3rd quarter sales of 11.805 trillion won 'highest in history'

4 trillion won in operating profit... 220% increase from last year

Increasing demand for servers and phones... increase in product price

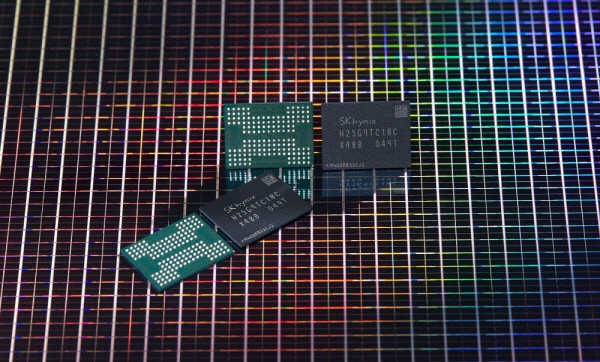

SK Hynix achieved the highest quarterly performance since its foundation in the third quarter of this year despite negative conditions such as rapid changes in the global supply chain and the prospect of a decline in memory semiconductor prices. In 2018, the NAND flash business also made a profit due to the performance of the semiconductor boom period (super cycle).

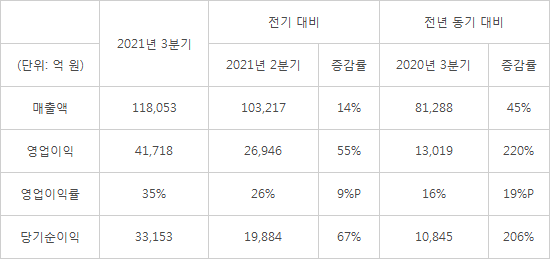

SK Hynix announced on the 26th that it recorded KRW 11,805.3 trillion in sales and KRW 4.17 trillion in operating profit in the third quarter, respectively. The sales increased by 45% and operating profit increased by 220% compared to the same period last year. This is an increase of 14% and 55%, respectively, compared to the previous quarter. The third quarter sales surpassed the previous record high of thethird quarter in 2018 (KRW 11,416.8 billion). It is the largest quarterly sales since the establishment. Its operating profit is the sixth largest in history, and is equivalent to the 2018 super cycle.

2018 was considered a period of super booming semiconductor industry.T he upcycle, which started in mid~2016,until the end of 2018, is called the supercycle. The reason why SK Hynix's performance is compared to that of the supercycle is that the demand for memory for servers and smartphones has increased, and product prices have risen. This was largely due to the increase in production scale while increasing the yield of major products such as 10-nano class 3rd-generation (1z) DRAM and 128-layer NAND. The performance improved by increasing shipments while increasing cost competitiveness of high-tech products. The CFO of SK Hynix, Jong-Won Noh, said, “It shows that the memory semiconductor market continues to grow despite concerns we had for the market.”

SK Hynix predicted continuous growth in the fourth quarter. CFO Noh predicted and said, “Servers will replace the products from 2018~2019 to server DRAM next year. The trend of the growth will continue from the second half of this year to next year.”SK Hynix announced that it is planning to increase DRAM shipments to mid-upper end single digits in the fourth quarter, and to increase shipments of NAND flash by more than double digits.

SK Hynix drew attention when it announced that its NAND business, which had been in deficit for a long time, not only turned into a surplus in the third quarter, but also reached its peak performance. According to the analysis of brokerage companies, SK Hynix's NAND business reported a loss for 11 consecutive quarters from the fourth quarter of 2018 to the second quarter of this year. NAND flash businesshas been SK Hynix's weakness.DRAM businessled the industry with a market share of 28%, while NAND flash business ranked only 4th with 11-12%.It is interpreted that SK Hynix has seized the opportunity to turn around quickly by releasing high-performance products such as 128-layer and 176-layer NAND.

It is 2-3 months later than the target schedule due to the delay in approval, but SK Hynix expected to complete within this year. CFO Noh said,”Only Chinaäs approval remains among the eight countries subject to authority's approval of the business combination. However, the Chinese government has came up with reasonable evaluation, and expects to approve it within a year.” After acquiring Intel NAND, SK Hynix has a strategy to build a complementary product portfolio in the direction of maximizing the strengths of both companies and to enhance economic scales as well.

☐ Comparison table of business performance in the 3rd quarter of 2021 (based on K-IFRS)

By Staff Reporter Gu-nil Yun (benyun@etnews.com)