Samsung Electronics has modified its automotive semiconductor business group. It broke up the “Parts Platform Business Team” that was responsible for the business and it has had other department absorb tasks that were previously assigned to the team. As a result, related industries are interested on Samsung Electronics’ next potential moves related to the company’s automotive semiconductor business.

According to Samsung Electronics, Executive Director Lee Tae-won who used to work as the vice president at Qualcomm Korea and had held the team leader position of the Parts Platform Business Team until the end of last year has become the leader of the System LSI Business’s “Custom SOC Business Team”.

The Parts Platform Business Team was under the company’s DS (Device Solutions) Division and it was formed at the end of 2017 for marketing and operation of automotive AP (Application Processor) and memory technologies. While running the group, Samsung Electronics recruited Executive Director Lee who was responsible for R&D at Qualcomm Korea.

One official from the industry said that the personnel who used to be responsible for development of APs at the business team moved to the Custom SOC Business Team while the personnel responsible for automotive memories moved to the company’s memory business. It is reported that former members of the business team are continuing same work at their respective departments.

Breakup of the Parts Platform Business Team indicates a change to Samsung Electronics’ strategy towards its automotive semiconductor business. Although the global automotive semiconductor market is making a steady growth, it is likely that Samsung Electronics has decided to draw up a new plan as the company does not have many products to offer for the market.

Normally, 200 to 300 semiconductors such as power semiconductor and MCU (micro-controller unit) go into single car. Companies such as NXP, Infineon, and STMicroelectronics are major suppliers of automotive semiconductors. Although the global market is expected to make a huge growth in the future due to increase in number of electric vehicles and self-driving cars, the market size of the analog semiconductor market such as power semiconductor and MCU is not very big. NXP, Infineon, and STMicroelectronics normally make somewhere between $2.7 billion (3 trillion KRW) and $3.5 billion (4 trillion KRW) in sales annually from automotive semiconductors. For Samsung Electronics, the market size is considered very small as the company made $64 billion (72 trillion KRW) in sales last year just from its semiconductor business.

Furthermore, profitability of automotive semiconductors is lower compared to memories which are one of Samsung Electronics’ main businesses. Operating profit ratios of major automotive semiconductor suppliers in the past three years ranged from 4 to 14%. There is a good chance that Samsung Electronics believed it would be difficult to see a satisfactory operating profit ratio from automotive semiconductors considering the fact that its operating profit ratio in its semiconductor business is normally around 20% and its ratio in 2018 in particular was 51.65%.

The fact that the automotive semiconductor industry requires many years of product development in order to see meaningful results was also not appealing to Samsung Electronics.

“Because Samsung Electronics moves around very quickly, it needs to find business items that can create meaningful results in a short period.” said one industry official. “Because automotive semiconductors that are highly reliable require years of investments, it is likely that Samsung Electronics’ management team was hesitant about development of automotive semiconductor business.”

As a result, the company is looking to secure “efficiency” and “profitability” at the same time by continuing to respond to the automotive semiconductor market, finding new items with high-added values, and spreading its automotive semiconductor business to different departments.

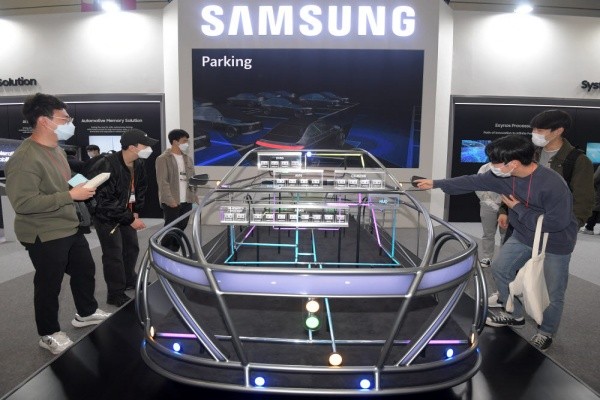

Until now, Samsung Electronics has used a “choice and focus” strategy where it has been supplying APs for infotainment and automotive high-performance memories to leading automakers such as Audi rather than covering entirety of automotive semiconductors. It is expected that the company will maintain the strategy while looking for items that can provide high-added values to the company.

In fact, the company has been focusing on chips used for self-driving cars recently. While developing and making chips for Tesla and Google’s self-driving car Waymo, it has also been working on development of high-end processors that require HPC (high-performance computing) operation.

A representative for Samsung Electronics said that although it is true that the company is continuing its automotive infotainment AP business, the company cannot confirm its roadmap on next-generation automotive chips.

Staff Reporter Kang, Hyeryung | kang@etnews.com