The percentage of mobile banking customers has exceeded that of Internet banking for the first time. It is estimated that the number of customers using smart phones for bank account check and small amount transfer services is overwhelmingly larger than those using PCs. The daily average trading amount through smart phones is also approaching KRW 2 trillion. It is evaluated that the new paradigm in financial transactions has already become actualized.

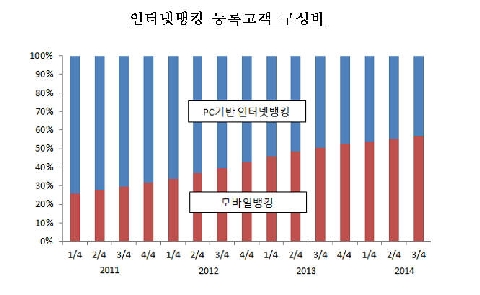

According to a report ‘domestic Internet banking service utilization in the third quarter’ from the Bank of Korea on the 18th, the number of registered mobile banking customers as of the end of September is 57.56 million, which increased by 4.7% (2.57 million) from the previous quarter (54.99 million) as a result of the smart phone effects.

The number of registered mobile banking customers using smart phones other than the IC chip and VM type models has also increased to 45.59 million, which is by 6.1% from the previous quarter, and thus is displaying a rapid growth. The percentage of mobile banking customers out of the total number of registered Internet banking customers has exceeded a 50% level (56.9%) for the first time.

The number of mobile banking service usage and trading amount (daily average) in the third quarter were 31.81 cases and KRW 1.8561 trillion respectively, which increased by 8.1% (2.4 million cases) and 8.0% (KRW 137.5 billion) from the previous quarter. Of the total count of mobile banking service usage, 29.02 million were for account check service and 2.79 million were for fund transfer, and thus the percentage of account check service usage through mobile banking was found to be as high as 91.2%.

The smart phone based service usage count, which represents most of mobile banking service usage, is 31.61 million and the trading amount is KRW 1.8232 trillion, which again increased by 7.6% from the previous quarter.

Mobile banking represented as many as 47.9% of the total Internet banking usage count. However, based on the trading amount, it represents only 5.1%. This indicates that customers use mobile banking service mainly for account check and small amount transfer services.

In line with the upward trend of mobile banking, the number of registered Internet banking customers as of the end of September became 101.1 million. The 100 million mark was exceeded for the first time since the service commencement in 1999. As for the number of Internet banking service usage and daily average trading amount, 66.45 million and KRW 36.7131 trillion were recorded, which increased by 2.8% and 2.5% respectively from the previous quarter.

As if reflecting this trend, the percentage of non-face-to-face deposit, withdrawal and fund transfer transactions was found to be 88.7%, and thus considerably exceeded that of face-to-face transactions (11.3%). CD/ TM continue to be an absolute power in non-face-to-face transactions (40.7%). However, while the percentage of CD/ ATM transactions decreased by 2.7% in two years since the highest at 42.7% in September 2012, the percentage of transactions through Internet banking increased by 4.7% from 30.3% in September 2012 to 35.0% in September this year.

“The spreading of mobile banking service is bringing about a big bang to the financial industry that even the net current profit of banks per branch has become halved,” said an industry expert. “The financial sector needs to set up more fundamental measures by escaping from passive response, such as restructuring or liquidation of poorly performing branches.”

Gil Jae-shik | osolgil@etnews.com

인터넷뱅킹, PC→스마트폰으로 대체...일평균 거래 2조원 육박

모바일뱅킹 등록고객 비중이 사상 처음 인터넷뱅킹을 추월했다. 조회서비스와 소액이체 부문에서 PC보다 스마트폰을 이용하는 고객이 압도적으로 많은 것으로 추정된다. 스마트폰을 통한 일평균 이용금액도 2조원에 육박했다. 금융거래의 새로운 패러다임이 이미 현실화하고 있는 것으로 평가됐다.

18일 한국은행의 ‘3분기 국내 인터넷뱅킹 서비스 이용현황’에 따르면 9월 말 모바일 뱅킹 등록고객은 스마트폰 효과에 힘입어 전 분기(5499만명) 대비 4.7%(257만명) 증가한 5756만명을 기록했다.

IC칩과 VM방식을 제외한 스마트폰 기반 모바일뱅킹 등록고객 수도 전 분기 대비 6.1% 증가한 4559만명으로 빠른 증가세를 보였다. 인터넷뱅킹 전체 등록고객 중 모바일뱅킹 등록 고객이 차지하는 비중은 사상 처음 절반을 넘어선 56.9%를 기록했다.

3분기 모바일뱅킹 이용건수와 금액(일평균)은 각각 3181만건, 1조8561억원으로 전 분기 대비 각각 8.1%(240만건), 8.0%(1375억원) 증가했다. 전체 모바일뱅킹 이용건수 중 조회서비스는 2902만건, 자금이체서비스는 279만건으로 조회서비스 비중이 91.2%에 달했다.

모바일뱅킹 이용실적의 대부분을 차지한 스마트폰 기반 이용건수는 3161만건, 이용금액은 1조8232억원으로 전 분기 대비 7.6% 증가했다.

인터넷뱅킹 이용건수 중 모바일뱅킹이 차지하는 비중은 47.9%에 달했다. 다만 금액 기준으로는 5.1%에 머물러 있어 조회서비스와 소액자금 이체에 주로 모바일뱅킹을 사용하는 것으로 나타났다.

모바일뱅킹의 성장세에 힘입어 9월 말 기준 인터넷뱅킹 서비스 등록고객 수는 1억110만명으로 1999년 서비스 개시 이래 최초로 1억명을 돌파했다. 인터넷뱅킹 이용건수는 6645만명, 일평균 이용금액은 36조7131억원으로 전 분기 대비 각각 2.8%, 2.5% 증가했다.

이를 반영하듯 입출금 및 자금이체 거래에서 비대면거래는 88.7%를 차지하며, 대면거래(11.3%)를 월등히 앞질렀다. 비대면거래의 최강자는 여전히 CD/ATM(40.7%)이었다. 하지만 2012년 9월 42.7%까지 기록했던 CD/ATM이 2년 만에 2.7% 줄어든 반면에 인터넷뱅킹은 2012년 9월 30.3%에서 올해 9월 35.0%로 4.7% 상승하는 모습을 보였다.

업계의 한 전문가는 “모바일뱅킹이 확대되면서 은행의 점포당 당기순이익이 반토막 날 정도로 금융산업의 빅뱅을 몰고 오고 있다”면서 “금융권은 부실점포 정리나 구조조정 같은 소극적인 대응 태세에서 벗어나 보다 근본적인 대책을 수립해야 할 것”이라고 말했다.

길재식기자 | osolgil@etnews.com