SK Hynix’s performance in this first quarter far surpassed expectations from the market. It was able to achieve positive performance by offsetting low demands for mobile DRAMs with demands for server DRAMs.

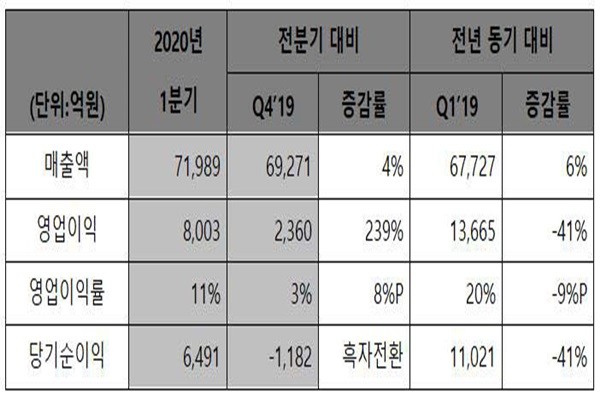

SK Hynix announced that it made $5.85 billion (7.1989 trillion KRW) and $650 million (800.3 billion KRW) in sales and operating profit respectively in this first quarter. Its sales and operating profit in the first quarter are 4% and 239% higher respectively than that of the previous quarter.

Although its operating profit in this first quarter is 41% lower than that of the first quarter of 2019, it is meaningful from a standpoint that SK Hynix had withstood a dead season for memories in 2019 and made a huge recovery in its performance in 2020. Its operating profit ratio recorded 11% which is the first time it surpassed 10% since the second quarter of 2019. Its performance is drawing the industry’s attention as it was able to overcome lack of demands for IT due to the global spread of COVID-19.

SK Hynix explained that its performance was able to improve as the sales volume of server DRAMs experienced a huge jump.

“Although demands for mobile DRAMs saw a declined due to a seasonal slow season for DRAM and negative effects from COVID-19, demands for server DRAMs offset low demands for mobile DRAMs and resulted in only a 4% decline in shipments compared to the previous quarter.” said SK Hynix. “However, the average selling price went up by 3%.”

The number of shipments of NAND flash memories increased by 12% compared to the previous quarter due to increased demands for server SSDs (Solid State Drive). The average selling price also went up by 7%.

SK Hynix previously announced that the forecast of the global memory market is unclear. However, it predicts that the global server memory market will grow in the medium and long term due to increased demands for contactless IT despite the fact that the global sales volume of smartphones has been on a decline.

While maintaining a conservative approach towards investments in facilities and equipment, it plans to continue microfabrication and preparation of cleanrooms for the M16 fab that is scheduled at the end of this year without any setback. It also plans to convert part of its production capacity of DRAMs into CMOS image sensor and NAND flash memory into 3D NAND flash memory according to its initial plans.

SK Hynix announced that all of its semiconductor fabs have been operating normally since the outbreak of COVID-19 as it has completely followed advices made by countries and local authorities.

“We are taking a belt and braces approach in technology innovation and preparation of infrastructures so that we can minimize risks rising from COVID-19 and respond to growth momentum centered on server.” said CFO Cha Jin-seok of SK Hynix.

Staff Reporter Kang, Hyeryung | kang@etnews.com