Performance of top five semiconductor equipment manufacturers in the world in the second quarter dropped all together due to lack of semiconductor demands that has continued since the second half of 2018 and sharp reduction in sales from South Korean market. These manufacturers are Applied Materials, Lam Research, and KLA from the U.S., ASML from Netherland, and TEL (Tokyo Electron) from Japan. They have significant influence on relevant markets as they own about 70% of the shares of semiconductor equipment markets in the world.

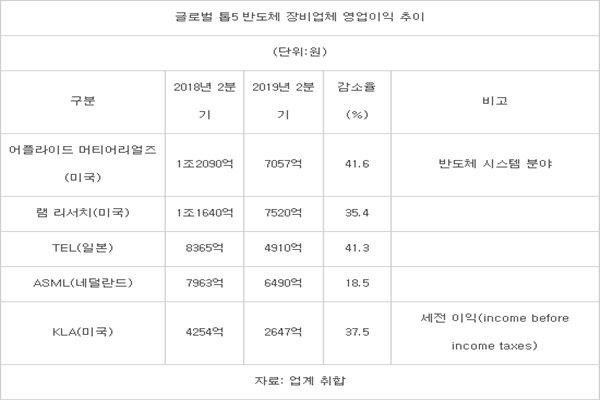

Applied Materials, which is the top semiconductor front-end equipment manufacturer in the world, made $579 million in operating profit from semiconductor system field in the second quarter. This amount is 41.6% lower than the amount of operating profit it earned in the second quarter of 2018. Tokyo Electron also saw its operating profit ($408 million (493.7 billion KRW)) drop by 41.3% compared to the second quarter of 2018. The amount combines sales from semiconductor and display equipment.

Lam Research, which is known for its etching equipment, also saw its operating profit drop. It made $617 million in operating profit in the second quarter that is 35.6% decrease from its operating profit ($958 million) in the second quarter of 2018. ASML, which is the only one out of the five to supply EUV (Extreme Ultraviolet) photolithography equipment, also saw its operating profit drop 18.5% from $521 million (630.1 billion KRW). All five manufacturers’ operating profits dropped by more than 20% since the first quarter and their operating profits in the second quarter dropped by similar percentage or even more except for ASML.

They also saw their sales from South Korean market drop as well. While Applied Materials made $1.232 billion, which is 27% of its entire sales, from South Korean market alone in the second quarter of 2018, it only made $441 million, which is about 13% of its entire sales, in the second quarter of this year. TEL, which made overwhelming sales in South Korea, made $835 million (88.9 billion Yen) from South Korean market alone in the second quarter of 2018. However, it only made $347 million (36.9 billion Yen) in this past second quarter.

Fact that there is no sign of recovery in demands for memories is the major cause of reduction of their sales. Samsung Electronics and SK Hynix both saw their second quarter performance take a hit due to lack of semiconductor demands. Since the beginning of this year, they have been stating through many channels that they will be conservative on facility and equipment investment. In addition, SK Hynix is starting to reduce its output while Samsung Electronics is planning to adjust items and its output by adjusting its production lines. South Korean market is important for equipment manufacturers as it is responsible for 25 to 30% of their sales.

Uncertain international state also impacted their performance. Due to continuous trade conflict between the U.S. and China, Chinese businesses that are one of the biggest investors in the semiconductor market are slowly letting up their investments. CEO Peter Wennink of ASML said that he met with representatives from South Korean semiconductor industry and discussed about current geopolitical issue when he visited South Korea in May. Trade war between South Korea and Japan is also one of huge factors on facility and equipment investment. “Because foreign companies that are recording operating profit ratio of 20% or over are struggling, South Korean companies that have relatively weak foundation need to hold up throughout the rest of this year.” said a representative for a semiconductor equipment manufacturer.

Staff Reporter Kang, Hyeryung | kang@etnews.com