Sunic System turned red last year

YAS, sales down 9.7%, operating profits down 36%

Efforts to improve performance by replacing CEO

Promoting new equipment development and market development

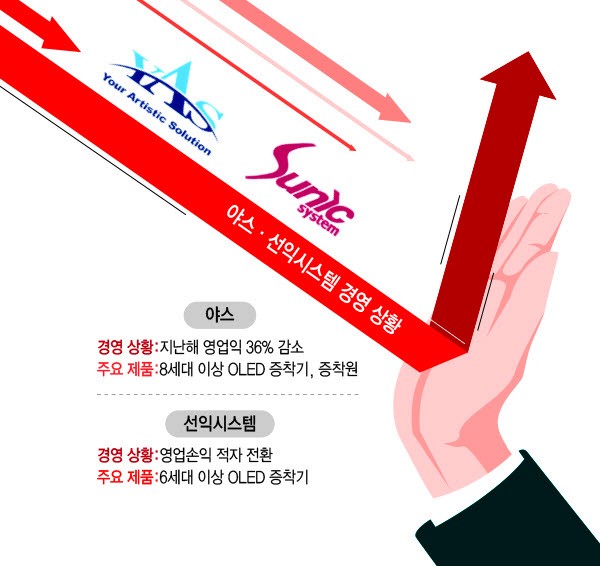

YAS and Sunic System, two of South Korea's leading organic light-emitting diode (OLED) deposition equipment companies, are in a state of emergency due to their falling performance. Management performance fell sharply last year, which sparked an extreme move to replace the management. Development of new OLED deposition equipment and market development have fallen due to a flurry of difficulties.

According to the industry on the 2nd, YAS recorded KRW 49.7 billion in sales and KRW 1.5 billion in operating profit last year. Sales fell 9.7% year-on-year and operating profit fell 36%. Sunic System recorded KRW 46.2 billion in sales and KRW 7.1 billion in operating losses in 2021, down 29.6 percent in sales, and an operating loss.

YAS and Sunic System are South Korea's leading OLED deposition equipment companies. Although YAS has a next-generation solar cell division and Sunic Cystem has a metaverse equipment division, OLED deposition equipment account for most of their sales.

The decline in both companies' earnings appears to be due to delays in investment from the display industry. Sunic System stated that the reason for the conversion to operating loss was due to a decrease in orders, and large fluctuations in profits due to exchange rate fluctuations.

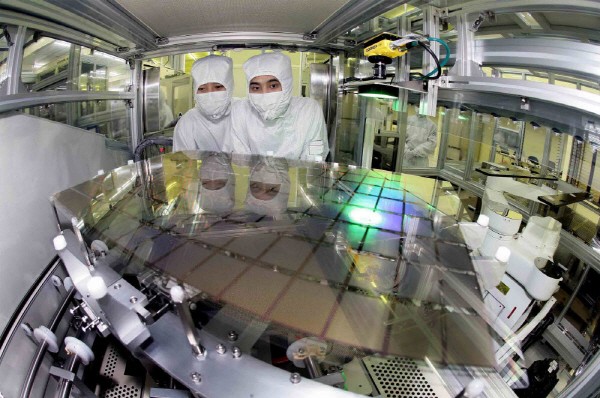

These companies are South Korea's leading companies in the field of OLED deposition equipment that evaporates and attaches organic matter to OLED glass substrates. YAS has localized and delivered 8th generation depositors, meanwhile Sunic Systems has localized and delivered 6th generation depositors. Their technology has been recognized enough to make and supply deposition devices that evaporate organic matter to the vaporizer.

However, Japan's Canon Tokki and Ulvac still demonstrate their strength in the industry, so it is urgent to secure technology and cost competitiveness that surpass these overseas companies.

Sunic System is known to have recently appointed President Hye-dong Kim as its CEO. YAS appointed CEO Kyung-in Kang last year. The specific reason for their CEO replacement has not been confirmed.

Industry sources say that changes in the display market may have played a role in the management change between the two companies. The new CEOs of both companies are from domestic display companies and are known to be experts in the field of OLED deposition equipment.

YAS and Sunic System are reportedly developing red (R), green (G), and blue (B) deposition equipment. By developing small and medium-sized, as well as large-sized display deposition equipment, they are expected to increase their market competitiveness and expand their display customers.

Samsung Display and LG Display are also expected to speed up their OLED investment this year. Samsung has started investing in large-scale quantum dot (QD) OLEDs, and LG has announced that they will expand investment in OLEDs.

As OLED investment is in full swing, the initial order receipts are expected to determine the future performance of these companies. In particular, it is important to secure references for large deposition equipment, such as 8th generation equipment. Currently, Samsung and LG are reportedly struggling to secure deposition process technology while constructing their mass production lines for their large OLEDs.

By Staff Reporter Ji-woong Kim (jw0316@etnews.com)