As the date of general meeting of stockholders is approaching fast, whole Samsung Group including Samsung C&T and Cheil Industries are on high alert. All of Samsung C&T’s executives and staff members went out end of last week to do public activity targeting Korea’s minority investors to inform rightfulness of this merger and they are focusing on general meeting of stockholders for this merger as they know that it will determine the future of the company.

However the result comes out, either Samsung or Elliott will receive serious damage. But damage that Samsung will receive when the merger becomes foundered will be greater than damage that Elliott will receive when the merger becomes successful.

Both sides claimed that neither one will concede to each other and they are both taking stance that they will not prepare for the worst scenario, which means that they both do not have plan B.

It is expected that Elliott will not lose too much even the merger becomes successful. It already expanded inclination for dividend up to 30%, and stockholder’s value’s improvement plan that focuses on establishment of stockholder’s rights and interests committee already came out. Stock price is also higher than when initial purchase, and there is a high chance that Elliott already set up a preparation if stock price collapses due to founder of merger.

“It is possible that hedge fund confirmed profit through public sale of stock and sale of stock present when stock price goes up. Although it is only estimation, confirmation of profit is a method that derivative market usually uses.” Researcher BaekKwang Jae of Kyobo Securities explained about plans that Elliott might have set up for the future.

He said that hedge funds do not really make a loss when there is additional decrease of stock price, but it can make additional profits. He also added that there is a high chance that damage from decreased stock prices will go to regular stockholders when the merger becomes foundered.

If the merger becomes successful, it is expected that Elliott will prepare different lawsuits. Although it already lost two lawsuits, it applied for appeals on both of them.

Even if stabilization of management structure is Samsung’s ultimate goal, it is predicted that it will be difficult for Samsung to push for the merger again by overcoming burdens from failure. Even if it takes long time, there is a high chance that it will look for new methods to stabilize management structure.

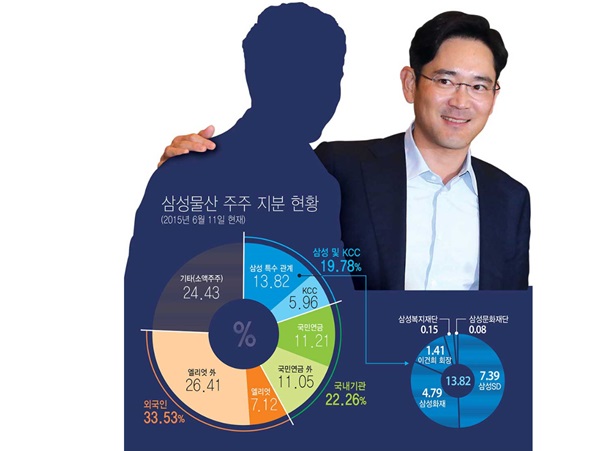

Essence of this merger of Samsung C&T and Cheil Industries is Samsung Electronics’ stake that is worth 4.06%, which is 7.1 billion dollars (8.12 trillion KRW (Estimation of Samsung Electronics’ market capitalization of 174.3 billion dollars (200 trillion KRW))), that Samsung C&T possesses.

“If one to consider Samsung Electronics’ actual control on Samsung Group, there is a high chance that Samsung will pass Samsung Electronics’ share that Samsung C&T possesses to Cheil Industries, which will act as a holding company, if the merger becomes foundered. Only problem to this solution is that it will be hard for Cheil Industries to obtain 7.1 billion dollars temporarily. Due to this reason, there is a high chance that Samsung Electronics’ share that Samsung C&T possesses will become a nonperforming asset while it prepares for a suitable plan.” Chief Researcher Kim Jun Sup of Eugene Investment & Securities predicted about a possible problem and a solution if the merger becomes foundered.

Chief Researcher Kim said that if Samsung considers that only way to Cheil Industries to obtain fund is through large-sized loan or listing of Samsung Biologics, there is a high chance that speed of adjustment of management structure that it was rapidly pushing for will stabilize. He also said that it might take more than 2 years if it considers about the timing of Samsung Biologics to be listed.

Senior Reporter Lee, Sungmin | smlee@etnews.com