South Korea’s memory semiconductor industry, which is an important industry for the South Korean economy, was able to overcome the COVID-19 crisis. Despite the global economy going through a recession due to the COVID-19 pandemic, South Korean memory semiconductor companies have been making positive performances as they have been able to induce many demands for server memory by carrying out more contact-free activities.

Because this positive trend is expected to continue until next year, the level of importance of the semiconductor industry that supports the South Korean economy will be even greater than before.

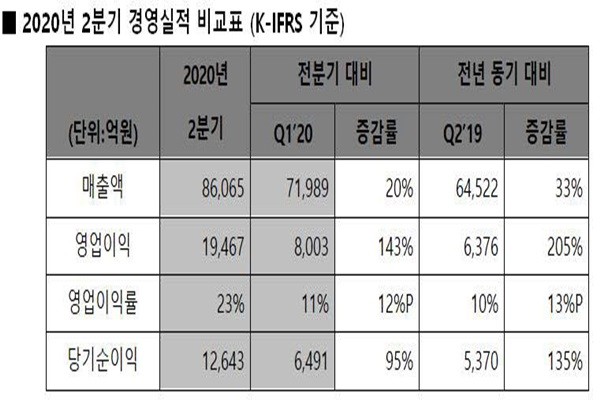

SK Hynix announced on Thursday that it made $7.17 billion (8.6065 trillion KRW) and $1.62 billion (1.9467 trillion KRW) in sales and operating profit respectively in the second quarter. These amounts are 33% and 205% increases compared to that of the second quarter last year respectively and they easily surpassed market estimates.

Memories for server and data center were behind the company’s positive performance in the second quarter. Although there were less demands for memories that go into smartphones due to poor consumer spending, the company was able to offset lack of demands for mobile memory by experiencing increased demands for memories used for servers and data centers as there were more contact-free activities such as telecommuting, online education, and internet service. Increased demands for SSD (Solid State Drive) that is made up of NAND flash memory also contributed to the company’s positive performance. The company stated that the percentage of SSD shipments out of its NAND flash business came close to 50% for the first time.

Prior to SK Hynix’s announcement, Samsung Electronics also revealed that its tentative second quarter performance achieved an earning surprise. It is estimated that Samsung Electronics, which announced that it made $43.3 billion (52 trillion KRW) and $6.75 billion (8.1 trillion KRW) in sales and operating profit respectively, made more than $4.17 billion (5 trillion KRW) in operating profit from its DS (Device Solutions) Division and that the company had also benefitted from increased contact-free activities.

Because COVID-19 started to have a significant impact on the global economy in the beginning of the second quarter, South Korea’s semiconductor industry had been paying careful attention on what kind of impact the virus would have on the industry. However, the industry seems to be benefiting from the virus after seeing that both Samsung Electronics and SK Hynix recording positive performances and overcoming the COVID-19 crisis.

The global economy is still feeling the aftereffect of COVID-19 and is going through uncertainties such as intensified trade war between the U.S. and China. However, it is expected that the memory industry will still be in a good condition as contact-free activities will continue to be prevalent throughout all industries.

SK Hynix actually announced during its second quarter performance call that the memory industry is expected to go through a huge growth next year.

Although there will be temporary price adjustments in the second half, the company predicts that memory semiconductor sales will make a huge jump next year as companies that manage data centers are planning to extend their current infrastructures and IT device sales will be able to recover from low sales this year.

“DRAM bit cross and NAND flash memory bit cross are expected to 20% and early 30% respectively next year due to positive factors such as double figure increase in 5G smartphone shipments.” said Park Myung-soo who is in charge of the marketing for SK Hynix.

The company predicts that the memory industry’s positive trend will continue until next year as major countries partially begin opening up their economies and new IT devices such as 5G smartphone and game console that require high capacity are scheduled to be released.

It plans to gradually increase sales volume of its 2nd gen 10nm DRAM and focus on high-value added memories sales by strengthening 128-layer NAND flash memory sales.

However, it announced that it would continue to be conservative when it comes to investment in facilities and production capacity according to its initial plan. It is currently constructing basic infrastructures for the M16 fab at its Icheon Campus where its headquarters lies.

“Although we cannot pinpoint what the exact amount of our investments in facilities going to be for next year, it will certain be higher than this year’s amount.” said a spokesperson for SK Hynix. “However, it will not be a drastic increase.”

Staff Reporter Kang, Hyeryung | kang@etnews.com