South Korea’s semiconductor and display equipment markets had been cold in the third quarter just like the first half of last year. Although DRAM and NAND flash memory prices are starting to recover, semiconductor device manufacturers are still thinking over the appropriate timing of their investments causing little impact on the markets. The display equipment market has gone through another difficult time as Samsung Display’s investment into next-generation large display is expected to create positive effects starting from 2020.

Semiconductor equipment market has another difficult quarter in the third quarter

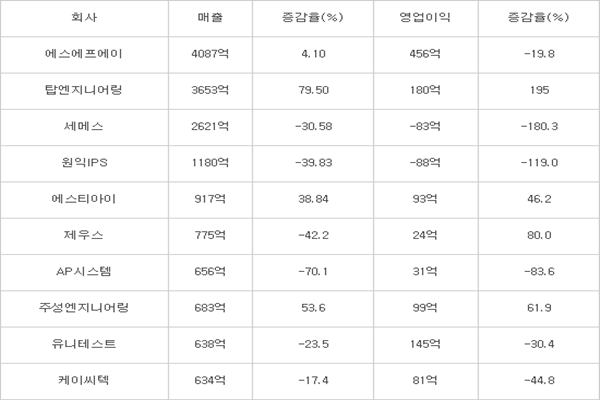

SEMES, which is the top South Korean semiconductor equipment manufacturer, has recorded a loss for three quarters in a row by recording an operating loss of $7.05 million (8.3 billion KRW) in the third quarter. Compared to the third quarter of 2018, its operating profit decreased by about 180%. WONIK IPS also recorded an operating loss of $7.48 million (8.8 billion KRW).

TES, EO TECHNICS, and Eugene Technology also saw their operating profits decreased by 148.66%, 59.28%, and 58.22% respectively compared to the third quarter of 2018.

Fact that Samsung Electronics and SK Hynix, two main semiconductor manufacturers in South Korea, have drastically reduced their investments in plant and equipment has caused poor performance of semiconductor equipment manufacturers. Although they had bought necessary equipment in 2018 while ‘super memory semiconductor boom’ was taking place, they have caused a huge blow to semiconductor equipment manufacturers this year due to sudden lack of semiconductor demands.

Fact that conflict between the U.S. and China, which are the two biggest buyers, has become worse due to the current trade war has created a huge negative impact on South Korea’s semiconductor market.

The U.S. has many data center companies such as Google, Amazon, Facebook, and Microsoft while China’s Smartphone manufacturers such as Huawei, OPPO, and VIVO are the main customers of Samsung Electronics and SK Hynix.

“New demands will be created once the trade war between the U.S. and China settles down.” said a representative for the industry.

While most of semiconductor equipment manufacturers are going through a difficult time, there are also companies that have continued to grow their businesses such as STI that focuses on CCSS (Central Chemical Supply System).

STI has practically been the only one that has supplied its CCSS to South Korean semiconductor device manufacturers. As a result, its operating profit in the third quarter was $7.90 million (9.3 billion KRW) that is 46.28% increase compared to the third quarter of last year.

STI publicly announced last month that it would construct a new plant by investing $33.1 million (39 billion KRW).

Although semiconductor equipment manufacturers are going through a difficult time this year, they predict that the situation is starting to become better.

“Although it had been difficult until the third quarter, we are expecting to recover our performance as the situation has become little bit better.” said a high-ranking official of a semiconductor equipment manufacturer.

“We heard that SEMES is expecting a turnaround due to a positive performance in the fourth quarter and that it is looking to make more than $1.53 billion (1.8 trillion KRW) in sales next year.” said a representative of another semiconductor equipment manufacturer. “It seems that SEMES is predicting that the market will recover.”

However, some predicts that the market will recover at a slow pace.

“Investments will start to take place once the second half of 2020 comes.” said a representative for the industry. “This is because it will take some time for the trade conflict between the U.S. and China to settle down and for the 5G market to be established fully.”

South Korea’s display equipment industry expects bigger things in 2020

South Korea’s display equipment market saw most of manufacturers’ sales and operating profits fall in the third quarter except for few top manufacturers. It seems that many investments that were initially scheduled have been delayed as South Korean display manufacturers have focused on increasing the production yield of OLED and saw aggressive investments by Chinese companies into LCD slow down a bit. Most of display equipment manufacturers had had a difficult time in the third quarter yet again followed by the first half of this year.

SFA, which recorded the most sale in the third quarter, made $347 million (408.7 billion KRW) in sales (including its subsidiaries) in the third quarter and saw its sales increase by 4.1% compared to its sales in the third quarter of last year. However, its operating profit ($38.7 million (45.6 billion KRW)) decreased by 19.8%. Due to increased new orders for OLED equipment and increased sales from semiconductor equipment and general distribution equipment, forecast of its performance in 2020 has become brighter.

Its expectation on the fact that its attempt in new areas such as equipment for secondary battery can lead to positive result has also grown.

TOP Engineering made $310 million (365.3 billion KRW) and $15.3 million (18 billion KRW) in sales and operating profit respectively in the quarter and saw its sales and operating profit increase by 79.5% and 195% respectively compared to the third quarter of last year due to the fact that the performance its subsidiary called POWERLOGICS has been added to the performance of TOP Engineering since the first quarter of last year. POWERLOGICS, which primarily focuses on camera modules, saw its sales and operating profit in the third quarter grow by 82.9% and 99.8% respectively compared to the third quarter of last year.

AP System, which is going through a difficult time due to reduced investments from Samsung Display, made $55.7 million (65.6 billion KRW) and $2.63 million (3.1 billion KRW) in sales and operating profit respectively in the quarter and had to see its sales and operating profit decrease by 70.1% and 83.6% respectively compared to the third quarter of last year. It is looking to overcome current crisis by replacing Samsung Display, which was responsible for most of its sales, with Chinese panel manufacturers.

Its performance is expected to recover in 2020 as Samsung Display has decided to invest into QD display and is planning on investments related to foldable display.

Jusung Engineering made $58.0 million (68.3 billion KRW) and $8.41 million (9.9 billion KRW) in sales and operating profit respectively and saw its sales and operating profit grow by 53.6% and 61.9% respectively compared to the third quarter of last year as its semiconductor and display equipment businesses have grown evenly. Its performance was positively affected by LG Display’s investment into its OLED plant in Guangzhou and supply of equipment to SK Hynix.

In the first half, 65.1% and 34.7% of its sales came from semiconductor equipment and display equipment respectively. In the third quarter, percentages became 54.7% and 45.2% respectively as its sales from display equipment for LG Display’s fabrication facility in Guangzhou were applied. It seems that display equipment will be a bigger part of its sales in the fourth quarter as well.

Staff Reporter Bae, Okjin | withok@etnews.com & Staff Reporter Kang, Hyeryung | kang@etnews.com