It is expected that the image sensor market will make an upward growth this year despite the semiconductor market having a slow season. While SONY’s shares in the image sensor market is unrivaled, Samsung Electronics is quickly gaining grounds by expanding the lineup of its image sensors.

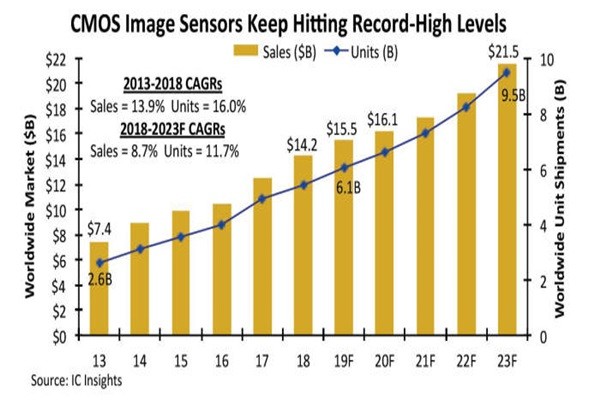

IC Insights is estimating that sales are estimated to increase 11% in 2019 to $15.5 billion.

Also, it is estimating that sales are estimated to increase 9% in 2020 to $16.1 billion despite a small hiccup due to the trade war between the U.S. and China.

IC Insights is also estimating that shipments will continue to increase as well. It is estimating that there will be 6.1 billion units sold worldwide in 2019 and that there will be 9.5 billion units sold worldwide in 2023 as shipments will continue to increase by 11.7% on average annually.

It is shown that China is the country that has purchased the most CMOS (Complementary Metal Oxide Semiconductor) image sensors. Out of entire CMOS image sensors sold worldwide in 2018, 39% of them were sold to Chinese companies. As Chinese Smartphone manufacturers such as Huawei and Xiaomi that adopt image sensors grow their businesses, they are purchasing more image sensors as well. The U.S. purchased 19% of the units sold in 2018.

Image sensor is a prototypical system semiconductor and it is like an eye for an IT device. Just as an eye sends information that it perceives to a brain, an image sensor converts light that comes through a camera lens into digital signal and sends the signal to an ISP (Image Signal Processor).

As Smartphone manufacturers start to include dual-cameras and triple-cameras to their products, there are more demands for image sensors as well. 61% of entire sales of image sensors are purchased by Smartphone manufacturers for their products. However, image sensors are starting to be used in many different areas. According to IC Insights, sales of image sensors for cars, medical industry and science, security, and industries are estimated to increase by 29.7%, 22.7%, 19.5%, and 16.1% on average annually by 2023.

Competition between Samsung Electronics and SONY is also something to keep an eye on. SONY currently owns half of the shares of the image sensor market and is currently ranked first based on market shares.

However, Samsung Electronics has closed up on SONY recently. It is focusing on expanding the lineup of its image sensors as it looks to become the world’s biggest system semiconductor company by 2030. Samsung Electronics recently released 108MP ISOCELL Bright HMX. This product, which also involved partnership with Xiaomi, is expected to be included into Xiaomi’s premium Smartphones as well.

Samsung Electronics has also secured other image sensors with various mega-pixels and is looking to target every facet of the image sensor market.

“Sales and shipments of CMOS image sensors that have rapidly increased since 2011 will not be stopped by the stagnant semiconductor market and the trade war between the U.S. and China.” said IC Insights.

Staff Reporter Kang, Hyeryung | kang@etnews.com