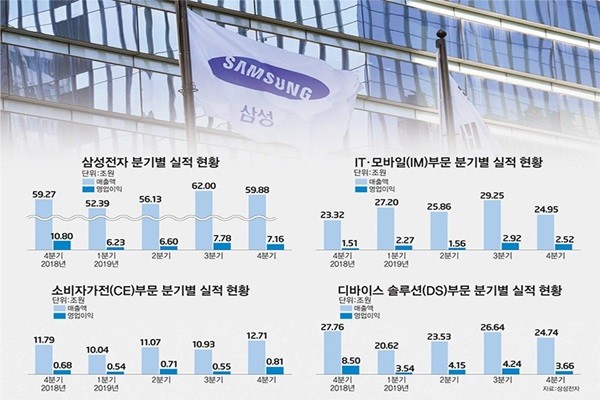

Samsung Electronics was not able to break out of a slump that had affected its semiconductor business in 2019. Its poor performance in semiconductor business in 2019 became more noticeable when it was compared to how Samsung Electronics was able to enjoy an economic boom within the semiconductor industry until 2018. In its semiconductor business alone, its operating profit in 2019 fell by $25.2 billion (30 trillion) compared to its operating profit in 2018. As semiconductor is largely responsible for the performance of the entire company, Samsung Electronics’ overall performance also plunged.

However, Samsung Electronics is looking to rebound this year as there are signs that the semiconductor industry will be able to rebound after a slump in 2019. Stock firms are also estimating that Samsung Electronics’ operating profit in 2020 will jump 50% compared to its operating profit in 2019. Samsung Electronics will continue to expand its network business, which had shown a positive growth in 2019, and strengthen lineups of both high-value smartphones such as foldable smartphone and medium to low-end smartphones.

◊DS Division looks to rebound this year

Samsung Electronics’ semiconductor division’s performance dropped sharply in 2019 due to depression in the memory industry. However, its semiconductor division is expecting a rebound this year as there are increased demands for semiconductors for datacenters and 5G smartphones. Samsung Electronics will also look to secure more customers for its foundry business through its EUV (Extreme Ultraviolet) 7nm and 5nm processes.

Samsung Electronics’ semiconductor division made $11.8 billion (14.02 trillion KRW) in operating profit last year that is 68.54% reduction compared to its operating profit in 2018 ($37.4 billion (44.57 trillion KRW)). The main reason for the sudden drop was recession within the memory semiconductor market.

However, there have been positive signs this year for a possible rebound. The industry believes that the market has started to recover with last fourth quarter as the starting point. There have been increased demands for datacenters while smartphone manufacturers have started to release their 5G smartphones one after the other.

Samsung Electronics is also experiencing these positive signs as it made $2.89 billion (3.45 trillion KRW) in operating profit in last fourth quarter and preventing its quarterly performance from dropping continuously.

During a conference call, it predicted that its inventories of DRAMs will be normalized during the first half of this year and that there will be a steady recovery of its performance and it explained that the NAND flash memory market already hit its lowest point and is starting to rebound. It is also working on new investments in plant and equipment as the market shows signs of recovery.

“We are expecting bit growth of 10% and 20% in annual demands for DRAM and NAND flash memory respectively.” said a representative for Samsung Electronics. “We are also expecting that we will be able to rebound to these levels.”

Samsung Electronics is also planning to induce customers to its foundry business, which is another major business of Samsung Electronics in addition to memory semiconductor, through state-of-the-art processes.

Samsung Electronics’ display business had also struggled in 2019.

Samsung Display made $26.0 billion (31.05 trillion KRW) and $1.33 billion (1.58 trillion KRW) in sales and operating profit respectively in 2019. Compared to its sales and operating profit in 2018, its sales and operating profit in 2019 decreased by 4.4% and 39.7% respectively.

“Our poor performance in 2019 was led by increased cost resulting from decreased operation rates of our production lines for small to medium-size displays and reduced demands for some of our premium products.” said Director Choi Kwon-young of Samsung Display. “Our large display business had suffered from reduced sales volume and lower selling price due to an oversupply.”

Samsung Display expects that reduced demands from some of its customers within its small to medium-size display panels during this first quarter will lead to slower operation rates of its production lines. It also expects that its large display panel business will continue to suffer from stagnant sales resulting from a seasonal slow season.

It predicts that competitions within the small to medium-size display panel market will be even more intense this year. However, it predicts that there will be huge demands for OLED panels as smartphone manufacturers start to release their 5G smartphones. It is planning to secure profitability through new demands such as foldable panel while emphasizing its differentiated designs and competitive price.

For large display panel business, Samsung Electronics is expecting a loss due to seasonal slow season. While prices continue to drop due to oversupply of panels, it is expected that the cost of constructing QD (Quantum Dot) display production plant “Q1” will lead to reduction in operating profit.

In order to induce new demands for its large display panel business, it is planning to continue to increase the percentage of high-value products such as 8K superhigh quality display panel.

“In the medium to long term, we are going to convert our LCD business into QD display business.” said Director Choi. “We are going to do our best to enter the giant TV market according to our schedule for the transition.”

◊Samsung Electronics’ IM Division look to continue innovative products

Samsung Electronics’ IM (IT and Mobile) Division made $90.0 billion (107.27 trillion KRW) and $7.78 billion (9.27 trillion KRW) in sales and operating profit respectively in 2019. Compared to its sales and operating profit in 2018, its sales in 2019 increased by 6.5% while its operating profit decreased by 8.8%.

Although it predicted its profit ratio would be even poorer due to stagnant premium smartphone market and deepened competitions within the low to medium-end smartphones market in last fourth quarter, it was able to put up a good defense.

Samsung Electronics is expecting an improvement in its overall performance as it prepares to release its flagship smartphone Galaxy S series and its new foldable smartphone that will be introduced to the public on the 11th of next month. However, it is likely that its operating profit will be similar to the operating profit from previous quarter due to increased marketing cost.

5G and foldable are the two main keywords for the smartphone market this year. Samsung Electronics has included a 5G model to the lineups of its major smartphones and it is also planning to expand the lineup of its premium smartphones by applying a new design to its foldable smartphone as well.

First, it has decided to include a 5G model to the lineups of its low to medium-end smartphones such as Galaxy A series. Its plan is to continue to strengthen competitive edge of its smartphones that respond to the public by quickly applying latest technologies based on requests from the market.

In addition to making optimal products, it is looking to provide new values and experiences from aspects of content with superhigh quality, game, AR (Augmented Reality), communication, and computing experience through 5G.

It is planning to maintain ODM (Original Development Manufacturing) method mostly for low-end models and limited supplies. It is going to continue to work with trusts in order to secure an appropriate level of quality while maintaining same operational basis as last year.

It has high expectations on its foldable smartphone, which is a “super premium product”, as it looks to set foldable smartphone as a major category within the mobile market.

“Although it is difficult for us to state the exact output of our foldable smartphones for this year, we are currently increasing our production capacity in order to increase production of foldable smartphones.” said Director Lee Jong-min of Samsung Electronics’ Wireless Division’s Wireless Planning Team. “We are currently working on improving the degree of completion from aspects of display, design, and UX.”

Samsung Electronics is looking for opportunities for its network equipment business within foreign markets such as the U.S. and China that have started to commercialize 5G network on full-scale. It is planning to actively push for foreign businesses in the U.S. and China that stated their plans to construct large-scale 5G networks and Japan that is currently planning to commercialize 5G network according to the schedule of 2020 Olympics in Tokyo.

◊Samsung Electronics’ CE Division looks to carry on a positive trend from last year

Samsung Electronics’ CE (Consumer Electronics) Division made $37.5 billion (44.76 trillion KRW) and $2.19 billion (2.61 trillion KRW) in sales and operating profit respectively in 2019. Both of these amounts were an increase compared to sales and operating profit in 2018. Samsung Electronics’ TV and home appliances businesses had both shown an upward trend.

Samsung Electronics was able to achieve a positive performance in its TV business due to positive sales of premium products such as QLED TV and giant TV. Compared to QLED TV’s sales volume in 2018, QLED TV’s sales volume in 2019 doubled. Samsung Electronics was able to maintain a huge lead within the giant TV market especially TVs that are bigger than 75 inches.

CE Division is looking to increase its sales and improve its profitability by selling more high-value products such as giant TV and lifestyle TV with QLED 8K TV at the center in this first quarter. It is also planning to introduce microLED TV for households during the second half of this year.

Because many major sports events such as Tokyo Olympics and Euro 2020 are scheduled this year, Samsung Electronics is expecting a higher growth of the TV market compared to last year. Samsung Electronics is planning to strengthen its leadership within the premium TV market while introducing products that meet various needs of consumers in order to maintain the first place within the TV market for 15 years in a row.

Samsung Electronics’ home appliances business’ performance in 2019 was better than that of 2018 due to increased sales of premium products such as BESPOKE Refrigerator and large dryer in the fourth quarter.

While increasing sales of new lifestyle home appliances and premium products this year, Samsung Electronics is planning to strengthen its B2B (Business to Business) business and increase online sales as well.

Staff Reporter Kwon, Geonho | wingh1@etnews.com & Staff Reporter Kang, Hyeryung | kang@etnews.com & Staff Reporter Park, Jungeun | jepark@etnews.com & Staff Reporter Yoon, Heeseok | pioneer@etnews.com