The NAND flash memory market is going through heavy waves globally. Although the memory market is finally showing signs of recovery after it had shown a slump since the second half of 2018, it is expected that major memory manufacturers will have mingled feelings of joy and sorrow due to unexpected variables. While Kioxia and SK Hynix have had stagnant performances due to a setback in production and decreased investments respectively, Samsung Electronics is seeing this situation as an opportunity and is carrying out large investments. As new NAND flash manufacturers such as Intel are rapidly entering the market, the NAND flash industry is expected go through huge ups and downs this year.

◊The NAND flash memory market showing signs of recovery

The NAND flash memory market has been showing an upward trend as the level of inventories has quickly become normal.

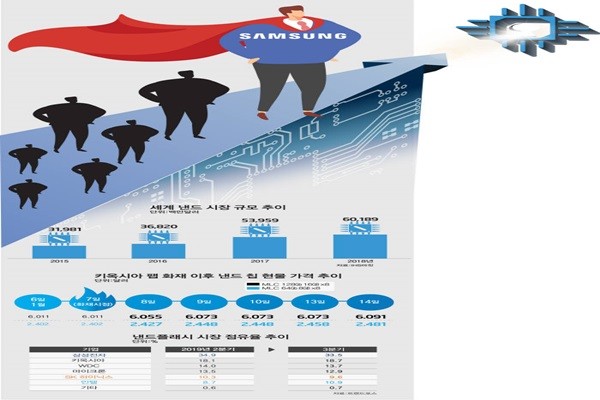

According to a market research company, the average selling price of 128Gb MLC, which is a general NAND flash memory used for SSD (Solid State Drive), in December was $4.42 that is a 2.55% increase compare to the average selling price in November. After the price started showing an upward trend in July of last year, it rose nearly 12% by the end of December.

It is heard that inventories have been greatly improved as well.

“We heard that Samsung Electronics’ inventories of NAND flash memories have reached a normal level recently.” said a representative for the industry. “It seems that the NAND flash memory market is showing a quicker recovery than the DRAM market.”

As a result, some estimate that the average selling price of NAND flash memory in the second half of this year will be 30 to 40% higher than the average selling price in the second half of last year.

◊Samsung Electronics enjoying opportunities while Kioxia going through unfavorable factors

Recovery in demands and market expansion are opportunities for companies to grow. However, it seems that there will be mingled feelings of joy and sorrow.

Samsung Electronics is the one that has been the most aggressive. It is planning to carry out an investment (65,000 units) in plant and equipment in its second semiconductor plant in Xian. It looks to expand its business through expansion as the market is showing signs of recovery.

Samsung Electronics is also looking to differentiate itself through technical skills. It is heard that Samsung Electronics can lower production cost by 20 to 30% compared to its competitors through CHT (Channel Hole Technology) that connects cells with one another through a cylindrical channel of 128-layer NAND flash memory.

On the other hand, companies that have established themselves at the middle of ranking have not had a positive start this year.

Kioxia had to endure a fire at its Yokkaichi 3D NAND Flash Plant on the 7th. As a result, Kioxia is not able to produce 4% (0.8 EB) of its quarterly output of NAND flash memories.

Since the fire, the spot prices of 256Gb TLC (Triple Level Cell) 3D NAND flash memory rose by 4% in just a week. Unfavorable factors such as a large-scale black out due to an earthquake in June of last year and the recent fire have hurt Kioxia its pride as the original NAND flash maker.

It seems that SK Hynix, which has also established itself at the middle of ranking, will also experience a change in its standing due to reduced investments in plant and equipment. The industry is paying sharp attention to SK Hynix that announced during its conference call on the performance of 3Q19 that it would reduce investments in 2020 despite signs of a recovery in demands. It is expected that investments in plant and equipment in M15, which is SK Hynix’s state-of-the-art NAND flash memory production line that was completed in 2018, will be insignificant this year as well just like last year.

M15 is currently operating about 15% of its entire fab and it is expected that its operation rate will rise to about 30% this year. However, such rise is not considered a huge rise considering the trend within the market. It is heard that deficit in NAND flash memory business and issue with production yield are holding back SK Hynix from making additional investments. It is heard that SK Hynix changed many personnel related to its NAND flash memory business last year to improve production yield. Fact that SK Hynix’s product line of NAND flash memories is not strong is another reason why SK Hynix is seeing low sales from its NAND flash memory business.

“Because SK Hynix’s products are mostly general NAND flash memories rather than NAND flash memories for data centers that can bring in high-added values, it is difficult for SK Hynix to create huge sales from its NAND flash memory business.” said a representative for a semiconductor company.

◊Newly rising companies chasing after top-ranked and middle-ranked companies

While Kioxia and SK Hynix are struggling, newly rising companies are fiercely chasing after them. Intel is a primary example. Intel displayed its power within the NAND flash memory market as well after being ranked fifth in 3Q19 with 10.9% of market shares and surpassing SK Hynix (9.6%).

Intel announced that it would enter the market on full-scale this year. Along with 96-layer NAND flash memory, it is looking to shake up the market by releasing world’s first 144-layer NAND flash memory this year.

Chinese companies, which are supported by its market and astronomical amount of government support, are also expected to enter the market. YMTC, which is under Tsinghua Unigroup, stated that it started producing 64-layer NAND flash memories based on its own technology called Xtacking Technology.

Some Chinese media reports that YMTC will skip production of 90-layer NAND flash memories and go straight to production of 128-layer NAND flash memories.

“It is predicted that Samsung Electronics is tightening the reins of the construction of its second semiconductor plant in Xian after being aware of a movement by Chinese companies.” said a representative for the semiconductor equipment industry.

As a result, competitions within the market will be even fiercer this year as Samsung Electronics looks to separate itself while middle-ranked companies struggle, and newly rising companies chase after middle-ranked companies and Samsung Electronics.

“It is expected that companies will intensely compete against one another this year to secure market shares within the NAND flash memory market.” said a representative for the industry. “It will be interesting to see which company will start to gain an upper hand within the market.”

Staff Reporter Kang, Hyeryung | kang@etnews.com & Staff Reporter Yun, Geonil | benyun@etnews.com