Sales at $555.9 billion... 26.2% increase from the previous year

System and memory semiconductors grew evenly

Samsung and SK Hynix achieved best performance ever

Large-scale M&A as a strategy to overc

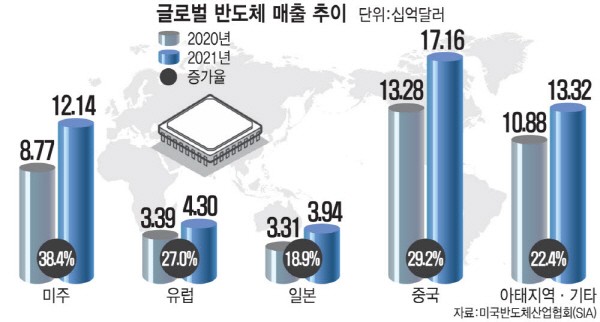

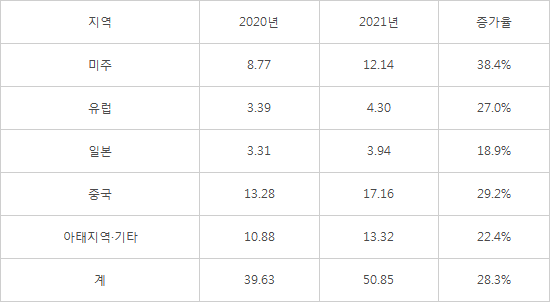

Global semiconductor sales reached an all-time high last year, similar to the rise of semiconductors in the 1990s. An intense competition is expected in order to dominate the market leadership as mergers and acquisitions (M&A) become more active this year. The Semiconductor Industry Association of America (SIA) announced on the 15th (local time) that global semiconductor sales recorded $555.9 billion (about KRW 665.18.9 billion) last year, which is an increase of 26.2% compared to last year. The market surpassed the $500 billion in four years after breaking the $400 billion mark in 2017, and it is expected to reach $600 billion this year.

Both system and memory semiconductors grew evenly. System semiconductor sales increased 30.8%, which is $154.8 billion, and memory sales increased 30.9%, which is $153.8 billion. Semiconductor sales are increasing exponentially as information technology (IT) companies invest more in data centers and demand for electronic devices rise. Automotive semiconductor sales reached a record high of $26.4 billion, and analog semiconductor sales is $74 billion, which is 34.3% and 33.1% increase from the previous year, respectively.

The performance of semiconductor companies is also at an all-time high. Samsung Electronics' semiconductor business and TSMC achieved the greatest performance in sales of KRW 94 trillion and KRW 68 trillion, respectively. Although Samsung took over the top spot in sales from Intel, but Intel’s performance improved significantly compared to last year. Sales of semiconductor companies are expected to increase by 11% compared to last year according to market research firm IC Insights. This is the third consecutive year where the market is experiencing double-digit growth, and the second time since the unparalleled semiconductor boom of 1993-1995.

Major companies began to expand their size through M&A and large-scale investments. Intel made an official announcement of acquiring Tower, which is the world's 8th largest foundry company. Intel showed its dedication to overcome the semiconductor supply shortage head-on by entering the 8-inch wafer-based semiconductor foundry market. AMD also completed the acquisition of Xilinx, and began to venture into new markets. AMD’s investment for large-scale facility is continuing as well. TSMC is investing an all-time high of $44 billion this year, and Intel has currently formalized an investment of $40 billion.

Samsung Electronics and SK Hynix are expected to make large-scale investments. It is analyzed that they have enough resources as it recorded the highest performance. The total amount of investment of private semiconductors this year was KRW 56.7 trillion from the analysis of the Korea Semiconductor Industry Association's survey of domestic corporate investment plans. This is a 10% increase compared to last year. Similar to those of large corporations, the amount of investment from small and medium-sized enterprises (SMEs),which make up the semiconductor ecosystem, is also quite large. Investments by SMEs in materials, parts, equipment, and post-processing fields accounted for KRW 1.8 trillion, and investment plans for system semiconductors such as fabless and power semiconductors accounted for KRW 1.3 trillion.

Global semiconductor sales in December 2020 and 2021 (unit: USD 1 billion)

Source: American Semiconductor Industry Association (SIA)

By Staff Reporter Heeseok Yoon and DongjoonKwon (pioneer@etnews.com,djkwon@etnews.com)