Because price of D-RAM for PCs greatly fell than expected, it had bad effects on SK Hynix’s performance in second quarter. It is planning on its growth by increasing importance of D-RAM for servers and mobiles as well as next-generation DDR4 and LPDDR4 that have their demands increase.

SK Hynix (CEO Park Sung Wook) announced on the 23rd that it made sales of 3.96 billion dollars (4.639 trillion KRW) and business profit of 1.17 billion dollars (1.375 trillion KRW) in last second quarter. Although sales and business profit increased 18% and 27% respectively compared to last year, it fell to -4% and -13% compared to first quarter of 2015.

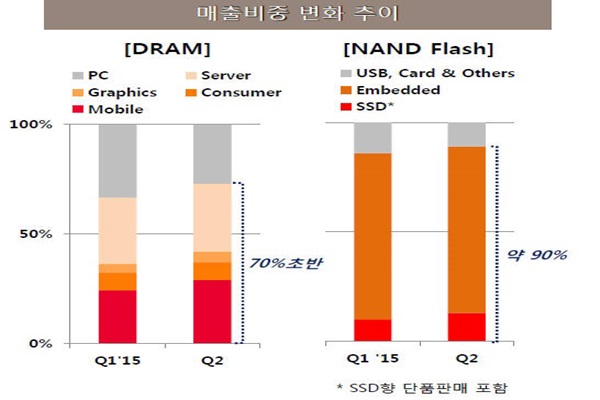

Reason why performance is lower compared to last quarter’s performance is because drop of price of D-RAM for PCs is greater than expected and demand decreased as well. As the price of D-RAM for PCs fell, some servers and consumer markets that use those products were affected as percentage of their shipments increased 4% but their total average sales price (ASP) of D-RAM fell 8%.

Mobiles and D-RAM played huge rolls in increasing D-RAM’s shipment. NAND-Flash maintained previous quarter’s price standard as its shipment increased 8% compared to previous quarter, but its ASP fell 6%. Due to increase in seasonal demand in China and expansion in demand for mass storage, multi-chip package (MCP) that is laminated with NAND and mobile D-RAM secured 14% of total sales and recorded highest quarterly sale.

SK Hynix is predicting that demand for PCs will recover in end of 2015. But it is estimating that effect of Intel’s Skylake and MS’s Window 10’s releases won’t be big enough to recover all of PC demands.

Third quarter will focus on expanding next-generation DDR4, LPDDR4 for mobiles, and 32 GB mass-storage D-RAM modules for servers. It is expected that steady increase in demand will happen as D-RAM modules for servers have bigger storages and mobile D-RAM for medium to low-priced phones centered on LPDDR4 as demand for choosing increases.

Shipment of D-RAM will increase 10% in third quarter, and it is planning to increase percentage of D-RAM from 30% up to 40%. On the other hand, it is seeing that percentage of D-RAM for PCs will decrease to 20%. Percentage of DDR3 production will be decreased as well.

It is predicting however that shipment of NAND-Flash will increase to middle of 10% as demand for embedded multi-chip package (eMCP) increases and it is becoming more important to install mass-storage NAND on to mobiles such as Smartphones.

Director Park Rae Hak of D-RAM Marketing Department said that development speed of supplies of SK Hynix’s LPDDR4 and DDR4 will be faster compared to market and supply rate will be advanced as well. He also said that output of 20-Nano early (2z) DDR4 and NPDDR4 will be increased at M14 line that will be built in early 2016.

Production percentage of 16 nm Triple Level Cell (TLD)-NAND will soon be completed by end of this year, and profitability and competitiveness of production cost will be increased by expanding Solid State Drive (SSD) and NAND-based solution to all.

M14 line that had its deadline delayed due to casualties will finish loading equipment and start testing operation. Because it is delayed for about 2 months, it is predicted that production of wafer will fall from 13,000 sheets per month to 7000~8000 sheets.

“We are planning to gradually move previous M10 line’s equipment to M14 and use M10 space for other purposes. Because completion of M14 is delayed, we have to secure certain level of M14 output while maintaining M10 production until next year to discuss about a new place to use.” Director Lee Myung Young of Finance Department said that M14 needs to be completed in order for them to move on to next steps.

It is predicted that influence will change in entering Chinese D-RAM industry depending on level of technology and speed of entering. “Although we know that China will definitely enter memory semiconductor industry, we do not know how fast it will enter and at what level of technology it will enter. It is possible to preoccupy market if we can gain competitiveness in production cost by having superior technology level.” SK Hynix said that Korea can gain edge over China by having superior technologies.

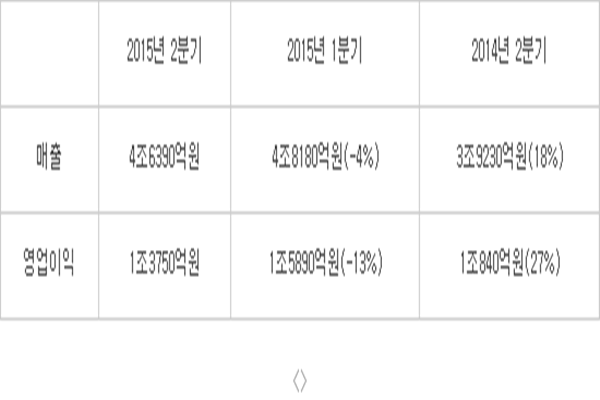

■ [Table] SK Hynix’s level of performance in second quarter

▲ SK Hynix’s sales in past 3 quarters were 3.96 billion dollars (4.639 trillion KRW (second quarter of 2015)), 4.11 billion dollars (4.818 trillion KRW (first quarter of 2015 (-4%))), and 3.35 billion dollars (3.923 trillion KRW (second quarter of 2014 (18%))).

▲ SK Hynix’s business profit in past 3 quarters were 1.17 billion dollars (1.375 trillion KRW (second quarter of 2015)), 1.36 billion dollars (1.589 trillion KRW (first quarter of 2015 (-13%))), and 925 million dollars (1.084 trillion KRW (second quarter of 2014 (27%))).

Staff Reporter Bae, Okjin | withok@etnews.com