BankSign, which is blockchain-based joint authentication service heavily invested by South Korean banks, is not drawing much attention from consumers and there is a high chance that it will be left as a failed IT investment case.

BankSign, which is a next-generation authentication platform that will replace current official certificates, started ambitiously with participation from 15 banks. Although it was given the name ‘world’s first joint authentication platform by banks’, it is being regarded as ‘half authentication system’ that is not even effective as official certificates.

Although BankSign was launched 3 months ago with The Korea Federation of Banks (KFB) leading the way, there are not even 100,000 cases of BankSign being issued to consumers. It is confirmed that about 15,000 stopped using BankSign after downloading it.

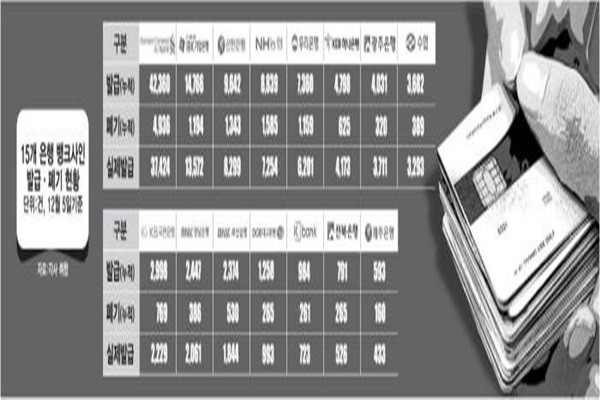

The Electronic Times looked into numbers of issues and disuses of BankSign.

Total number of issues of BankSign, which was launched on the 27th of August, was 106,923 based on 15 participating banks as of the 5th of December. It is not even 0.2% compared to that of official certificates. Number of cases when consumers were issued BankSign and stopped using it is 14,187. Considering this number, actual number of issues of BankSign is only 92,736.

BankSign is currently issued by KB Bank, Woori Bank, Shinhan Bank, IBK Bank, K-Bank, SC Bank Korea Limited, NH Bank, KEB Hana Bank, Kyongnam Bank, Kwangju Bank, The Daegu Bank, Busan Bank, Suhyup Bank, Jeon Buk Bank, and Jeju Bank.

It is embarrassing to even show number of issues of BankSign by each bank. Some of local banks did not even issue BankSign more than 1,000 times.

SC Bank Korea Limited is responsible for 40% of total issues with 42,360 cases followed by IBK Bank (14,766), Shinhan Bank (9,642), NH Bank (8,839), Woori Bank (7,360), KEB Hana Bank (4,798), Kwangju Bank (4,031), Suhyup Bank (3,682), KB Bank (2,998), Kyongnam Bank (2,447), Busan Bank (2,374), The Daegu Bank (1,258), K-Bank (984), Jeon Buk Bank (791), and Jeju Bank (593).

Number of disuses of BankSign compared to number of issues of BankSign surpassed 10% for most of these banks. This indicates one person out of ten people do not use BankSign and throws it away in a trash can.

Number of disuses of BankSign is the highest for SC Bank Korea Limited with 4,936 cases followed by NH Bank (1,585), Shinhan Bank (1,343), IBK Bank (1,194), Woori Bank (1,159), KB Bank (769), KEB Hana Bank (625), Busan Bank (530), Kyongnam Bank (386), Kwangju Bank (320), Suhyup Bank (289), The Daegu Bank (265), Jeon Buk Bank (265), K-Bank (261), and Jeju Bank (160).

Although it has been more than 3 months since BankSign was launched, number of issues of BankSign is not even more than 100,000.

Despite banks working to advertise BankSign by putting advertisements on their homepages and mobile applications, there is not much improvement.

These banks are also starting to feel dissatisfied with BankSign as problems such as lack of professionalism by KFB that emerged during development process of BankSign are being brought up.

Some SI companies are criticizing BankSign by calling it a ‘fake blockchain certificate’ that shares private certificates that are issued by banks with each other. Others are also criticizing KFB for eliminating small and medium companies from selection process for development of BankSign and not making specifications for BMT technology public.

Lack of follow-up protocol on BankSign is also being criticized. Some are pointing out that actual registration and use of BankSign is very complicated and that it is almost impossible to find log-in and registration menu.

“BankSign signals the start of blockchain-based bank platforms on full-scale.” said Chairman Kim Tae-young of KFB during launching ceremony of BankSign. “We have prepared a foundation to push for more various blockchain projects in the future.” However, disappearance of blueprint for Industry 4.0 ecosystem is leading to more blame on Chairman Kim.

Participating banks are also frustrated as they are not provided with marketing for advertisements and follow-up protocol even though they are paying enormous amount of expenses to KFB. They are also saying that KFB is actually blaming them for lack of performance.

“Although we brought up many issues regarding BankSign, our opinions were ignored.” said a representative for a participating bank. “KFB is basically utilizing BankSign to show South Korean Government how much it is contributing to South Korean Government’s plan to expand foundations for FinTech industry.”

Staff Reporter Gil, Jaeshik | osolgil@etnews.com