South Korea’s credit card industry was warned that it would see an annual loss of $587 million (700 billion KRW) when South Korean Government reduced fees for franchises at the end of last year. As a result, it announced that it would have to reduce benefits for customers and throw out credit cards with many benefits to cover the loss. Despite South Korean Government’s measure, credit card companies’ net profits only decreased by 1% in the first quarter and the second quarter. Credit card industry believed that it was able to put up a good defense through intense restructuring and reduced operating expenses.

However, credit card companies have created an abnormal structure where they fill the gaps by reducing sales for VAN (Value Added Network) companies that act as proxies for credit card payments.

As a result, net profits for affiliated VAN companies dropped by tens of millions of dollars pushing VAN companies on the edge of a cliff.

In addition, credit card companies already converged their flat sum systems to fixed rate systems resulting in reduced agency fees for VAN companies. Also, they are intent on introducing direct approval system, which removes agency business by VAN companies, to franchises.

Although industries cannot just condemn the choice made by credit card companies that are trying to save their sales from dropping, they cannot just stand and watch VAN companies that have been working with credit card companies from being threatened of their existence.

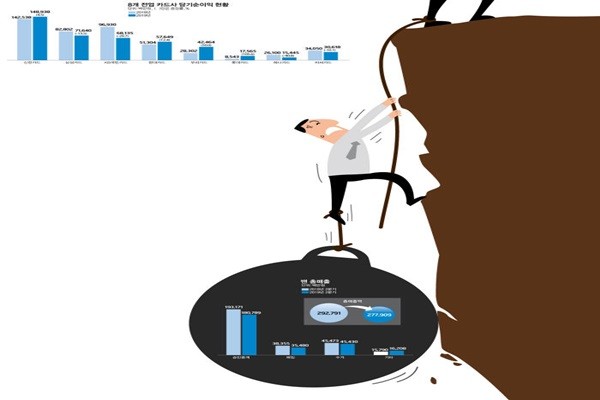

◊Comparison between net profits of credit card companies

After The Electronic Times looked into net profits of 8 South Korean credit card companies (based on Financial Supervisory Service’s Data Analysis, Retrieval and Transfer System) in the first and second quarters, their net profits only fell by 1%.

Shinhan Card, which is ranked first, saw its net profit from second quarter ($125 million (148.938 billion KRW)) increase 5% compared to its net profit from last year’s second quarter ($119 million (142.538 billion KRW)). Woori Card saw its net profit from second quarter ($35.6 million (42.464 billion KRW)) increase 50% compared to its net profit from last year’s second quarter ($23.7 million (28.302 billion KRW)). Remaining credit card companies saw a decrease in their net profits from second quarter compared to their net profits from last year’s second quarter.

Total net profits from these 8 credit card companies in the second quarter were $379 million (452.454 billion KRW).

“Even if we consider one-time costs, credit card companies are continuing to fill their gaps with agency fees.” said a representative for South Korea’s VAN industry. “It will be difficult for small and medium VAN companies to survive once credit card companies introduce non-signature transaction system and direct approval system.”

◊12 VAN companies see their sales drop by at least 5%

The Electronic Times also looked into the sales of 12 South Korean VAN companies. Their sales in the second quarter dropped by at least 5%. They are currently in their biggest crisis since the establishment of their companies.

Usually, VAN companies’ sales are divided into intermediary approval service, purchase, collection, and other charges. Entire sales from 12 VAN companies in the second quarter were $233 million (277.9909 billion KRW) that is about 5.1% lower than their sales from the second quarter of last year ($246 million (292.79114 billion KRW)).

Their sales from intermediary approval service were $152 million (180.78939 billion KRW) that is about 6% lower than their sales from the second quarter of last year ($162 million (193.17181 billion KRW)). Their sales from purchase were $29.7 million (35.48086 billion KRW) that is about 7.5% lower than their sales from the second quarter of last year ($32.1 million (38.35579 billion KRW)). Their sales from collection were $38.1 million (45.43086 billion KRW) that is about 0.1% lower than their sales from the second quarter of last year.

In addition, they are faced with unfavorable factors and have to be concerned about their own existence.

Actually, few small and medium VAN companies are already up for sale. Starting with LG Uplus’ Electronic Payment Business Department, KSNET and JTNET are currently up for sale.

“If one analyzes sales of credit card companies, he or she can see that many of them have been able to reduce risks by reducing agency profits for VAN companies except for reduction of operational expenses through large-scale restructuring.” said CEO of a VAN company. “If this trend continues, there will be no VAN company left in South Korea.”

◊VAN companies feel undervalued

South Korean credit card companies’ payment infrastructures are one of the best infrastructures in the world because it is the only country where a person can purchase something anywhere in the country as long as he or she has a credit card. Contributions made by VAN companies into building these infrastructures cannot be ignored.

VAN companies along with credit card companies have played major roles in building advanced payment infrastructures and they have also made enormous amount of profits through these infrastructures. This is why there are negative public opinions towards them. Due to these negative opinions, VAN companies have been silent towards the pressure from credit card companies.

Above all else, VAN industry wants consumers to know how much it has contributed to making payment systems more advanced and invested into credit card infrastructures.

Unlike other countries, South Korea has ‘VAN’ industry involved in a payment process. While other countries’ payment infrastructures are based on consumers, franchises (stores), and credit card companies, South Korea’s payment infrastructure adds VAN industry to these three. Fast and perfect credit card payment infrastructures are seen as possible through different characteristics of these four systems.

South Korea is the only one that operates backup systems when there is a system failure or large amount of credit card information is leaked. VAM companies are the ones that operate backup systems. VAN companies also play vital roles in national projects. South Korean Government’s plan to replace IC cards is a prime example.

When magnetic cards were replaced with IC cards, corresponding card readers were replaced through VAN agencies. VAN companies are also responsible for security standards and certifications.

VAN companies also jumped into South Korean Government’s plan to gather franchises for its Zero Pay project because they wanted to operate their network and set up their infrastructures.

Despite these efforts, there is consensus of opinions that VAN companies are undervalued.

“When VAN companies that are responsible for the back-end of the credit card industry collapse, South Korea can lose its competitive edge in payment infrastructure and experience its advanced credit card system becoming weaker.” said a representative for the VAN industry.

Staff Reporter Gil, Jaeshik | osolgil@etnews.com