Samsung Electronics is going to extend production facilities for 3D NAND-Flash memories at its 17 Line of semiconductor facilities in Hwasung by investing $2.13 billion (2.5 trillion KRW). Its strategy is to solidify its position in memory markets by increasing production capability starting from second half of this year. Because Samsung Electronics is going to make investments into its facilities in Pyeongtaek at the end of this year, equipment providers will become huge beneficiaries.

According to an industry on the 14th, Samsung Electronics has decided to use its second step of investments for 17 Line in Hwasung to produce 3D NAND-Flash memories and is going to place orders from equipment providers at the end of this month at the earliest. Size of production is going to be about 40,000 wafers, and Samsung Electronics is going to start mass-production starting from end of this year after installing equipment. Stock industry is estimating that Samsung Electronics will invest between $1.70 billion and $2.13 billion (2 trillion KRW and 2.5 trillion KRW) for this extension.

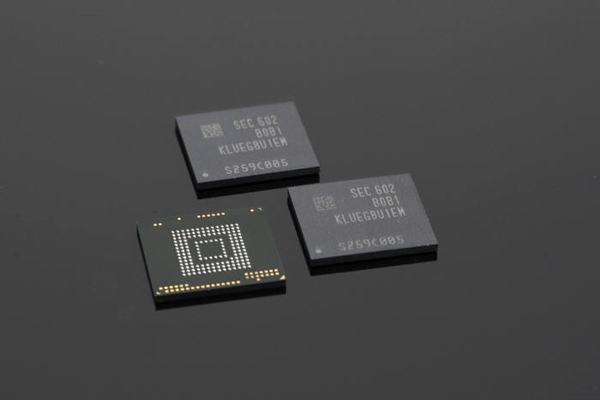

17 Line in Hwasung was constructed for system LSI. However as situations of related markets became worse, first step of investment was made for D-RAM (40,000 sheets per month). Samsung Electronics had made careful considerations on type of products for second step of investment and has decided to go with 3D NAND-Flash memories and told its partners about such news. It is also planning to mass-produce 3D NAND-Flash memories at its new lines in Pyeongtaek that are going start operation in next year. Followed by facilities in Xi’an, its facilities in Hwasung and Pyeongtaek will also establish mass-production system for 3D NAND-Flash memories.

A reason why Samsung Electronics is building extensions is because market situation of NAND-Flash memories is showing a positive trend. According to a market research company called D-RAM eXchange, fixed transaction price of 64GB MLC (Multi-Level Cell) products, which are main NAND-Flash memories, had maintained stability between March and May. Generally there are more supplies of NAND-Flash memories than demands for them and it is natural if price gradually drops.

“Fact that a steady tone is getting maintained indicates that current situation of markets is very good.” said Kim Kyeong-min who is a researcher for Daishin Securities Co., Ltd. Fact that SSD is becoming more popular in markets for PCs and servers is a main reason why current situation of markets is showing a positive sign. NAND-Flash storage capacity, which is loaded into mobile devices, is also showing an increased trend.

Markets are predicting that Apple’s new iPhone will also bring positive effects. It is predicted that iPhone 7, which will be released in Fall of this year, is going to be released in 32, 128, and 256GB rather than how iPhone 6 came out with 16, 64, and 128GB. “Samsung Electronics are going to supply 256GB NAND-Flash memories for iPhone 7 as 3D products.” said JP Morgan on a recent report that was published.

“It is known that Samsung Electronics had other packaging business in charge of its task to respond to Apple’s requirements (EMI Shielding).” said a representative for an industry. “It is heard that Samsung Electronics will work on its own packaging method (Spray-type EMI Shielding) in next year.”

To stop Samsung Electronics from monopolizing this market, other up-and-coming businesses are also speeding up their preparations to mass-produce 3D NAND-Flash memories. Toshiba is mass-producing 3D NAND-Flash memories at its second fabrication facility in Yokkaichi starting from second half of this year and also introduced its plan to construct a new facility for 3D NAND-Flash memories. Micron is currently converting its NAND-Flash facilities in Singapore into 3D NAND-Flash memories and is going to prepare for mass-production in second half of this year. Intel is also converting its system semiconductor facilities in Dalian into production facilities for 3D NAND-Flash memories and is going to start mass-producing them in second half of this year. SK Hynix, which has started to mass-produce 36-layer products at its M12 facilities in Cheongju, is planning to finish development of 48-layer products by end of this year and is also planning to mass-produce 3D NAND-Flash memories from production lines located on the second floor of M14, which is a new facility in Icheon.

“It is expected that TES and WONIK IPS, which deal with Plasma CVD, PSK that deals with asher equipment, and WONIK Materials, which is a CVD Gas supplier will benefit from Samsung Electronics’ increased investments in 3D NAND-Flash memories.” said Lee Sae-cheol who is a researcher for NH Investment & Securities Co., Ltd.

Staff Reporter Han, Juyeop | powerusr@etnews.com