Oversupply of LCDs made by Chinese manufacturers is expected to start starting from the first quarter of 2018 because BOE pushed forward schedule for mass-production at its super-large 10.5th generation LCD plant from the second half of 2018 to the first quarter of 2018. It is expected that there will be oversupply starting with LCD TV panels that are 50 inches and over.

It seems that LCD markets will quickly turn into Red Ocean as CEC is also planning to operate its new 8th generation LCD lines in the second and third quarter of 2018 and CSOT and other manufacturers are also building new LCD panel plants.

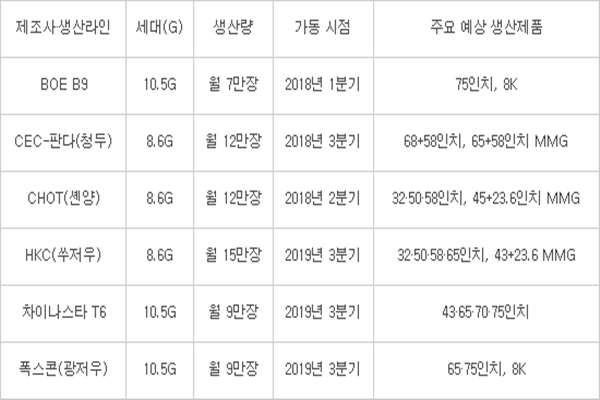

According to industries on the 13th, BOE is going to push forward timing of operation of its 10.5th generation LCD production line called B9. Although initially it was planning to operate it during the second half of 2018, it has hurried its investments and decided to operate it during the first quarter of 2018. Besides BOE, other Chinese LCD manufacturers such as CEC and CHOT are also going to operate their new plants one after the other.

8.6th generation (2,250x2,610mm) production line that is being built by CHOT, which was established by CEC and Caihong, in Shenyang and 8.6th generation production line that is being built by CEC-Panda in Chengdu will start operating in the second quarter and the third quarter of 2018 respectively.

More LCD production lines will be built between 2019 and 2022. CSOT is currently building 11th generation production line (same standards as 10.5th generation) called T6 with an aim to finish construction by the second quarter of 2019; Foxconn is also building 10.5th generation production line with an aim to finish construction by June of 2019. HKC, which started its 8.6th generation production line located in Chongqing this year, has also decided to build another 8.6th generation production line in Suzhou.

There are also many new LCD production lines that are likely to be established with investments. It is heard that BOE is thinking about making investments into building 8.7th generation production line (B14) in Chongqing and CSOT is also thinking about building its second 11th generation production line (T7). HKC is looking into making investments into building 10.5th generation production line.

Market research company called IHS Market calculated that 8 new 8th generation a-Si (amorphous-Silicon) production lines, 1 new oxide production line, 3 new 8.6th generation production lines that use both a-Si and oxide methods, and 5 new 10.5th generation production lines will be built in China between 2016 and 2022. This calculation also includes fabrication facilities that are not established with investments yet.

Industries are worried that new investments into LCDs made by Chinese manufacturers will not only cause oversupply but also cause negative impact on South Korean panel manufacturers that are operating their strategies based on large panels. Although Chinese panel manufacturer have been producing mostly 32-inch and 40-inch panels, they are planning to mass-produce 50-inch, 60-inch, and even 70-inch panels from their new fabrication facilities.

BOE, CSOT, Foxconn, and CEC Group have decided to apply 8K resolution to 60-inch panels and even super-large panels that are between 70 and 80 inches. This is their strategy to surpass South Korean companies that have better quality and technical skills.

Opinions from South Korean experts differ as Chinese panel manufacturers set to mass-produce LCDs from their new plants starting from the first quarter of 2018. Most of experts predict that oversupply will be inevitable and that South Korea’s LCD industries will be heavily affected by Chinese manufacturers. On the other hand, some even predict that it will take significant amount of time for Chinese panel manufacturers to actually mass-produce super-large panels from their new fabrication facilities as yields of panels that are 50 inches or bigger are low.

Because it also took many years for Japan’s Sharp to secure its yield from 10.5th generation fabrication facility, many experts suggest that it will not be easy for Chinese manufacturers to draw meaningful results starting from the first half of 2018. In that case, it will be advantageous for South Korean panel manufacturers during the first half of 2018.

“Although BOE can secure 1 to 2% of supplies from global TV markets annually, it is not a large amount.” said Director Park Jin-han of IHS Market. “Amount of impact of BOE’s 10.5th generation line will not be much when considering production yield as well.”

“Oversupply of Chinese LCDs will not only threaten South Korean panel manufacturers but it will also cause competitions between Chinese manufacturers.” said a representative for an industry. “Because Chinese panel manufacturers are also investing into OLED at the same time, competitions between them will only become more competitive.”

Staff Reporter Bae, Okjin | withok@etnews.com