As Nissan has started to lose its competitive edge globally, it carried out an extensive restructure plan that includes its withdrawal from the South Korean market. It believes that additional restructuring plans will be inevitable if it is unable to stabilize its business through the recent restructuring plan.

According to the industry on May 31, disharmony within the “Renault-Nissan Alliance”, lack of sales due to prolongation of “COVID-19”, and boycott against Japanese products due to the spread of “anti-Japanese sentiments” all played roles in Nissan’s withdrawal from the South Korean market.

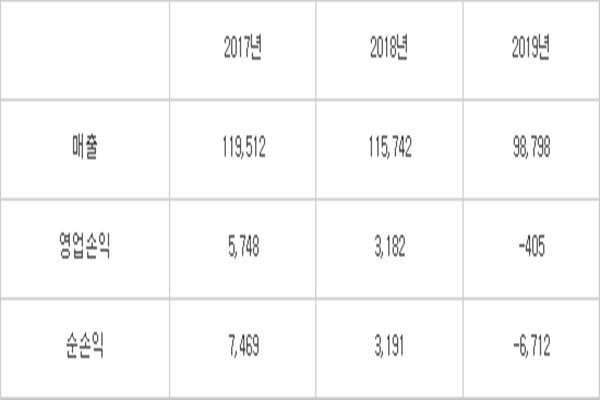

When Nissan almost went bankrupt in 1999, it received a financial support from Renault. At the moment, Renault holds 43% of Nissan’s shares while Nissan holds 15% of Renault’s shares. However, two companies have experienced a feud for a long time. Nissan was not happy that Renault did not make a reasonable pay for using its technologies. Nissan’s management team heavily opposed the plan to merge Renault and Nissan when Charlos Ghosn was the chairman of Nissan. Nissan’s performance plummeted as there was a conflict over management rights. Nissan’s net profit in the fiscal year of 2018 (April of 2018 to March of 2019) was $2.96 billion (319.1 billion yen) that is a 57.3% drop compared to the previous year. Nissan took a blow to its overall performance due to lack of sales in North America and Europe and it was heavily affected when Chairman Ghosn was trying to pursue a quantitative growth.

Nissan’s performance dropped even more as the COVID-19 pandemic broke out in the fiscal year of 2019. It made $91.7 billion (9.8789 trillion yen) in sales that is a 14.6% drop compared to the fiscal year of 2018. It recorded $356 million (40.5 billion yen) and $6.23 billion (671.2 billion yen) in operating loss and net loss respectively and it went into deficit for the first time in 11 years.

Its sales volume was 4.79 million units that is a 17.2% drop compared to two years ago (5.79 million). Its output also dropped 19.6% from 5.7 million units to 4.58 million units. Reduction in its sales volume and output suggest that Nissan has also started lose its competitive edge in global markets as well. Its withdrawal from the South Korean market and the Russian market and closure of its factories in Indonesia and Spain can be seen as its strategy to secure “ammunitions” to invest in future cars.

South Korea was subjected to Nissan’s first restructuring plan as the people in South Korea has continued to boycott against Japanese products. Between January and April this year, only 813 Nissan vehicles and 159 Infiniti vehicles were sold in South Korea. Compared to the same period last year, two companies’ car sales dropped 41% and 79% respectively. The fact that the South Korean Government added another digit to new license plates in September last year has been a negative factor for Nissan in the South Korean market.

By managing costs efficiently, Nissan plans to carry out its roles that it was in charge of within the Renault-Nissan-Mitsubishi Alliance. It is going to rule out a merge with Renault and continue the partnership between Renault and Mitsubishi.

The alliance recent announced roles of each company in order to prepare for the future mobility era. Nissan and Renault will be responsible for autonomous driving technology and connected car technology respectively. Nissan and Renault will develop e-PT (electrified powertrain) while Mitsubishi will focus on development of PHEV (Plug-in Hybrid Electric Vehicle).

The alliance chose “choice and concentration” strategy when targeting foreign markets. Nissan will focus on China, North America, and Japan. Renault will be responsible for Europe, Russia, South America, and North Africa while Mitsubishi will be responsible for ASEAN (Association of South East Asian Nations) and Oceania.

They are also planning to reduce investments through collaboration. Their strategy is to actively utilize the alliance’s assets through leader-follower method. The alliance is planning to launch public platforms such as “CMF-C/D” and “CMF-EV” after platforms such as “CMF-B” and “kei car” and they expect that they will be able to reduce the amount of their current investments by about 40%.

“Although automotive manufacturers need to continue to sell eco-friendly cars due to various environment regulations, they are having difficulties in making profits.” said Professor Min Kyung-deok of Seoul National University. “Whichever company that reduces its deficit will be the last survivor.”

Staff Reporter Park, Jinhyung | jin@etnews.com