While number of exports and performance of South Korea’s major robotic companies in the first half of this year became worse compared to the first half of last year, status of South Korea’s robotics industry in the second half of this year is also unclear. This is because there is a high chance that Chinese robotics market, which is the biggest export market for South Korean robotics companies, will shrink as the trade war between the U.S. and China prolongs. Unstable number of exports will also act as a negative factor for them as well. Some say that South Korean Government needs to accelerate their R&D support for small robotics companies.

According to South Korea’s robotics industry and relevant associations, prediction on the performance of South Korean robotics companies in the second half has become unclear due to the trade war between the U.S. and China.

“Growth of Chinese robotics market has slowed down compared to the last year.” said a representative for the robotics industry. “Current trade war between the U.S. and China is partially responsible for the slowdown and it is likely that the trade war will continue to have some sort of negative effect until the end of this year.”

China is the biggest export market for South Korean robotics companies. In 2017, amount of exports to China was $455 million (551.7 billion KRW). On the other hand, amounts of exports to the U.S., Japan, and others were $119 million (143.8 billion KRW), and $69.8 (84.6 billion KRW), and $222 million (268.8 billion KRW) respectively.

Chinese robotics market has recently started to shrink in size. According to a Chinese robotics association’s analysis based on information from IFR (International Federation of Robotics), Chinese robotics market sold 135,000 robots in 2018 that is 3.7% reduction compared to the number of sales in 2017. This is the first time Chinese robotics market made a growth backwards since 2013 and it was mostly due to slow Chinese economy and the trade war that picked up steam starting from the second half of last year.

South Korea’s major robotics companies saw their performance become lower in the first half of this year compared to the first half of last year. After analyzing semiannual reports of major robotics companies such as Hyundai Heavy Industries’ robotics sector, Robostar, T-Robotics, SMEC, Hyulim ROBOT, Robotis, Yujin Robot, all of their performance except for SMEC was lower in the first half of this year compared to the first half of last year. Companies such as Meere Company and Koh Young Technology that specialize in surgical robots also saw their performance in the first half lower compared to the first half of last year. Basically, entire robotics industry in South Korea saw their performance drop.

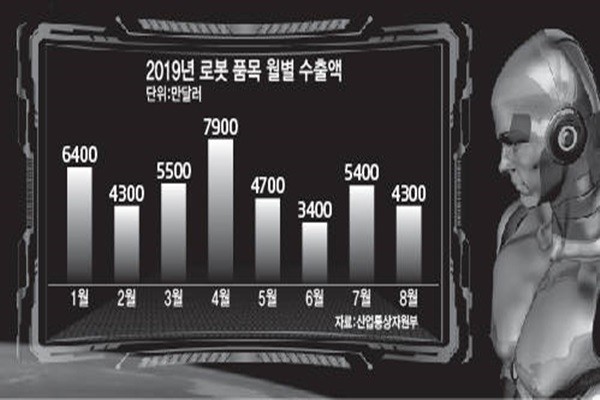

Amount of exports for South Korean robotics companies was also lower this year compared to the last year. According to Ministry of Trade, Industry and Energy (MOTIE), amount of exportation of robots in the first half of this year was $323 million that is 8.5% reduction compared to the first half of last year. Amount of exports in July was 8.1% lower compared to July of last year while the amount of exports in August actually 4.1% higher compared to August of last year.

Sudden increase and decrease in the first half show how weak South Korea’s robotics industry is. While amount of exports in April was $79 million and was 24.6% higher compared to April of last year, the amount of exports in June was $34 million and was 45.3% lower compared to June of last year.

It is easy for South Korean robotics companies to be swayed by outside changes as they are relatively small and the amounts of their exports are not much either. According to MOTIE, only Hyundai Heavy Industries and Robostar make more than $165 million (200 billion KRW) in annual sales out of 718 manufacturing robot companies. Most of service robot companies are also small except for Samsung Electronics, LG Electronics, Yujijn Robot, Robotis and EveryBot. Out of 472 service robot companies, 322 of them make less than $825,000 (1 billion KRW) in annual sales.

Some say that South Korean Government needs to accelerate its R&D support so that robotics companies can prepare foundations for their growth.

“Robotics industry is slowly shifting from industrial robot to service robot.” said a different representative for the robotics industry. “Predictions will be different depending on the growth of service robot markets in the second half.”

Staff Reporter Byun, Sanggeun | sgbyun@etnews.com