Competitions for developing next-generation secondary batteries are becoming fiercer. Although number of demands for secondary batteries is rising rapidly, lithium-ion batteries that are currently the main batteries that are used have reached limitations in performance and continue to have safety problems.

According to industries on the 16th, South Korean and foreign battery manufacturers as well as global home appliance and automotive industries, universities, and laboratories have all jumped into competitions for developing next-generation batteries.

Lithium-ion battery, which was first developed and commercialized by SONY in 1991, has gone through many improvements such as anodic and cathodic materials and change of makeup for 20 years. However speed of improvement of its performance has slowed down recently. Also there is a high chance of ignition for lithium-ion batteries that use liquid or gel-type electrolytes when they are applied with pressure or impact.

Industries predict that capacity of lithium-ion batteries will reach limitation within next 5 to 7 years. However it is becoming more difficult to differentiate performance that sticks out with current technologies. Due to this reason, industries are paying their attention towards development of secondary batteries.

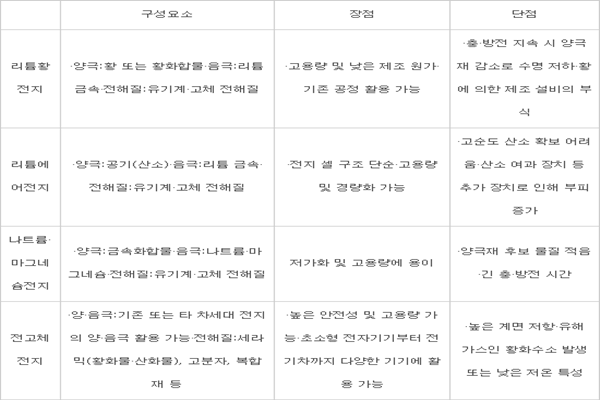

All-solid-state batteries, lithium-sulfur batteries, lithium-air batteries, and sodium-magnesium ion batteries are seen as candidates for next-generation secondary batteries. Out of these batteries, the most likely candidate is all-solid-state batteries.

All-solid-state batteries use solid electrolytes between anodic and cathodic materials and lowers danger of ignition that can be caused by liquid electrolytes. Unlike how lithium-ion batteries cause chemical reactions and ignite when electrolytes come outside of batteries as batteries are applied with impact, all-solid-state batteries can greatly reduce possibility of explosion or leakage of electrolytes. They can prevent from their performance becoming lower even in environments with high temperature or high pressure.

However because movement of ions is not smooth with solid electrolytes compared to liquid electrolytes, it is difficult to secure similar performance as lithium-ion batteries. Although capacity of all-solid-state batteries is similar to that of current batteries, it is difficult to increase their lifespan.

Toyota is one of the businesses that is most active in developing technologies regarding all-solid-state batteries. It has secured about 200 technology developers and is currently developing sulfide all-solid-state batteries with Tokyo Institute of Technology. Early last year, it developed all-solid-state batteries that are three times better than lithium-ion batteries in performance. Although Toyota somewhat entered markets for electric vehicles late, it will be gain upper hands in performance for safety and long-distance drive if it is able to preoccupy all-solid-state battery technologies in advance.

China’s CATL has also been developing sulfide all-solid-state batteries with Chinese Academy of Science since 2015 in order to mass-produce them in 2023. Japan’s Murata, which acquired SONY’s battery business in 2016, is also working on development of all-solid-state batteries by combining its ceramic stacking technology and SONY’s material and battery process technologies.

Dyson, which is popular for its wireless vacuum cleaners, acquired Sakti3, which is a startup company for solid batteries, in 2015. Bosch, which specializes in automotive parts and electric tools, also acquired an American startup company called Seeo that has solid battery technologies.

While South Korean businesses, that are top two in global markets for small batteries, are also working on development of all-solid-state batteries, they are extremely reluctant to introduce level of their detailed technologies.

Although Samsung SDI made development of all-solid-state batteries official in 2013 by introducing prototypes, it did not display other prototypes at recent exhibitions as it is having difficulty in commercializing them contrary to its initial goal.

Hyundai Motor Company is also working on developing its own electric vehicle batteries. It is heard that it is currently developing all-solid-state batteries and securing related technologies with Namyang Laboratory’s Battery Leading Development Team at the center.

Reason why automotive manufactures and home appliance manufacturers are also working on development of next-generation batteries is because internalization of technologies has become very important in order to strengthen competitive edge in products as percentage of batteries that batteries occupy in electric vehicles and wireless home appliance products has become bigger. However position that each business takes towards next-generation battery markets is subtlety different from each other.

Automotive manufactures, which lost upper hands in lithium-ion markets, are showing much more activeness in securing next-generation battery technologies. Reason why automotive manufactures are not working with battery manufacturers and developing their own technologies is a same context.

On the other hand, battery manufacturers that have yet to establish stable surplus structures while carrying out enormous amount of investments into lithium-ion batteries for electric vehicles have no choice but to be conservative towards next-generation batteries.

“Although all-solid-state batteries will be a remarkable innovation when they are developed, battery manufactures are having hard time commercializing them.” said a representative for a battery industry. “It is likely that it will take another 5 to 10 years to actually commercialize all-solid-state batteries since technologies on lithium-ion batteries are continuing to be developed and development of technologies and actual commercialization are totally different issues from each other.”

It seems that long-term preparation is needed since all-solid-state batteries are seen as the most likely candidates as next-generation batteries. “Because general manufacturing process for all-solid-state batteries is very different from current lithium-ion batteries, technical capability in material science and optimum development of manufacturing process for materials are must.” said Choi Jung-deok who is a researcher for LG Economic Research Institute. “Because it is not easy to just copy all-solid-state batteries and to accumulate capabilities in a short period of time and that companies that lost timing on development can be hugely affected with blow that cannot be recovered in a short period of time, it will be necessary for companies to diversify structures of their competitions through outside support.”

Staff Reporter Jung, Hyeonjung | iam@etnews.com