27th of this month marks the first anniversary since unitary regulation of paid broadcasting industry was abolished. unitary regulation was put into effect on the 28th of June of 2015 for three years and it has stirred controversies as some members of the National Assembly have been pushing for extension of this regulation even after it was abolished.

Although Ministry of Science and ICT (MSIT) presented ex-post regulation as an alternative to unitary regulation, there has yet to be any discussion due to the crippled operation of the National Assembly. Discussions towards government bills are urgently needed as market conditions continue to change.

◊Did unitary regulation have any positive effect?

The National Assembly voted for a revision of Broadcasting Act in May of 2015 and stated ‘limitation to monopoly within paid broadcasting market’ and ‘development of balance between media’ as political goals. It limited number of members of a particular paid broadcasting business to 33% of number of members of entire paid broadcasting industry such as IPTV, cable TV, and satellite TV. Its plan was to keep its concern for monopoly by KT, which is the top paid broadcasting business, in check and encourage competitions within the industry by helping cable TV businesses to secure competitiveness.

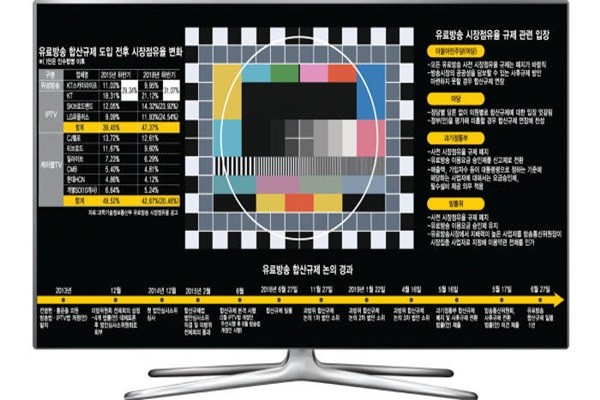

However, unitary regulation could not overcome reorganization of paid broadcasting market. Market share of KT and KT SkyLife increased from 29.34% in 2015 to 31.07% by the second half of 2018. During same period, SK Broadband’s market share increased from 12.05% to 14.32% while LG Uplus also saw its market share go up from 9.09% to 11.93%.

On the other hand, market shares of cable TV businesses fell from 49.52% and 42.67% and fell behind of IPTV businesses.

It is difficult to say that monopoly was eased while unitary regulation was in place, and balance between media was not achieved as well. Since unitary regulation was abolished, LG Uplus acquired CJ HelloVision while SK Telecom merged SK Broadband and t-Broad. Acquisitions and mergers placed cable TV businesses’ places within paid broadcasting industry are placed at the crossroads.

◊Monopoly issue eased even through absence of unitary regulation

The National Assembly needed three years to have clear evaluation and analysis on causes of success or failure in order to extend unitary regulation. While this premise requires preparation of supplement policies and discussion of extension, it is difficult to find any discussion based on data unitary. Although there at least needs to be a discussion on whether 33% is an appropriate limit, it is difficult to deny the fact that discussions are focused on either one-year extension or two-years extension.

Based on recent market trends, concentration of paid broadcasting market eased up even when unitary regulation was abolished and this has led to limiting monopoly by KT. LG Uplus’ market share will increase to 24.54% once it successfully acquires CJ HelloVision. Market share of SK Broadband and t-Broad will also increase to 23.92% and thus narrowing the gap between them and KT by more than two times compared to the gap before.

On the other hand, unitary regulation will limit expansion of platforms by allowing KT’s market share to approach 33% once it is introduced again. Fact that KT will give opportunities only to its competitors to increase their members at once while its feet are bound by unitary regulation will not be fair.

Ultimately, unitary regulation will limit competitions and it does not help welfare of consumers as well.

“Even when a business develops an excellent product and decides to sell it, it will not be able to sell the product if it is limited by market share restriction.” said Professor Park Min-soo of Sungkyunkwan University. “Ex-ante regulation towards market share is not advisable.”

◊Need for the National Assembly to discuss about supplement measures

Speed of changes of media market is becoming faster as global media such as Netflix and YouTube expand their influence within South Korean market. Paid broadcasting market is faced with a task of increasing their competitiveness in contents by implementing economy of scale through active M&A.

Broadcasting industry cannot be seen just from market perspective. However, as reorganization of structure of paid broadcasting industry started already, South Korean Government must secure public benefits of paid broadcasting industry by preparing reasonable ex-post regulations, resolving concerns for monopoly, and maintaining regionality.

At the moment, it is difficult to see that extension of unitary regulation will keep monopoly in check or increase public interests within broadcasting market.

MSIT presented a plan that will strengthen ex-post regulation by having abolishment of ex-ante regulation towards market share as the premise. Korea Communications Commission caused a controversy when it suggested few different opinions.

Although discord within South Korean Government is a problem, fact that proper evaluations and discussions towards government plans are not taking place due to a political strife within the National Assembly is a bigger problem. Ultimately, this issue leads to market uncertainty that even prevents businesses such as D’Live selling their businesses voluntarily.

The National Assembly stated that it will push for a legislation that will extend unitary regulation if there is not any adequate alternative. Uncertainty can only be solved if conclusions towards government plans are made as soon as possible.

“Extension of unitary regulation will cause reorganization of structure of paid broadcasting market to lose ‘golden time’.” said a representative for the paid broadcasting industry. “Although insufficient, we hope that the National Assembly will reach a conclusion soon since the government presented alternatives.”

Staff Reporter Park, Jisung | jisung@etnews.com