It is shown that South Korea, which is considered as a lithium-ion battery powerhouse, is still far away from catching up to China and Japan when it comes to market shares of four key battery materials such as cathode material, anode material, electrolyte, and separator film.

According to the results of an investigation recently announced by a Japanese market research company called Yano Research Institute on the four key battery materials markets in 2018, South Korea’s market shares in these four markets still stand at a single digit.

Although South Korea’s market share in market for cathode material, which is a key material that impacts the performance of a battery, was 8.6% and was slightly lower than its market share in 2017, its market share in the market for anode material, which impacts the lifespan and the charging time of a battery, made a slight increase to 6.0%. Its market share in the electrolyte market was 7.7% while its market share in the separator film market remained similar to its market share in 2017 at 8.5%.

Although South Korea is ranked first and fifth in the small battery market and the mid to large battery market respectively, it currently depends on foreign companies for the significant part of key materials. It obtains some of supplies of cathode materials and anodic materials from Nichia Corporation and Umicore and Mitsubishi Chemical Corporation, BTR, and Shanshan respectively. It receives significant amount of supplies of separator films from Asahi Kasei, Toray Industries, and Senior Material. Many Japanese companies such as Mitsubishi Chemical Corporation, Central Glass, and Ube Industries are also part of the supply network of electrolytes as well.

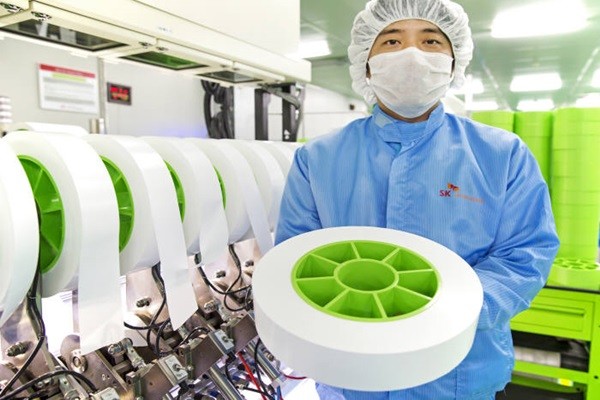

However, the industry believes that there is a possibility that market shares will start to increase as the need for localization of materials has become very important ever since Japanese Government’s regulation on exports was implemented. South Korean battery manufacturers are starting to receive supplies of cathode materials more from South Korean companies such as ECOPRO BM, L & F, and POSCO Chemical and they are also starting to gradually increase internalization ratios as well. POSCO Chemical is also starting to increase its market share in the anode material market. EnChem and Panax Etec have included themselves in the supply network of electrolytes. In case of separator film, SK Innovation, which is ranked second in the wet separator film market globally, is starting to increase the supply amount of separator films.

China, which is the world’s biggest electric vehicle battery market, is also maintaining its presence within the markets for relevant materials. It currently owns 63.6%, 74.0%, and 69.7% of market shares of the cathode material market, the anode material market, and the electrolyte market respectively, and its market share in the separator film market is also approaching 60% as it currently stands at 56.7%. Japan, which was the first country to develop a lithium-ion battery, currently owns about 30% of market share of the separator film market and it also owns market shares that range between 10 and 20% of other three markets.

“Although it seems that Chinese companies will continue to have their presence felt until the end of 2020 when South Korea’s subsidy policy is scheduled to end, there is a chance that they will stop growing if they fail to expand their markets through top Chinese battery manufacturers or foreign battery manufacturers.” said Yano Research Institute. “South Korean battery materials manufacturers, which supply their products mainly to South Korean battery manufacturers, will be able to expand their influence as European automotive manufacturers start manufacturing electric vehicles on full-scale.”

These four markets were worth $19.7 billion in 2018 that is 134.2% growth compared to 2017. Once multinational automotive manufacturers start manufacturing electric vehicles on full-scale, it is estimated that the market will be worth $22.7 billion this year that is 115.2% growth compared to 2018 and $33.4 billion in 2022.

Staff Reporter Jung, Hyeonjung | iam@etnews.com