A ‘Big Rally’ For National Equipment Providers

Semiconductors are booming. A ‘big rally’ is to be held for national equipment providers as material companies including Samsung Electronics and SK Hynix are embarking on technical development and investment.

According to the semiconductor industry on March 3rd, equipment·material companies for semiconductors are facing prosperous days in more than a decade. Above all, the industry status of semiconductors is good. The additional demand alone this year is expected to reach 12.5 billion dollars as the Internet of Things(IoT) effloresces. Demands in other various fields including automobiles are on the rise, as well.

Samsung Electronics and SK Hynix are embarking on aggressive technical development and investment. They are putting spurs to DDR4 switching of DRAM, three-dimensional(3D) laminating of NAND Flash, securing of 10 nano range microscopic processes, etc. Based on last year’s highest sales, investments are also expected. Samsung Electronics foretold this year that they will extend DRAM lines in Line 17, make converted investments in DRAM 20 nano, extend NAND Flash lines in Xian, China, and invest in 14 nano FinFET in Austin, USA. SK Hynix will embark on DRAM Line 14 extension and converted investment in 21 nano.

A high official in the semiconductor industry said “Samsung Electronics and SK Hynix are using a strategy of associating with major equipment·components companies or Mergers and Acquisitions(M&A), and quota investment” and assessed that “domestic equipment·components companies have earned a big opportunity as the power of Korean companies in the semiconductor market increased.”

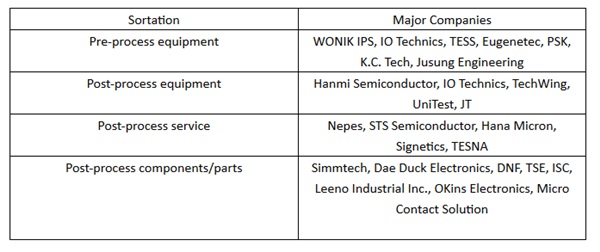

Expansion of 3D laminating and refining such as 20 nano DRAM development are an opportunity for pre-process equipment companies. Benefits are expected for WONIK IPS and TESS, PSK, K.C. Tech, etc. and professional components companies that support refining processes, DNF, OCI Materials, etc.

In the DRAM’s DDR4 conversion process, the technical skills of post-process·inspection companies are important. Business extensions of EO Technics and UniTest, Nepes, Hanmi Semiconductor, etc. are being brought up. Post-process components companies such as Dae Duck Electronics and Simmtech, and TSE are also likely to raise sales.

Moreover, the top two firms in the semiconductor pre-process equipment market, Applied Materials and Tokyo Electron, will be merged. This is not such a bad news for competitive domestic equipment companies, because Samsung Electronics and SK Hynix may strategically raise domestic equipment companies so as to build bargaining power among large foreign equipment companies.

China has recently embarked on promoting its semiconductor industry, led by the government. Utilizing this condition strategically well is also necessary.

An official of a domestic equipment company advised “preparing a footing of mid-and long-term growth by raising technology competitiveness and actively establishing overseas markets using this boom period is more important,” saying that “although the market conditions are positive, not all semiconductor equipment·cooperative companies are gaining benefits.”

Senior Reporter Kim,Seung-kyu seung@etnews.com