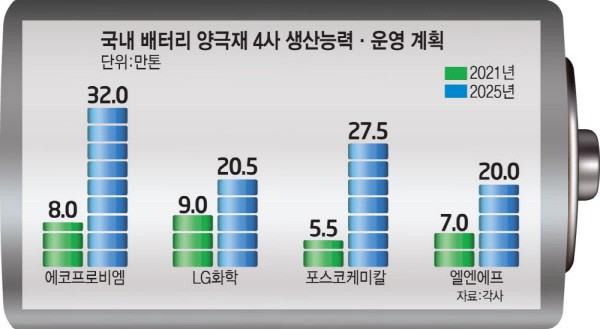

The four cathode materials companies, EcoProBM, LG Chem, POSCO Chemical, and L&F, have confirmed the production capacity of cathode material plants at home and abroad by 2025, which reaches 1 million tons. This quantity can produce 12 million electric vehicles per year. In line with the surge in demand for electric vehicle batteries, the four companies are planning to confirm the establishment of production bases in the U.S. and Europe this year. There will be a wide range of suppliers that rely on domestic battery companies.

According to the industry on the 9th, EcoProBM, LG Chem, POSCO Chemical, and L&F have confirmed the production capacity of cathode materials for electric vehicles by 2025 at 1 million tons. The investment is expected to be between KRW 6-7 trillion, since the facility investment cost per 10,000 tons of cathode materials ranges from KRW 60 billion to KRW 70 billion.

Cathode materials account for 40% of electric vehicle battery production costs. It determines performance such as mileage, charging and discharging. These four companies will confirm the establishment of production plants in Europe and the U.S. starting this year, along with the advancement of lithium-ion NCM (nickel, cobalt, manganese) and NCMA (nickel, cobalt, manganese, aluminum).

EcoProBM will increase its current production capacity of 90,000 tons of cathode material to 550,000 tons by 2026. The production capacity was initially increased from 480,000 tons to 550,000 tons by 2026. They respond quickly to the rapidly increasing demand for overseas cathode materials. Of the 550,000 tons, new factories with 180,000 tons and 140,000 tons will be built in the U.S. and Europe, respectively.

LG Chem plans to increase its production capacity from 80,000 tons to 260,000 tons by 2026. Recently, LG Chem have secured their own equipment technology capable of producing 10,000 tons per line per year, first in the world, and will undergo a trial production period before mass production in the second half of this year. The facility is the same size as its competitor's line, but its hourly production rate is more than twice as large. LG Chem plans to increase their price competitiveness with production efficiency by applying this technology to new lines.

POSCO Chemical have confirmed their plans, the first in Korea, to establish a positive electrode material joint plant in Canada with finished battery cell products companies such as LG Energy Solution, and General Motors (GM), the largest U.S. automobile company. They are the only domestic company to build a 100,000-ton factory in Gwangyang, Jeollanam-do to localize precursors, a key raw material for cathode materials.

L&F plans to expand its current 70,000-ton domestic mass production facility to at least 200,000 tons by 2025. Last year, it was reported that the company secured NCMA cathode material mass production technology for the first time in Korea and signed a contract to supply cathode materials directly to Tesla. They plan to diversify its customers by using high-nickel cathode material technology.

Sung-Hoon Yoon, a professor at Chung-Ang University, said, “As demand for cathode materials for electric vehicle batteries grows, the domestic cathode material industry is receiving a lot of attention from global battery and finished car companies, adding, " If we reduce our dependence on China for cathode materials such as precursors, our companies' competitiveness could reach further heights," he said.

By Staff Reporter Tae-jun Park (gaius@etnews.com)