LG Display made more than $880 million (1 trillion KRW) in quarterly operating profit for the first time in this first quarter. In spite of seasonal slow season, it was able to make its greatest quarterly performance due to increase in selling prices of panels such as LCD panel. LG Display is planning to expand its production capacity and secure new driving forces with small and medium OLED panels at the center this year.

◊Effects of Unclear Estimation of LCD Price in Second Half

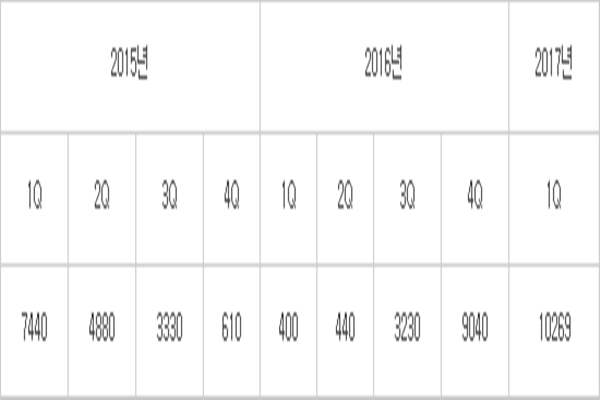

LG Display made $905 million (1.0269 trillion KRW) in operating profit in first quarter and this value is 2498.3% increase from operating profit in first quarter of last year. It made $6.22 billion (7.0622 trillion KRW) in sales which is 17.9% increase from sales in first quarter of last year. Surplus has increased compared to previous quarter due to increase in percentage of premium products such as continuous enlargement of LCD TV panels and increase in sales of IT panels with high resolution.

LG Display is predicting that market situations in second quarter will be similar to how they were in first quarter. It is predicting that an area of shipment will be similar to as first quarter and that amount of shipment will either be reduced or stay the same. It is also predicting that selling prices of panels will be stable overall and that selling price per area will fall to a single digit due to seasonal effects.

It is especially going to expand production line of extra-large LCD panels that are bigger than 60 inches on full-scale starting from second half of this year and is predicting yearly growth of more than 30%.

Although LG Display made $880 million (1 trillion KRW) in operating profit in first quarter, predictions from markets on whether or not LG Display will continue this trend in second half differ as there is a possibility that set manufacturers, which are financially burdened due to lack of TV sales, will reduce their output even when prices of large LCD TV panels continue to rise. If set manufacturers reduce amount of orders for panels, there is a possibility that prices of large LCD TV panels might fall. Prices can fall even more if Chinese companies ease lack of supplies of panels by operating their new 8th generation lines.

Some also predict that LG Display will be able to maintain $880 million (1 trillion KRW) of quarterly operating profit for rest of this year because LG Display, which has relatively higher competitive edge in technologies than Chinese companies, is at a more advantageous situation than Chinese companies as number of demands for extra-large LCD TV panels continues to increase.

Increase in supply amount of OLED TV panels starting from second half of this year can also have positive impact on LG Display’s sales and profits. Some also think that because area of operation of new lines in China is only 3% based on 8th generation lines, it is currently not at a level yet to change or shift flow of markets.

◊Modification of Strategies due to More Positive Responses from Markets than Expectations

“Responses from markets towards CSO (Crystal Sound OLED) and wallpaper are better than our expectations.” said Executive Director (CFO) Kim Sang-don of LG Display. “Because interests and demands for small and medium plastic (flexible) OLED panels are growing bigger, we are currently modifying our strategies, direction of investments, and detailed plans.”

This year’s yearly facility investments will be concentrated on small and medium plastic OLED panels.

“We are going to focus 70% of our yearly facility investments on OLED panels and majority of this 70% will be on small and medium plastic OLED panels.” said Executive Director Kim. “However because cost of investments for plastic OLED panels is significantly bigger than cost of investments for LCD panels, we are going to deeply examine certainty towards demands in this market and situations of our customers and carry out investments conservatively.”

LG Display is predicting that number of demands for small, medium, and large OLED panels in 2018 and 2019 will be bigger than its initial prediction. It is planning to decide on size of investments and direction of P10 Line accordingly.

“We are calculating size of our investments again as we are receiving many requests from many customers.” said Executive Director. “Fortunately because product’s profitability, evaluation, and market conditions are positive, we are examining things according to these conditions.”

There is a higher chance that LG Display will achieve surplus from its OLED TV panel business based on EBITDA (Earnings Before Interest, Tax, Depreciation and Amortization). LG Display is estimating that there will be 300,000 and 500,000 shipments of OLED panels per quarter during first half and second half of this year respectively. Its expectations that actual results will surpass its internal goals have also risen due to positive responses from markets.

LG Display is going to expand its production capacity for OLED TV panels this year and is going to start mass-producing 6th generation plastic OLED panels for mobile devices and 5th generation plastic OLED panels for lights. Second stage of extension of its 8th generation E4 Line is expected to be finished by end of second quarter. When construction is finished, its production capacity will increase from 26,000 panels per month to 51,000 panels per month.

It is planning to mass-produce plastic OLED panels from 6th generation line called E5 and E6 at the end of second quarter and second half of next year respectively. It is preparing to mass-produce OLED panels for lights from 5th generation line called P5 in second half of this year.

It is also working on creating new applications through CSO panels.

“Besides high quality and thin design, CSO panels also showed a possibility of convergence, which is one of strengths of OLED panels.” said Executive Director Song Young-kwon of Strategy and Marketing Group. “We are discussing with our partners since it can be applied variously due to its high expandability.”

Staff Reporter Bae, Okjin | withok@etnews.com