Market price of bitcoin, which is digital virtual money, broke its previous market price by reaching $1,932 (2.2 million KRW) at one point. People are investing on bitcoin left and right as Japan is accelerating in a process of commercializing virtual money such as bitcoin and as SEC (Securities and Exchange Commission) from the U.S. announced that it will reexamine bitcoin ETF (Exchange-Traded Fund) again.

Although there was an incident recently when a bitcoin exchange in South Korea was hacked and bitcoin worth of $4.83 million (5 billion KRW) was extorted and raised issues about security, popularity on bitcoin as an investment target is not cooling down.

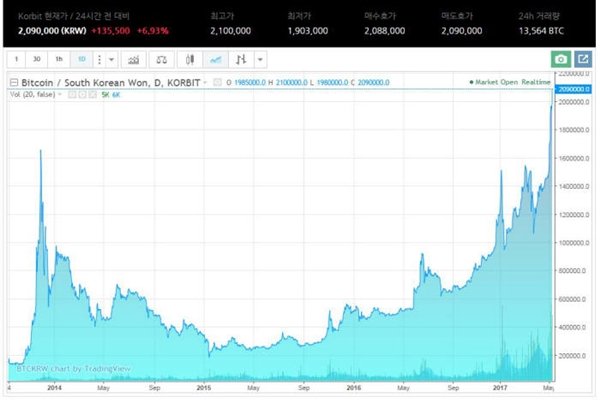

According to financial circles on the 9th, market price of $1,757 (2 million KRW) per bitcoin was formed at major South Korean bitcoin exchanges such as Bithumb, Coinone, and Korbit. Compared to how it was worth $176 (200,000 KRW) in early 2015 when its worth was the lowest and $439 (500,000 KRW) during same time last year, its value has increased by 10 times and 4 times respectively.

Bitcoin is online virtual money based on blockchain technology and it is issued after each user goes through a process called ‘mining’ where users solve particular mathematical formulas without any intervention from central organizations and financial companies. Because entire amount of currency is set at 21 million bitcoins, values are set depending on transactions between individuals. It is difficult for countries and central banks to intentionally participate in market price and exchange rate.

Bitcoin started drawing attention as countries considered incorporating bitcoin as next-generation currency to institutional system. As bitcoin exchange was also established in South Korea in 2013 and as bitcoin was seen as a major FinTech technology, its worth rose rapidly from $88 (100,000 KRW) to $1,405 (1.6 million KRW) in just couple months.

Afterwards its value has increased and decreased whenever governments from countries applied sanctions on transactions after seeing bitcoin as a target for regulation and considered incorporating it as money to institutional system. However its market price generally showed continuous declining graph. Because information of a trader is guaranteed of anonymity even though breakdown of transactions is all open to public, variety of ‘money laundering’ programs appeared and caused bitcoin to be used to conceal fund for crimes and ransom for ransomware.

It seems that recent sharp increase in market price of Bitcoin was applied with positive expectations as market situations in the U.S., China and Japan have changed.

Although SEC initially rejected bitcoin ETF, it announced at the end of last month that it will reexamine bitcoin ETF. Bitcoin ETF is a good news for legalization of bitcoin and introduction of large capitals from investment companies.

Although China once played a role of increasing value of bitcoin as percentage of China’s currency reached almost 90% out of entire transactions of bitcoin, bitcoin’s volume nosedived when The People’s Bank of China announced that it will regulate bitcoin. Although there are restrictions on wire transfers to foreign countries by Chinese bitcoin exchanges, bitcoin is still receiving spotlight as a way to avoid value of Yuan from dropping. Volume of bitcoin has recently increased in Japan as it recognized virtual money as a new method of payment by revising Fund Settlement Act.

It seems that market price of bitcoin is depends on effects from foreign markets as it is a method of investment to implement profits instead of using it as a method of currency. Although some stores introduced bitcoin as a method of payment, it was difficult to use it as currency as there were huge variabilities.

One of South Korea’s bitcoin exchange was hacked recently and the amount of bitcoin (3,816) that was hacked corresponds to 37% of customers’ assets it had possessed. This exchange became a controversy when it divided loss from this damage with all of its customers.

“Although it is institutionally difficult to prevent losses that occur from transactions of bitcoin in South Korea, expectations on Bitcoin are still high.” said a representative for an industry. “Because it is difficult to estimate market price of bitcoin and there is high variability, one has to be cautious when making investments that are made according to current trends.”

Staff Reporter Park, Jungeun | jepark@etnews.com