Dongbu HiTec, which is a semiconductor contract manufacturing (foundry) business, had made its greatest performance last year and had made its first annual net profit since its establishment in 1997. Although Dongbu Group’s creditors are pushing to sell Dongbu HiTec, there are rumors that voices on withdrawing from selling Dongbu HiTec getting bigger. From a perspective of vitalization of fabless industry based on experts, there are also increased number of voices that a business that specializes in foundry cannot be sold to a financial capital.

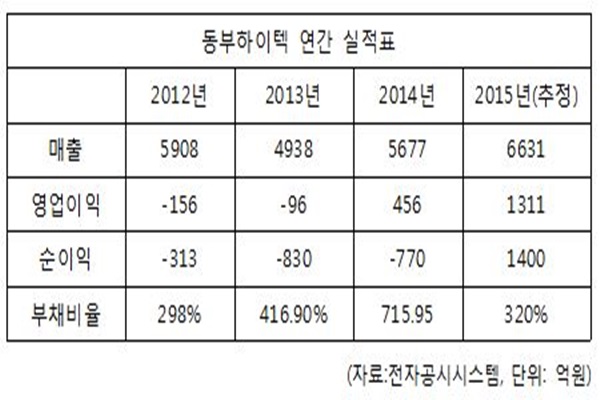

According to financial markets on the 25th, Dongbu HiTec had made $551 million (660 billion KRW) and $109 million (130 billion KRW) in sales and operating profit respectively in 2015. If results come out according to estimated values, sales and operating profit would increase by 16% and 180% compared to year before.

Its first annual net profit is also expected. Financial markets are analyzing that Dongbu HiTec had made $117 million (140 billion KRW) in net profit in 2015. Even if other one-time profits according to modification of interest rate of debt are excluded, there was net profit of almost $75.2 million (90 billion KRW). Although its debt ratio was more than 700% in 2014, it fell to 300% in 2015 because Dongbu HiTec was able to repay some of its debts and its capital has increased due to net profit.

Positive performance of Dongbu HiTec was due to increased number of fabless semiconductor businesses that use Dongbu HiTec’s factories. Dongbu HiTec’s major produced goods are display driver IC, image sensor, touch chip, electric semiconductor, connectivity chip and others. Output of display driver IC has quickly increased as demands for 4K UHD Resolution LCDs and OLED TVs have increased. Shipments of touch chips and image sensors that are used for low and medium-priced Smartphones have also increased. Recently it was in charge of mass-producing MST (Magnetic Secure Transmission) Chips for Samsung Pay that are used for Samsung Electronics’ medium and high-priced Smartphones. Because its customers’ businesses were successful, Dongbu HiTec was able to maintain its factories’ operating rates at 80 to 90% last year.

Its profit ratio has also increased due to many years of high-stressed restructuring. President Choi Chang-sik of Dongbu HiTec, who was appointed in March of 2013 and had previously worked for Samsung Electronics’ Semiconductor Business Department, has schemed for improvement of yield, reduction of management cost and others by carrying out structural innovation.

“Although Dongbu HiTec had to bring up its operation rate up to 90% if it wanted to satisfy break-even point in the past, its value has now fallen to 70% due to diversification of types of products and reduction of depreciation cost.” said Choi Do-yeon who is a researcher for Kyobo Securities Co., Ltd. “Dongbu HiTec’s positive performance will continue for many years since global increase of output from 200mm factories are limited.” Financial markets are estimating that Dongbu HiTec will make about $585 million (700 billion KRW) and $142 million (170 billion KRW) in sales and operating profit respectively this year.

Feelings of Dongbu Group and Dongbu HiTec’s executives and employees towards positive performance are complicated because Dongbu HiTec can be sold to a different business due to contract between Dongbu Group and The Korea Development Bank (TKDB). Just by looking at Dongbu HiTec, its situation is not bad to the point that it needs to be sold. However Dongbu Group’s creditors had requested to sell Dongbu HiTec by saying that it needs to show authenticity when Dongbu Group was facing liquidity in second half of 2013, and Dongbu Group had agreed to it.

TKDB had pushed for selling of Dongbu HiTec. However because IA Consortium, which was mentioned as a most likely candidate to buy Dongbu HiTec, gave up on being a primary negotiator due to financial burden to buy Dongbu Hitec, process of selling Dongbu HiTec was postponed. “Because Dongbu HiTec’s value has gone up so much that there are not many businesses that want to buy Dongbu Hitec.” said a representative of TKDB’s First Business Finance Department. “Currently Dongbu Group is postponing the process of selling Dongbu HiTec.” This representative added that Dongbu Group will decide on whether or not it will sell Dongbu HiTec by looking at situations of implementation of wording program such as reduction of loan size and others.

Excluding the possibility of Dongbu HiTec being sold, Dongbu Group’s restructuring is practically finished. Even if TKDB sells Dongbu HiTec, there is nothing that is left for Dongbu Group since Dongbu Group only has about 12.43% of Dongbu HiTec’s stakes and it needs to secure stakes of Dongbu Daewoo Electronic Co., Ltd. and Dongbu Lightec that Dongbu HiTec has again. “It is as if Dongbu Group is selling its prime affiliate that can make more than $83.6 million (100 billion KRW) in profit annually.” said a representative of financial industry.

Staff Reporter Han, Juyeop | powerusr@etnews.com (specializes in semiconductor)