property – Right Council, Byung-han Yoo, said, “In the development stage, it should be recognized as an asset through a proper evaluation of SW potential and market value as well as development costs.”

In other words, it means that a small SW company can grow only when there is a system in place to identify and recognize the potential of commercial SW and market ripple effect beyond the development cost.

President Yooalso said “There is a first draft of how to evaluate commercial SW value with different standards. We will verify this in cooperation with other associations and organizations.”

By Staff Reporter Ho-cheon An (hcan@etnews.com)