‘Red light’ has turned on network equipment industries’ performance. It seems that it will be inevitable for all of South Korean businesses and global businesses to avoid minus growth due to decrease of new Capital Expenditures (CAPEX) from telecommunication businesses. To make things worse, there are overflowing predictions that there will not be huge network investments until commercialization of 5G mobile telecommunication. This indicates that it will be hard for them to avoid decrease of performance next year as well. Although they are looking to diversify their sources of profits through new businesses such as entering foreign markets and IoT, many believe that it will take significant time for them to actual sales off of new businesses.

Most of South Korean network equipment industries are predicting that this year’s sales will decrease about 30% compared to last year’s sales. “Until 3rd quarter, size of telecommunication businesses’ facility investments that we expected only came to about half of amount that was announced at early this year.” said a person from Cisco Korea. “Even if we consider expected amount of investments until 4th quarter, this year’s sales will decrease about 30% compared to last year.” ZTE Korea is also estimating that this year’s sales will decrease from last year. Most industries believe that this year’s sales will stay about 70 to 80% of last year’s sales.

Huawei, which showed rapid growth in global markets, is also having difficulties in South Korean markets. “Although active re-investments in R&D and others are occurring due to positive performance in global network markets, we are having difficulties in South Korean markets compared to foreign markets.” said Huawei Korea. “It will be hard for us to make performance like last year.”

South Korean industries such as Dasan Networks are estimating that their network businesses will make minus growth compared to last year. “Although all of our 3rd quarter sales ($52.4 million (60 billion KRW)) increased 62% compared to last year, we made deficit of $2.53 million (2.9 billion KRW).” said Dasan Networks on the 16th of November. Because range of deficit is bigger than expected, Dasan is estimating that they will make loss somewhere between $1.75 to 2.62 million (2 to 3 billion KRW) by end of this year.

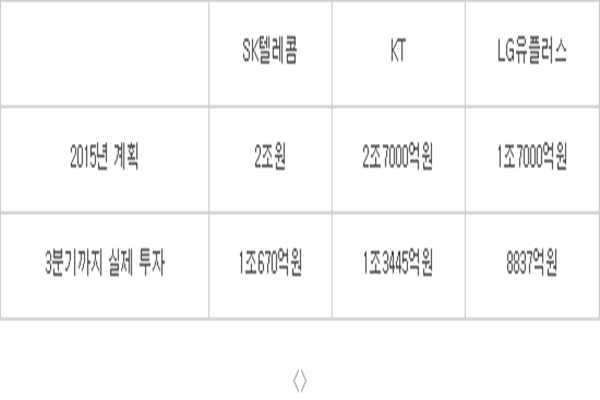

A reason why South Korean network markets are having so much difficulty in performance is due to decrease of investments from telecommunication businesses. According to Financial Supervisory Service, SK Telecom, KT, and LG Uplus have invested $2.87 billion (3.2952 trillion KRW) until 3rd quarter, and this is only about 51.5% of amount ($5.58 billion (6.4 trillion KRW)) that was announced at the beginning of this year.

“Although we expect that there will be additional investments in 4th quarter such as KT Giga-Internet and others, investments did not take place as we believed.” said a person from this industry. “As telecommunication businesses’ sales are decreasing, they are hesitant in making investments.”

There are a lot of predictions that low growth will continue next year as well. This indicates that telecommunication businesses will not make much move until investments in next telecommunication technologies such as 5G that is looking to be commercialized n 2018 happen very actively. Even if 5G is successfully commercialized, it seems that network equipment industries ‘cold winter’ will continue on because it will take some time for 5G to be stabilized in markets. Industries describe this situation as if network equipment industry has fallen into ‘canyon’.

Network equipment industries are looking for breakthroughs in IoT and media network markets. “We believe that current mobile telecommunication service markets are stagnant and are going to look for demands for network equipment from media markets that are slowly growing.” said Cisco Korea. “We will also need strategies that maximize sales of new businesses such as IoT and others.”

Dasan is planning to diversify markets by entering foreign markets such as the U.S., Japan, and others and increase proportion of global markets up to 50% out of overall sales next year. “We are going to overcome network markets’ limits with new driving forces such as IoT and others.” said Dasan. “We will be able to make visible performance in IoT next year.”

Staff Reporter Kwon, Dongjoon | djkwon@etnews.com