“P2P has same direction as that of government policies such as promotion of venture companies and redistribution of wealth because it provides loans with medium interest to classes excluded from current financial industry. It seems that this revised plan of tax law put out by South Korean Government indicates that South Korean Government understands benefits of P2P.”

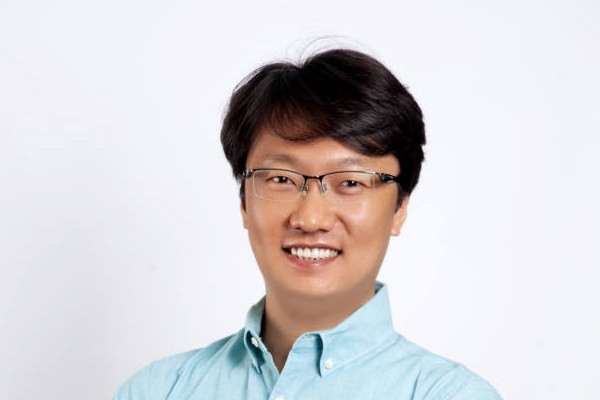

Chairman Yang Tae-young of Korea P2P Finance Association announced that Korea P2P Finance Association welcomes ‘withholding tax reduction of interest income from P2P finance’. South Korea’s P2P financial industry also added that it will create a healthy ecosystem according to such policy.

Ministry of Economy and Finance (MOEF) lowered income withholding tax from incomes earned by P2P investments to 14% through its revised plan of tax law on the 31st of last month. In the past, South Korean Government applied 25% tax to such incomes as it treated them as interest of non-business loan.

Korea P2P Finance Association also saw changes of P2P department within Financial Services Commission (FSC) as a positive sign.

P2P had been supervised by FSC’s Small Loan Finance Department just like loan industries. However, this task is now done by Financial Innovation Planning Department. FSC has established Financial Innovation Planning Department that will be responsible for cryptocurrency and P2P through reorganization.

“This change is an indication by South Korean Government that it will promote P2P as one of FinTechs.” said Chairman Yang. “There were negative views towards P2P in the past because Small Loan Finance Department had treated P2P industry as an industry that needs to be regulated.”

Korea P2P Finance Association saw that this change is a result of synergy between financial authorities and efforts from relevant industries despite unfavorable factors such as scam and bankruptcy of few companies.

FSC held a joint meeting with prosecutors and police on the 14th of June and exposed few companies with suspicion of embezzlement. Korea P2P Finance Association announced voluntary restraint plan at a provisional general meeting held in the same month. Its plan is based on supplementation and enhancement of money management systems, trust towards loan portfolio, and self-factual survey.

“As of now, we are planning to work with PG (Payment Gateway) companies that have similar level of money management systems as banks since our members are planning to have their money managed by banks rather than electronic PG companies.” said Chairman Yang. “We have prepared final detailed regulations of our voluntary restraint plan and we are going to distribute them after having feedbacks from our board of directors.”

However, Chairman Yang strongly stated need for legislation of relevant laws since voluntary restraint plan is only a ‘settled promise. He predicted that 3 bills (by Min Byung-doo, Kim Soo-min, and Lee Jin-bok) that are motioned to The National Assembly will be evaluated at the same time.

Chairman Yang’s goal is to finish voluntary restraint plan during his term and receive a corporation approval from financial authorities. Korea P2P Finance Association is planning to hold consulting and education for its members to create a healthy ecosystem.

“Since South Korean Government and financial authorities have sent out positive signals, we are going to encourage non-members to join our association so that we can contribute to development of South Korea’s P2P industry.” said Chairman Yang.

Staff Reporter Ham, Jihyun | goham@etnews.com