Japanese display businesses are showing special attention to Korean rear companies about producing on-cell TSP LCD.

The reason is because Japanese companies lack competitiveness due to high price of cost structure, and Chinese companies have yet to match quality due to lack of technical skills. Korean’s touch-related companies will receive many benefits since they suffered a drought in their supplies recently.

The person in charge of Japanese display businesses visited Korean etching, Indium Tin Oxide (ITO) coating, and sensor patterning (etching) related companies one after the other. He visited because Japanese display businesses are weak in rear supply chain management (SCM), and demand for on-cell TSP LCD is increasing centered on Chinese and Taiwanese markets.

There are a lot of cooperative companies such as Samsung and LG are lined up, so it is easy to find outside firms per process. Also many industries related to etching, ITO coating, and sensor patterning are located closed to each other that there is high distribution advantage.

Japan Display Inc (JDI) is currently using Japanese businesses to process on-cell TSP, but they are spending a lot of money on supplies because businesses that are in charge for each process are located far from each other.

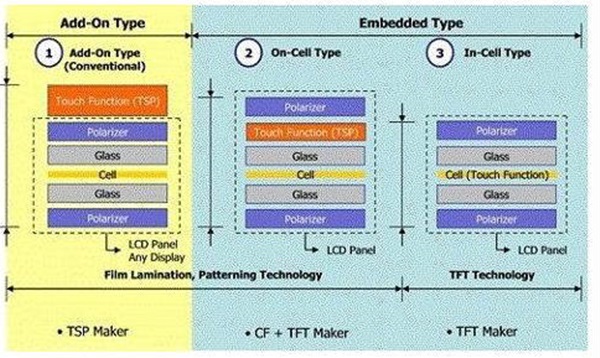

Chinese and Taiwanese businesses are being supplied of on-cell TSP LCD that is for Smartphone, Tablet PC, and Notebook PC from Japanese display businesses such as JDI and Sharp. Previously they chose GFF TSP+LCD on medium-low priced products and G2 TSP+LCD on high-priced products. But the problem is that GFF TSP lacks visibility, and price to supply G2 TSP is too expensive. Japanese display businesses were able to see some effects by attacking niche market with on-cell TSP LCD.

Improvement of on-cell TSP LCD technology also had effects compared to the past. Usually in-cell technology was used on TSP LCD, and the product that LG Display provides to Apple IPhone is a typical example. Unlike AM OLED, there is tremendous amount of noise on color filter surface of LCD. The noise interferes with touch signal awareness and decreases sensitivity. But as touch chip technology improved, there are more opportunities for commercialization.

Chinese and Taiwanese businesses such as AUO and BOE are also jumping into on-cell TSP LCD production. Because Chinese currently lacks in glass touch technology infrastructure, there is a probability that Chinese companies will use Korean companies for awhile.

“Complete products companies had a lot of insecurities about on-cell TSP LCD until last year, but most of the problems were solved as technologies improved. As there is competitiveness not just in medium-low priced products but also in high-priced products, it tells us that there is high possibility of growth of the market hereafter.” A person in this industry said about what effects on-cell TSP LCD can have on future market.

Staff Reporter Lee, Hyungsu | goldlion2@etnews.com