Huawei is found to be making preparations for a possibility that the trade war between the U.S. and China may last for a long period of time. In order to deal with the U.S. Government’s sanctions that prohibit Huawei from receiving semiconductors, Huawei is examining its supply network and looking into other technologies. These moves by Huawei are drawing eyes from South Korea’s semiconductor industry as Huawei is looking into South Korean companies that are related to semiconductor. It will be interesting to see whether Huawei will create opportunities for the semiconductor industry or drag the industry to the middle of the trade war between the U.S. and China that is becoming more intense.

According to the industry, it is understood that Huawei is looking into whether its partners from its supply network are using U.S. technologies. This investigation took place when the Department of Commerce made an announcement in May that it would also sanction foreign companies that use U.S. technologies to manufacture semiconductors and supply them to Huawei. It is confirmed that Huawei is also looking into whether its partners that make semiconductor equipment use U.S. technologies for their semiconductor equipment.

Huawei does not manufacture its own semiconductors. Although it designs application processors or modems, production of semiconductors is done by foundry companies such as TSMC and SMIC. The fact that Huawei is looking into whether its partners are using U.S. technologies for their semiconductor equipment indicates that it is looking at the entirety of semiconductor supply networks.

It is also heard that Huawei recently visited South Korean semiconductor equipment makers. Employees from its South Korean branch visited these companies. Although it is not known why they visited these companies and what they discussed about, it can be presumed that the visits are related to the U.S. Government’s sanctions considering the timing and the latest situation. It can be seen that Huawei is looking into South Korean equipment that may replace American equipment.

Since 2019, the U.S. Government has kept Huawei under a tight control. Due to a security reason, the U.S. Government has made it difficult for Huawei to purchase semiconductors and semiconductor equipment from Qualcomm and others.

Huawei has been responding to the U.S. Government by designing APs and modems through its subsidiary HiSilicon and entrusting TSMS with production.

However, the U.S. Government raised the level of its pressure on Huawei by preparing an additional sanction last month that prohibits foreign companies from supplying their semiconductors to Huawei. The U.S. Government’s strategy is prohibit U.S. technologies being used for Huawei’s semiconductors because it knows that U.S. technologies are used as key technologies for design and production of semiconductors. In addition, the U.S. Government intends to prohibit or delay Chinese companies from having an access to cutting-edge technologies.

Its sanction that requires companies to receive an approval from its authorities if they intend to use U.S. technologies to manufacture semiconductors for Huawei will be enforced starting from September. In this case, Huawei will not be able to use foreign foundry companies such as TSMC. It seems that Huawei will look to prepare alternative solutions as soon as possible before the new sanction goes into effect or its semiconductor inventory runs out. One of its plan is to purchase semiconductor design tools or semiconductor equipment that is not based on U.S. technologies and establish a mass-production system within China.

“One speculation is that Huawei will hand over a portion of TSMC’s supply to SMIC and look for a long-term alternative that will help Huawei to establish a fab for 12-inch wafers without using American equipment.” said one official from the semiconductor industry.

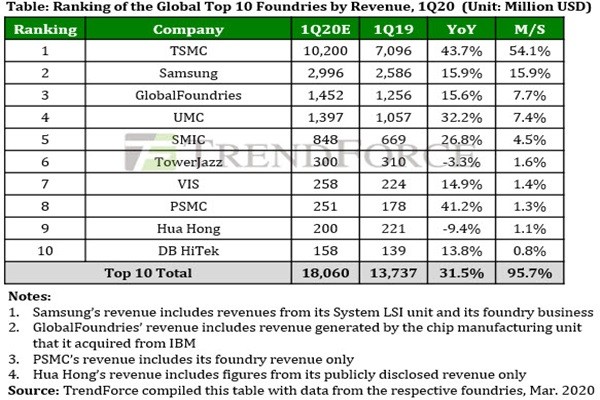

SMIC is the biggest Chinese foundry company. Although it falls behind in microfabrication technology when compared to other foundry companies such as TSMC, Samsung Electronics, and GlobalFoundries, it has well-established competitive edge as it ranks in top 5 in revenue. There is a high chance that Huawei and the Chinese Government will look to support SMIC as much as possible in order to develop China’s semiconductor industry and it is expected that Huawei will look to work with companies from South Korea, Taiwan, and Japan.

It will not be a simple situation if Huawei sees South Korean semiconductor technologies as essential and actively court South Korean companies. Although Huawei can be a new business opportunity for equipment and components makers, they can be fall into a nut cracker situation where they fall in the middle of the trade war between the U.S. and China. Because the U.S. Government can also enforce a sanction that targets South Korean companies if they show intentions to work with Huawei, they need to come up with strategies and measures carefully.

Meanwhile, it seems that the U.S. Government is preparing additional measures that target China’s high-tech industries. According to the industry, the U.S. Government recently started looking at the current state of American semiconductor companies’ Chinese businesses. It is likely that the state of the trade war between the U.S. and China will become even more intense as it is heard that the U.S. Government is looking at whether these companies are related to the Chinese military.

Staff Reporter Kang, Hyeryung | kang@etnews.com & Staff Reporter Yun, Geonil | benyun@etnews.com