CATL, Guoxuan, and Envision set up factories in the US

'Lithium iron phosphate' with high price competitiveness

Plans to supply automakers such as Tesla and Mercedes-Benz

Threatens local Korean and

Chinese battery makers such as CATL, the world's No. 1 electric vehicle battery maker, Envision AESC and Guoxuan, will build large-scale production plants in the United States. Currently, battery production plants in the US are led by Korean and Japanese companies. Fierce competition is expected between ternary (NCM, NCA, NCMA) batteries, the main products of Korea and Japan, and lithium iron phosphate (LFP) batteries from China, which have a competitive price edge.

According to multiple Chinese media on the 28th, CATL, Guoxuan, and Envision AESC will build electric vehicle battery plants in the US. CATL has the world's largest market share for mid- and large-sized batteries, meanwhile Guoxuan andEnvision AESC are the world's 8th and 9th largest battery makers, respectively.

CATL is planning to build a $5 billion (about 6 trillion won) battery plant in North America. CATL is expected to build a plant with an annual capacity of 80GWh and employ 10,000 people.

There are speculations that CATL will build ternary (NCM) and lithium iron phosphate (LFP) battery plants in North America for Tesla delivery in China. It is reported that CATL executives recently visited North America to search for a site for the plant.

In February, CATL Chairman Zeng Yuqun said, "The US is a market that CATL must enter."

Guoxuan also announced in December last year that they received a battery order from a listed company in the US and decided to supply at least 200 GWh of batteries accumulated over the next six years. The possibility has been raised that the local battery supplier for Guoxuan is Tesla. An official from Guoxuan said, "The two companies are discussing the possibility of local production of lithium iron phosphate batteries in the US and the establishment a joint venture."

Envision AESC, which recently decided to supply batteries for Mercedes-Benz's luxury electric vehicles 'EQS' and 'EQE', also plans to build a battery factory in the US and start operationsin 2025.

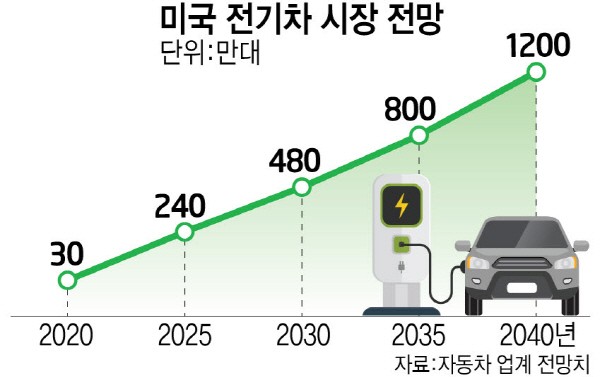

The successive entry of leading Chinese companies such as CATL into the U.S. market is expected to pose a threat to Korean and Japanese battery companies, even considering the rapidly increasing market growth every year. Local automakers such as General Motors (GM) and Ford have established or are in the process of establishing joint factories with Korean battery companies early on. Automakers in Europe and Japan, which are planning to build electric vehicle production plants in the US, have not yet decided on a battery partner. In addition, as Tesla is increasing the adoption of Chinese lithium iron phosphate (LFP) batteries, fierce market competition is expected from Korea and Japan to China's lithium iron phosphate.

An official from a domestic battery maker said, “Korean and Japanese battery makers already dominate the US market, so it is more stable than other regions such as Europe for the next five years."

Currently, four companies, LG Energy Solution, SK On, Samsung SDI, and Panasonic, are investing heavily in the North American market.

By staff reporter Tae-jun Park (gaius@etnews.com)