In 2015, the global smartphone market is forecast to record a negative growth (based on amount) for the first time in history. On the other hand, semiconductor market is expected to produce large profits stably as it escapes from the typical ‘cycle industry’ structure, and thus both the demand and supply increase rates slow down.

Stock market analysts made projections as such for the key semiconductor-related industrial fields in 2015 at the ‘Insight Seminar’ held by Korea Semiconductor Industry Association (KSIA) on the 29th in Pangyo, Gyeonggi-do.

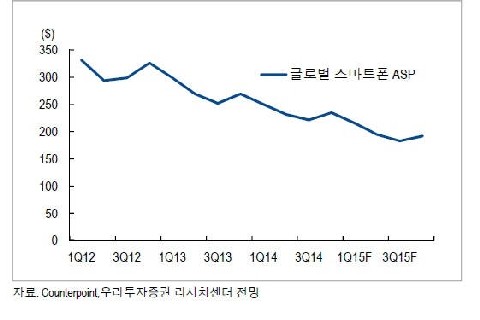

It has been forecast that 2015 will be a year in which the global smartphone market will record the first negative growth in history based on the amount. Although a growth is expected based on the forwarding volume, the rate at which average selling price (ASP) decreases has accelerated. The global smartphone market scale in 2014 is estimated at $298.1 billion, which increased by 10% from the year before. However, it is forecast that the scale will decrease by 4.3% to $285.2 billion next year.

Stock market analyst Kim Hye-yong from Woori Investment and Securities forecast, “The global smartphone ASP this year is $234.5, which decreased by 13.9% from last year. Next year, it will drop by 16.3% to $196.”

According to Kim, common carrier subsidy policy is not working in the emerging market that centers on the open market and, as a result, high-end smartphones are not selling well across the world. He estimated that Chinese companies, despite their growth on the outside, will record a deficit or just about meeting the breakeven point as their profitability is insufficient.

Kim commented, “Companies mainly selling medium to low-end products in the emerging markets will gain strength for smartphone business growth.” He advised. “As it is forecast that the tablet PC demand will be gradually absorbed into smartphones and smart watch will record a high growth rate by around 30% on an average a year until 2020, the companies must look for new market opportunities.”

“The field in which mobile ecosystem can expand most easily and quickly is smart vehicle,” he added. “Vehicular app market will expand and the demand for the related components, such as camera and LED sensor, will grow.”

In the semiconductor market, as DDR4, a next-generation DRAM, emerges as a key product, DDR4 for servers is forecast to rise to the top by substituting the reduced demand for the DRAM for PCs. In particular, it is forecast to escape from the typical ‘cycled structure’ where the price drops when manufacturers increase supply volume by intentionally extending production facilities and to shift to a high return industry where a focus is placed on profitability improvement.

Kyobo Securities Analyst Choi Do-yeon said, “The speed of micro process is slowing down and it is not easy to solve this problem. In addition, it will take a long time until actual application of this technology. As much as so, DRAM cost structure improvement will eventually slow down.”

“As the phenomenon of DRAM supply and demand tightening aggravates, the DRAM boom will continue and the trend of production facility extension will be maintained,” he forecast. “By deviating from cycled structure, the industry will shift with a focus placed on the stable promotion of high returns.”