Main business operators of LinePlus and Ground X respectively

Samsung SDS and LG CNS join the coalition camp

SK C&C to bid as the only major IT service provider

SecuredZero Pay 'Advisory' and to coo

The Bank of Korea’sCentral Bank Digital Currency (CBDC) simulation research project, which closed the bid on the 12th, is expected to be compressed into a three race among Naver camp, Kakao camp, and SK C&C. It is understood that major Information Technology (IT) service companies, which have been constantly discussed about the possibility of participating, have joined hands with the big tech camp rather than acting as main operators.

According to the industry, many companies including IT services and Big Tech, which were initially expected, have expressed their intention to participate in the CBDC simulation research project as the Bank of Korea closed the bid. In particular, Big Tech firmsand large IT service providers appeared to have strategically joined hands, drawing attention to the results of the screening later.

Initially, this project had strongly intended to build a platform for the CBDC simulation experiment, drawing interest toward whether it lead Big Tech camp and IT companiesrunning the block chain business to compete with each other or to participate in the market through a joint venture strategy.

According to multiple officials, Naver-affiliated Line Plus, Kakao-affiliated Ground X, and IT service providerSK C&C participated in the bidding as main operators, respectively.

Samsung SDS and LG CNS, which had been contemplating over whether to participate as the main operators, have joined hands with Line Plus and Ground X. It is not known which company they specifically established the coalitionwith.

Prior to this project, Samsung SDS and LG CNShad participated in the CBDC consulting project led by the Bank of Korea. At that time, attention was drawn to which IT service company that EY Korea, who oversaw the consulting business, would work with as a partner.

According to the industry, Samsung SDS has decided to form a final alliance with KPMG Koreaand LG CNS with AT Kearney. AT Kearney is found to have recruited many of the experts who practiced CBDC consulting at EY Korea.

SK C&C, the only IT service provider to bid as the main operator, has secured Zero Pay as an advisory organization and formed an alliance with multiple commercial banks.

An official from a participating company said, “This project does not allow the formation of consortium, so the general strategy is to form a coalition camp in the form of advisors and partners. Everyone is extremely silent because the alliance form can change until just before the technical briefing session, and if the united front form is disclosed in advance, it can lead to weaknesses from competitors.”

The Bank of Korea plans to schedule a separate technical briefing soon so bidders can explain their technical characteristics. The final preferred bidder will be selected by combining the technical score and the proposed price score.

When the final agreement is reached with the preferred bidder on project details, schedule, and price, the official project will begin. The Bank of Korea aims to start the project in August, and this CBDC simulation project will be conducted in two phases. When the first stage test is completed by December, the second stage test will be carried out by June next year.

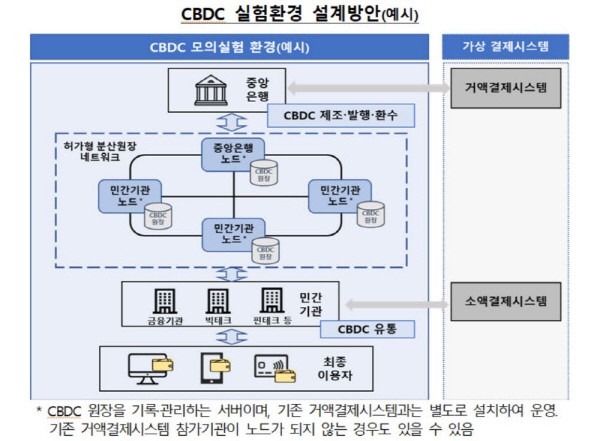

The first step is to review the technical feasibility of basic issuance, distribution, and redemption in a distributed ledger-based CBDC simulation environment. A CBDC ticketing system supportingcentral bank operations such as electronic wallet management of participating institutions, will be arranged to test whether it works properly.

The main goal of the second phase is to expand the central bank's CBDC distribution business. It will reviewsupport for cross-border remittance, digital asset purchase, offline payment, etc., and new technologies to strengthen personal information protection.

By Staff Reporter Ok-jinBaewithok@etnews.com