KRW 907.1 billion sales in the first half… drop in scale

China equipment purchases expected to drop by 14%

Status of South Korea being the largest exporting country is ‘shaky'

Semiconductor equipment exports to China dropped by 50% in the first half of the year compared to the same period last year. The largest exporting destination, China has gradually reduced the amount of its purchases. It is under the spotlight whether the aftermath will affect the export market for materials, parts and equipment while the controversy over joining the United States-led semiconductor supply chain alliance 'Chip 4' is in full swing.

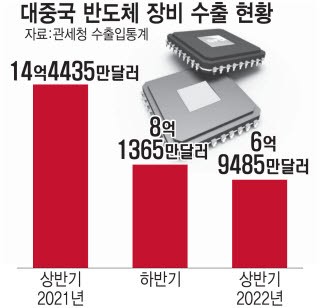

According to the import and export statistics of the Korea Customs Service, in the first half of this year (January to June), exports of semiconductor equipment (HS code 848620) to China totaled $694.85 million (KRW 907.1 billion). This is less than half of the $1.44435 billion in exports from last January to June, which was the record high export in the first half of the year. In the second half of last year, it recorded $813.65 million, and the trend of export volume is on the decline. Quarterly exports are on the decline as well. Exports in the second quarter amounted to $290.98 million, which is the first time that the quarterly sales fell to $ 200 million range since the third quarter of 2020.

The cause of the export drop is due to the impact of COVID-19. Major regions in China have been blocked, and logistics movement is restricted. Even if the COVID-19 lockdown policy is lifted in the second half of the year, it will be difficult to expect a dramatic recovery in export. This is because China is aiming to improve the semiconductor self-sufficiency rate, and has relieved the supply and demand for equipment to expand semiconductor production capacity, as well as increasing difficulty to import equipment due to United States sanctions. Semiconductor Equipment and Materials International (SEMI) predicted that China's semiconductor equipment purchases will drop by 14% this year compared to last year. China is the third in the semiconductor equipment amount with a total of $25.5 billion after Taiwan and South Korea. For last two consecutive years, China ranked first in the amount of semiconductor equipment purchases.

South Korea’s status of being the largest exporter of semiconductor equipment is shaking as China's semiconductor exports are shrinking. South Korea's semiconductor equipment exports to China amounted to $2.258 billion last year, which is overwhelmingly higher than other countries in 'Chip 4 Alliance’. This was 20 folds larger than other countries such as Taiwan ($181 million), the United States ($111.27 million), and Japan ($133.2 million). Including South Korea, Taiwan, Japan, China, and the United States are among the top five countries with semiconductor production capacity.

Exporting Semiconductor equipment to China is expected to become more difficult when South Korea joins the Chip4 Alliance or receives benefit from the United States Semiconductor Support Plus Act (CHIP-PLUS Act). U.S. semiconductor law restricts supporting expansion of Chinese semiconductor manufacturing capacity.

An industry official said, "It is highly likely that China will achieve localization of equipment as it improves its semiconductor self-sufficiency rate, which will further reduce opportunities for the domestic equipment industry. South Korea needs to find a new market to replace China in a long-term perspective; however, it is not easy to expand sales channels in Taiwan, Japan, and the United States, which already have large production capacities.”

[Semiconductor Equipment Exports to China by Semi-Annual]

Source: Import and Export Statistics from Korea Customs Service

By Staff Reporter Dong-jun Kwon djkwon@etnews.com