Domestic companies 'diversify' beyond memory

ALD·RTP foundry application development

Advanced process entry... Securing growth engines

The domestic semiconductor parts industry is targeting the foreign foundry (consignment production) process parts market in the new year. The foundry process requires the implementation of ultra-fine circuits, which makes it even more difficult to develop than memory. The tough development is a reason why U.S., Netherlands, and Japanese equipment companies have monopolized it. The localization of domestic semiconductor parts was an insignificant portion around 20-30%. Significant progress has been made in localization of the post-processing fields such as semiconductor testing, but domestic companies has yet to enter the core pre-processes such as exposure. Wash, deposition, etching, and heat treatment are the only process that have been localized.

Wonik IPS develops semiconductor parts compatible with extreme ultraviolet (EUV) equipment in the foundry process. It is in the process of choosing new equipment candidates such as hard mask deposition equipment and atomic layer deposition (ALD). Wonik IPS has some foundry equipment, but only entered the old and standard processes. It is trying to localize the increase-in-demand field of advanced process equipment.

AP Systems will improve the existing rapid thermal processing (RTP) for memory semiconductors to foundry system semiconductors. The product will be introduced in the first half of the year. Jusung Engineering will also improve its main products, ALD and chemical vapor deposition (CVD), for foundry use. It is being developed with a foundry customer. PSK is also targeting new equipment that can be applied to foundries. PSK, which has already localized the bevel etcher, has set its mid/long-term roadmap to develop etching equipment that can be applied to all semiconductor fields, including foundries. Local workforce will be expanded depending on the U.S.’ investment in foundry market.

Equipment localization was mainly focused on the memory field. This is because the semiconductor industry has developed around memory, which was led by Samsung Electronics and SK Hynix. The domestic foundry equipment market share is only in the single digit. On the other hand, foreign equipment such as U.S.’ Applied Materials (AMAT), Netherlands’s ASML, Japan’s Tokyo Electron (TEL), U.S.’ Lam Research dominate more than 70% of the global equipment market. Amongst these companies, up to 67% (AMAT) of their sales come from foundries.

Domestic companies must target the foundry sector in order to grow the domestic equipment market. Samsung Electronics, TSMC, and Intel are intensifying new investment in foundries. PSK CEO Kyung-il Lee explained, “The development of foundry equipment is a business strategy to double the growth rate.”

A huge amount of time and money must be invested in developing new equipment. The equipment industry has accumulated R&D expenses with high success in the business last year. The boom in the equipment industry continued, with major semiconductor equipment companies already achieving sales in the second and third quarters of last year.

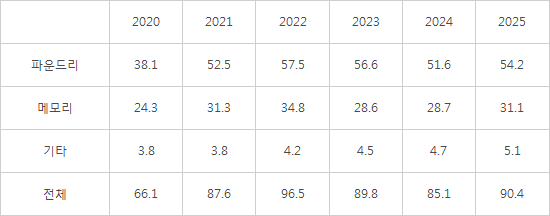

<Forecast of investment in foundry & memory equipment>

(Unit: 1 billion USD)

Table provided by industry collection

By Staff Reporter Dong-jun Kwon (djkwon@etnews.com)