Amount of net incomes for South Korean financial holding companies greatly exceeded $9.7 billion (11 trillion KRW) due to increase in loans, rise in interest rate, and stock market boom. This is the first time when this amount surpassed $9.7 billion since 2011. However, while profitability for banks and financial investment companies has increased consistently, profitability for insurance companies and credit card companies has dropped sharply due to recent negative factors.

Financial Supervisory Service (FSS) presented ‘Business Performance of Financial Holding Companies in 2018’ on the 1st. This performance includes performance of 9 financial holding companies such as KB, Shinhan, Nonghyup, Hana, BNK, DGB, Korea Investment & Securities, Meritz, and JB and it does not include performance of Woori Financial Holdings that was established this past January.

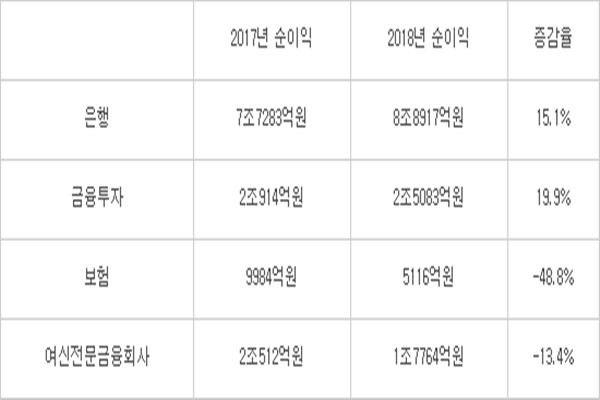

Amount of net incomes for all 9 financial holding companies in 2018 was $10.3 billion (11.641 trillion KRW) and it increased by 6.8% ($657 million (744.5 billion KRW)) compared to the amount in 2017 ($9.61 billion (10.8965 trillion KRW)). Amount of net profit of banks in 2018 is higher than the amount of net interest in 2017 by $1.03 billion (1.1634 trillion KRW) due to improvement in net interest margin. Financial investment companies, which had gone through stock market boom during the first half of 2018, saw an increase in their net profit by $368 million (416.9 billion KRW) due to increase in amount of profits from fees.

Percentages of profits of banks and financial investment companies in 2018 were 64.3% and 18.1% respectively and they increased by 4.3% and 1.8% respectively compared to the percentages in 2017.

“Business performance of financial holding companies in 2018 improved in every aspect such as growth, profitability, and stability due to increase in amount of profits.” said Team Leader Lee Jin of FSS’ Financial Group Supervisory Office.

On the other hand, profitability of insurance companies and credit card companies in 2018 was worse than the profitability in 2017. Amount of net profit of insurance companies in 2018 decreased by $429 million (486.8 billion KRW) compared to the amount in 2017 due to reduction in premium income of saving-type insurance and increase in loss ratio within auto insurance. Amount of net profit of credit-specialized financial companies that include credit card companies and capital companies in 2018 also decreased by $242 million (274.8 billion KRW) due to absence of factors that increase one-time profits. FSS ordered for accumulation of additional 30% of loan loss allowance on at least two card loans as a result of revision to supervisory regulations back in June of 2017. Percentages of profits also dropped greatly. Insurance companies and credit-specialized financial companies recorded 3.7% and 12.8% respectively that are 5.1% and 3.1% lower than the percentages in 2017.

It is expected that such trends will continue in the future as South Korean Government is preparing to introduce new IFRS17 (International Financial Reporting Standard) that will be applied to insurance companies in 2022. Although IFRS17 was planning to be enforced in 2017 and is now postponed by a year, expansion of capital has remained the same. As a result, it is expected that insurance companies would issue subordinated bonds and increase capital by issuing more new stocks again this year. It is likely that credit card companies will see their performance drop as there was additional reduction of transaction fees from their franchise stores at the end of last year.

“We are going to tighten up risk management and internal control of financial holding companies and induce establishment of healthy governing structure.” said Team Leader Lee.

Amount of total assets of 9 financial holding companies in 2018 was $1.68 trillion (1901.3 trillion KRW) and it increased by 8.8% ($147 billion (166.7 trillion KRW)) compared to the amount in 2017. In 2018, these 9 financial holding companies had 209 subsidiaries, 7,204 stores, and 121,125 executives and employees in total.

Staff Reporter Park, Yoonho | yuno@etnews.com