Sales increased 288% in the 3rd quarter, the largest ever.

Benefits of facility investment by global manufacturers

Securing competitiveness through internalization of self-development software.

CEO Ju

Innometry, a battery equipment company invested by EastBridge Private Equity (PE), which prevents fire risks, is drawing attention as it has achieved its highest growth. Innometry recorded its highest performance ever due to the explosive growth of the electric vehicle market and the resulting increase in demand from battery manufacturers.

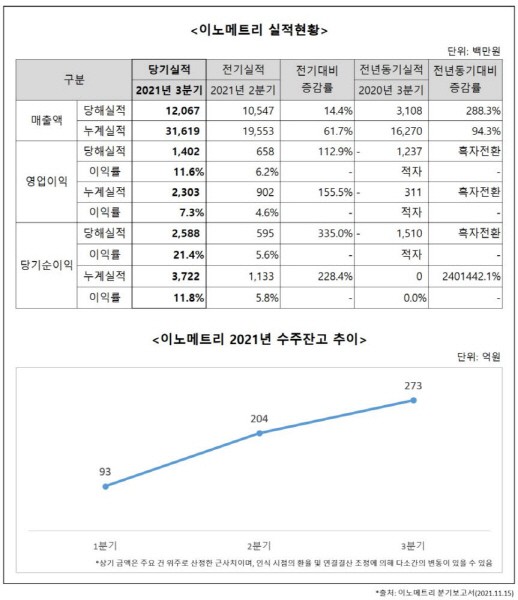

Innometry announced on the 15th that it recorded 12.1 billion won in sales and 1.4 billion won in operating profit in the third quarter. Sales rose 288% compared to the same period last year, and operating profit turned to a surplus. It also achieved record-high quarterly earnings for the second consecutive quarter and continued its surplus for the third consecutive quarter. A company official said, "The profit ratio increased from 6% in the second quarter to 12% in the third quarter due to the increase in the proportion of high-performance inspection equipment and the effect of fixed costs."

Innometry has simply transformed itself a year after Eastbridge PE took over. Innometry, whose largest shareholder of SPC Evision Limited, established by EastBridge PE in October last year, has already exceeded last year's annual sales of KRW 31.6 billion by the third quarter. This year's record-high performance is expected.

Innometry uses X-rays to make equipment to find out if the battery is manufactured according to the design and if there are any abnormal joints or defects. LG, Samsung, and SK, China's BYD, and Sweden's North Volt are their customers.

Innometry recorded an operating loss of KRW 20.7 billion and KRW 4.4 billion in sales last year. The sharp rebound in less than a year was due to the fact that battery manufacturers' facility investment, which had been delayed due to the influence of COVID-19, resumed in earnest from this year. LG and SK have started a joint venture with carmakers in the U.S., while Samsung SDI has begun expanding Europe in earnest. It is analyzed that Innometry is on a growth track as it also receives orders from new battery customers such as North Volt. In fact, the order balance increased from 9.3 billion won in the first quarter to 20.4 billion won in the second quarter and 27.3 billion won in the third quarter.

Multiple companies are competing in the market for battery inspection equipment using X-rays. Innometry’s equipment is differentiating itself with a "line scan (TDI)" method that inspects batteries in real time on the production line, rather than taking and analyzing pictures of each battery every time it is made. For TDI, large-capacity images must be analyzed in real time, but Innometry has been internalized as its own development software.

More and more automakers and battery manufacturers are trying to take the lead in the electric vehicle market by securing stability, said Jun-bo Kim, CEO of Innometry. "These companies are active in introducing equipment to inspect foreign substances in addition to the existing pole plate arrangement." In other words, demand for equipment is expected to increase as the battery inspection process is increasing.

"Global battery companies are irreplaceable market leaders and have confidence in their technology," an EastBridge official said. "We have confidence in Innometry's growth potential and will strengthen strategic support to help Innometry expand its corporate value in the mid to long term by utilizing its own network and experience in investing in more than 20 promising companies," they added.

EastBridge PE was established in 2011. It has invested in companies in various fields such as high-tech industries and consumer goods. Since the acquisition of Innometry in 2020, it has invested in T-Map Mobility, Yido, and Socar Mobility Malaysia this year.

Reporter Geon-ho Kwon wingh1@etnews.com