The mobile DRAM market has become excited as the ‘Galaxy S6’ series were received favorably.

The demand for mobile DRAM is expected to increase even more when the next generation iPhone series are released in the second half of the year. The prospect that prices, which now are on a downturn, will also rise starting from midyear is gaining strength.

According to the industry on March 12th, the demand for mobile DRAM is expected to grow along as the market’s attention on the new Galaxy S6 series grows. For last year’s second half, Apple’s iPhone 6 series led the growth of mobile DRAM, while for this year’s first half, the Galaxy S6 series are expected to become the driving force.

Since it is expected that Apple will show their next generation iPhone in the second half of this year, it is most likely that the mobile DRAM market will record its largest scale ever this year, just as it did last year.

The world market for mobile DRAM recorded 3 billion 670 million dollars in last year’s fourth quarter, which took up 27.8% of the whole DRAM. The proportion of mobile DRAM is expected to reach 40%, according to DRAM eXchange.

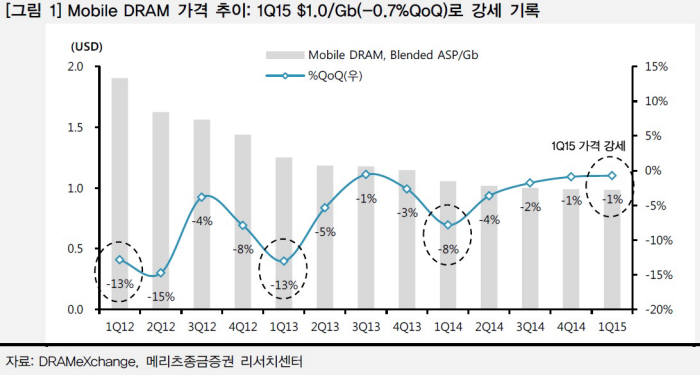

The price of Mobile DRAM has continuously dropped, although the quarterly price drops evidently decreased right before and after the releasing of iPhone 6 and iPhone 6 Plus last October.

According to the actual data that DRAM eXchange provided on the progression of the fixed price of mobile DRAMs, although the first quarter prices of 2014 dropped -8% compared with the previous quarter, the price dropping degree gradually decreases: -4% for the second quarter, -3% for the third, and -1% for the fourth. The fixed price of mobile DRAM during this year’s first quarter is 1 dollar per Gb, which is 1% dropped compared with the previous quarter.

The semiconductor industry expects the dropping level of mobile DRAM price to gradually lessen and rally in the second half of the year. Although mobile DRAM prices dropped last year, the scale of overall market sales increased as the demand for bit increased.

Since both the price and bit demand has increased this year, it is predicted that the market scale will exceed that of last year. The DRAM capacity of middle-low priced smartphones has been raised from 512MB to around 1GB, and Galaxy S6 adopted 3GB LPDDR4. The iPhone that is expected to be released in the second half of the year will increase in capacity from 1GB to 2GB LPDDR4.

It is also highly possible that supply shortage will occur, especially because there exist strong markets of the Galaxy S6 series and the release of the next generation iPhone. It is a situation where DRAM manufacturing companies can raise prices by strategically taking close actions against the market demand.

Staff Reporter Bae, Ok-jin

In this situation where the demand of PC DRAM is dropping, another concern is to what extent Samsung Electronics and SK Hynix will expand their mobile DRAM proportion among overall DRAM production. According to the industry, the mobile DRAM takes up the largest proportion in Samsung Electronics at around 39% and in SK Hynix at around 36%.

An official of the industry said, “Although the PC DRAM market, which is the biggest, is diminishing, the mobile DRAM market is quickly growing and becoming the leading axis of the overall growth of DRAM. We will also have to keep an eye on the changing flow of manufacturing companies, from the existing DRAM production line to mobile DRAM.”