Four South Korean comprehensive programming channel providers requested three times more PP (Program Provider) fee than current PP fee from paid broadcasting companies such as IPTV, cable TV, and satellite broadcasting.

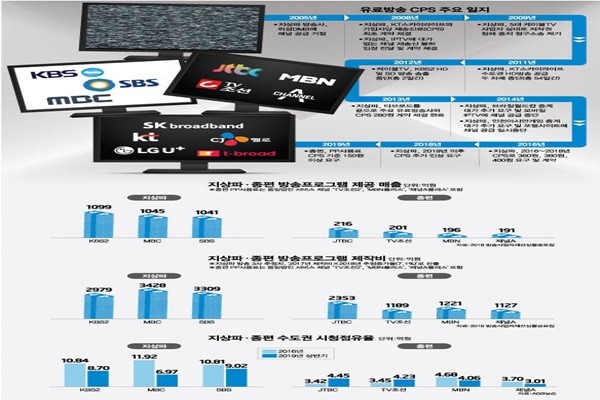

They also insist that current method of calculating PP fee needs to be changed into CPS (Cost Per Subscriber) method. While three national broadcasting companies are requesting an increase in CPS from $0.33 (400 KRW) to $0.42 (500 KRW), total TV programming channel providers have also joined forces with national broadcasting companies.

It is expected that there will be huge financial burden on paid broadcasting companies due to these requests from comprehensive programming channel providers. There are going to be unavoidable battles between paid broadcasting companies, national broadcasting companies, and total TV programming channel providers.

◊Background

Paid broadcasting companies, national broadcasting companies, and total TV programming channel providers all have difference stances.

Paid broadcasting companies are claiming that they are facing a slow increase in number of subscribers and stagnant sales at the same time.

Increase in number of subscribers that exceeded 800,000 people semiannually after the second half of 2015 has slowed down since the first half of 2018. Number of subscribers of paid broadcasting companies in the second half of last year only increased by 530,000 people from the first half of last year.

Cable TV companies’ sales have been regressing since 2014. Growth of satellite broadcasting companies has been stagnant while amount of growth of IPTV companies has reduced every year.

National broadcasting companies and total TV programming channel providers are also in a same boat as paid broadcasting companies. National broadcasting companies state that they are having lesser money to invest into contents due to continuous reduction in number of advertisements.

While total TV programming channel providers are seeing increased advertisement sales, they are requesting normalization on PP fee by stating that the amount of PP fee is absurdly low compared to impact of their contents.

Because they were designated as public interest broadcasting channel providers when they were established in 2012, they cannot stop providing channels and they state that they are not receiving PP fees properly.

Some total TV programming channel providers requested an increase in PP fee from OTT (Over The Top) providers that are not obligated to public interest broadcasting in the past and stopped providing their channels to these OTT providers when OTT providers did not accommodate their request.

◊Situation

Total TV programming channel providers requested a change in how PP fee is calculated from paid broadcasting companies. Current PP fee is about $15 million (18 billion KRW) and it is about $0.04 (50 KRW) per month based on CPS standard. Total TV programming channel providers are requesting that it needs to be at least $0.13 (150 KRW) per month.

Their argument is based on CPS of national broadcasting companies. CPS of national broadcasting companies is currently $0.33 (400 KRW) per month after starting at $0.23 (280 KRW). Amounts of CPS in 2018 for KBS, MBC, and SBS were $91.8 million (109.9 billion KRW), $87.3 million (104.5 billion KRW), and $87.0 million (104.1 billion KRW) respectively. National broadcasting companies are currently negotiating with paid broadcasting companies regarding CPS after 2019. They first mentioned $0.67 (800 KRW) per month and they are now mentioning $0.42 (500 KRW).

“CPS is even between $0.27 (320 KRW) and $0.28 (330 KRW) if we were to assume that national broadcasting companies are receiving CPS limited to subscribers of digital broadcasting companies.” said a representative for a total TV programming channel provider. “It is reasonable for us to request at least $0.13 (150 KRW) considering investment cost and audience share.”

Fact that audience shares of total TV programming channel providers jumped higher compared to the audience shares of national broadcasting companies is another reason why they are requesting an increase in CPS. Based on metropolitan areas in the first half of this year, audience shares of total TV programming channel providers were 15.75% while audience shares of national broadcasting companies were 24.69%. Difference in audience shares decreased from 18.3% in 2016 to 8.9%. Total TV programming channel providers point out that difference in costs for contents between them and national broadcasting companies is less than twofold when the difference in audience shares is move than fivefold.

There is also an issue with production cost. KBS2, MBC, and SBS spent about $251 million (300 billion KRW) each last year as part of their production costs. JTBC spent about $167 million (200 billion KRW) while TV Chosun, MBN, and Channel A spent about $83.6 million (100 billion KRW) each. While production costs of total TV programming channel providers are low, total TV programming channel providers insist that the difference in PP fees is too much.

◊Prediction

Because there is clear difference in stances between paid broadcasting companies, national broadcasting companies, and total TV programming channel providers, fierce battles between them will be inevitable. There is a high chance that it will take a while before they are able to come to an agreement.

Paid broadcasting companies insist that CPS of national broadcasting companies cannot be the standard for total TV programming channel providers to negotiate PP fee with them. They are stating that there is yet to be any proper verification on whether CPS standard of national broadcasting companies is reasonable and whether CPS method is reasonable.

Actually, national broadcasting companies never showed how they calculate CPS.

Although ratings and audience shares of national broadcasting companies have gone down, CPS has increased continuously. Paid broadcasting companies stated that they cannot accept national broadcasting companies’ request for $0.42 (500 KRW) per month for CPS in a situation like this.

“National broadcasting companies are only stating that they are losing impact of their contents when there needs to be reasonable basis for an increase in CPS.” said representatives for multiple paid broadcasting companies. “There is not any progress in negotiation.”

Paid broadcasting companies are also stating that they contributed to resolving fringe area issue and increasing advertisement profits for national broadcasting companies. They claim that national broadcasting companies need to pay them for retransmission when they pay national broadcasting companies for retransmission.

Biggest issue is that it is not difficult to calculate optimal CPS that can be accommodated by everyone.

In 2016, Korea Communications Commission and Ministry of Science, ICT and Future Planning (Currently Ministry of Science and ICT) announced ‘retransmission negotiation guideline for national broadcasting’ and prepare grounds to organize ‘national broadcasting retransmission cost verification consultative group’.

However, it is up to the business to apply advices from the consultative group to a contract through the guideline without legal binding power.

“South Korean Government needs to determine whether the request from national broadcasting companies to paid broadcasting companies is appropriate and prepare a way to calculate reasonable cost for contents for total TV programming channel providers.” said Professor Kim Yong-hee of Soongsil University. “Although part of total TV programming channel providers’ arguments are valid, there are concerns about a possibility of reduced portion for small and medium PPs when reduced profits for paid broadcasting companies are considered.

Staff Reporter Park, Jinhyung | jin@etnews.com