South Korea’s OTT (Over the Top) market is going through a reorganization. While Netflix is gaining more power, other OTT businesses are joining forces or withdrawing from OTT business. Some businesses are looking to find their next driving forces within OTT market.

◊South Korean OTT market grows bigger every day

There are currently 32.49 million people who are subscribers of paid broadcasting services in South Korea. Growth rate of number of subscribers has gone down for the past three years from 6.3% to 5.9% and to 3.6%.

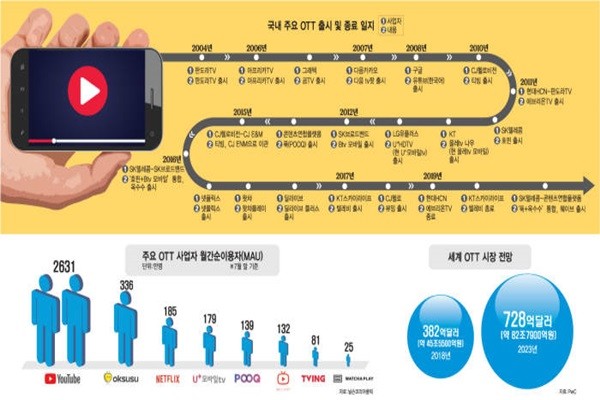

On the other hand, OTT market is growing at a rapid rate. According to a consulting company PwC, global OTT markets are currently worth $38.2 billion, and their worth is expected to double in 2023.

Although it is impossible to calculate how much global OTT businesses are making from South Korea’s OTT market, number of their subscribers show that their sales have grown tremendously. According to a market research company called Nielsen Korean Click, MAU (Monthly Active Users) of YouTube, which is practically monopolizing South Korea’s AVoD (Ad Based Video on Demand) market, is 25.54 million people. YouTube’s MAU in SVoD (Subscription Based Video on Demand) market also surpassed 10 million people.

Because fees for South Korean paid broadcasting services are still inexpensive, many believe that it is still too early to lean towards OTT services over paid broadcasting services . However, their potential threat to South Korean markets is huge considering how media use is being shifted towards VoD (Video on Demand). Actually, number of subscribers of Netflix increased rapidly when Netflix added more contents. Netflix’s MAU increased from 1,280,362 in January to 1,855,334 in July.

◊South Korean OTT businesses looking into various ways to survive

Many businesses are trying to solidify their status within South Korean OTT market that is filled with possibilities for growth.

SK Telecom and three national television companies are restructuring an OTT service POOQ into a comprehensive OTT service called ‘WAVE’. SK Telecom’s knowhow in marketing and its capital will be added to national television companies’ knowhow in creating contents.

Their goal is to create a platform that can compete with global OTT services. They have also secured competitive price by having the lowest monthly subscription of WAVE at $6.63 (7,900 KRW).

WAVE will provide broadcasting contents that used to be provided by POOQ as well as movie contents. SK Telecom and national television companies signed contracts with major South Korean and foreign CPs (Contents Provider).

D’LIVE is currently looking into a renewal of OTT business because it believes that it will be difficult to improve its corporate value only through cable TV business. It is looking to creating a comprehensive OTT platform that will support N-Screen and it is planning to launch its OTT platform early next year.

On the other hand, some businesses decided to withdraw from their OTT businesses. MSO (Multiple System Operator) called Hyundai HCN is ending its OTT service ‘EveryOn TV’ on the 30th. EveryOn TV was first launched in 2012 along with Pandora TV. Although EveryOn TV provides about 100 channels, it does not have any noticeable content.

KY SkyLife also announced that it would withdraw from its OTT service ‘TELEBEE’. TELEBEE was launched in 2017 and it is based on A-La-Carte method that allows viewers to watch channels that they want without having to sign a contract. However, TELEBEE’s A-La-Carte method started to collapse when few channels left TELEBEE. It lost its initial intent when it started to introduce contracts to lower financial burden from the OTT device price.

◊Competition within OTT market becomes fiercer

South Korea’s OTT market is expected to go through a reorganization and be comprised of few businesses with contents and capital. Other businesses are expected to partner up with these few businesses and continue to provide their services.

“In order for an OTT service to gain competitive edge, it needs to have killer contents and original contents.” said experts.

Currently, WAVE is the only South Korean OTT service that is drawing attention. This is because SK Telecom signed partnerships with telecommunication companies from various countries and was in responsible with attracting investments.

Netflix is expected to grow continuously within South Korea’s OTT market. A possibility that Disney and Apple, which announced that they would enter OTT market, entering South Korean market in the future cannot be ruled out as well. It is not easy for a South Korean OTT service to go head-to-head with global OTT services that have strong funding power and original contents.

Competition within South Korean OTT market will only become fiercer and this can lead to South Korean OTT services losing their grounds.

“A key is how fast and how South Korean OTT market overcomes the strength of global OTT services.” said experts. “South Korean OTT services need to benchmark successful cases of global OTT services and continue to differentiate their services.” They also mentioned the need for laws and systems that are optimized for OTT market.

Staff Reporter Park, Jinhyung | jin@etnews.com