South Korea’s 2 online only banks are going to compete against each other with their robots that manage assets and ‘Finger Banking’ that can process all financial tasks in just 10 minutes. Online only banks are almost done with their data processing, hiring, and preliminary tasks and are going to be launched at the end of this year. It is predicted that South Koreans will be able to see fun and surprising services that they have not experienced before.

Financial Services Commission (FSC) held a press meeting with KakaoBank and KBank at KakaoBank’s office that is located at Pankyo H Square on the 6th. (Reference: Page 20 of a related article)

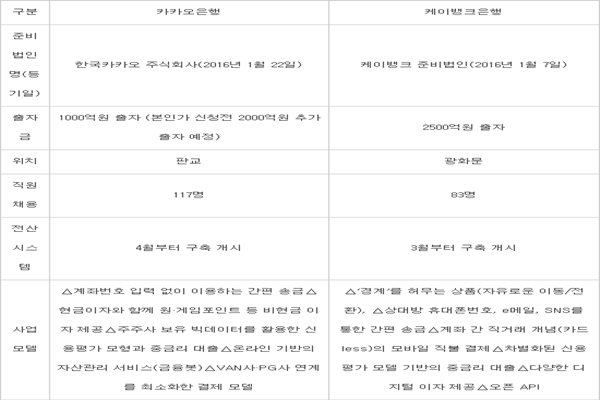

These two online only banks announced their business strategies and partially introduced their innovative business models.

KakaoBank put out ‘Chatbot’ that converses with people. It is KakaoTalk-based financial robot that gives advices to questions from customers in real-time 24 hours.

Financial robots are planning to give schedules for payments of utility bills, break down payments of electronic transfers, and introduce customers to nearby restaurants where coupons can be used. They will also check and manage financial situations of customers and recommend merchandises and support counseling service.

KBank put out 100% non-face-to-face financial service that can process all financial tasks online. Its plan is to develop ‘Finger Banking’ that allows customers to use banking whenever they want.

Its goal is to implement a real-life financial platform that can be approached whenever and wherever and to provide a new financial environment that can complete all tasks within 10 minutes.

KakaoBank’s major business models are: simple wire transfer without inputting account numbers, non-cash interest such as points from music and games along with cashback, credit evaluating model (Kakao Scoring) based on Big Data from and loans at medium interest rate, online-based asset management financial robot, loans for small businesses on E-Bay (G-Market and Auction), and card payment system that minimizes VAN and PG (Payment Gateway).

“Before applying for a final authorization, we are going to push for paid-in capital increase worth about $172 million (200 billion KRW).” said CEO Yoon Ho-yeong of KakaoBank. “We are currently establishing an exclusive mobile channel that will provide new financial experiences, introducing open-source OS (operating system), and establishing infrastructures at low cost.” KakaoBank is also at a final stage of establishing IT systems. While it is establishing account and information industries, center and disaster restoration center are established at LG CNS Sangam IT Center and KT Bundang IDC respectively.

KakaoBank is planning to establish strategies that will respond and distinguish requests for information security to strengthen security by end of July. It established an exclusive task force that will protect consumers and also established civil process centered on customers.

KBank also introduced many innovative services that weren’t seen before at traditional banks. Its goal is to establish 100% non-face-to-face transactions.

KBank is planning to commercialize digital interest savings, one-touch mortgage loans, one-stop SOHO financial platforms, beacon property secured loans, real-time wire transfer to foreign countries, banking at convenient stores, and Express Pay.

“Our goal is to create banks that are the closest and most familiar to customers by utilizing characteristics of online.” said CEO An Hyo-jo of KBank. “We are going to create a complete non-face-to-face online banking from creating accounts to loans and transactions.”

Both of these banks attracted attentions by introducing ‘innovative interest service’ that can give more benefits from loans at low interest rate. KakaoBank is planning to introduce interests that allow customers to select interests that they want such as converting interests into points for music and games. KBank is going to introduce ‘digital interest’ that can be converted into distribution, telecommunication service, media, and e-commerce fields by utilizing variety of its partners.

KBank and KakaoBank are going to apply for final authorizations in between August and September and between November and December respectively. They are going to hire extra 210 employees sometime during second half of this year.

“We are going to share credit information from credit bureaus that are possessed by Korea Credit Information Services so that online only banks can become new players in lending loans at medium interest rate.” said Chairman Lim Jong-ryong of FSC. “Even though they have yet to apply for final authorizations, we are planning to link data processing systems from online only banks to payment settlement network of Korea Financial Telecommunications & Clearings Institute and The Bank of Korea and credit information network of Korea Credit Information Services.”

Regarding bank laws, which are considered as biggest obstacles in expanding number of online only banks, Chairman Lim emphasized that there will be revisions during 20th National Assembly to ease.

Staff Reporter Gil, Jaeshik | osolgil@etnews.com & Staff Reporter Kim, Jihye | jihye@etnews.com