The downturn in the semiconductor market has hit upstream production as well. With semiconductor manufacturers reducing investments due to economic recession, the aftermath is reaching the equipment industry. With cases of planned purchases being cancelled showing up, concerns are being raised about the aftermath of the semiconductor recession.

According to the industry on the 25th, it was determined that SK Hynix cancelled a considerable portion of their semiconductor equipment purchases at the end of last year. After requesting delays in shipment starting from the 2nd quarter of last year when the semiconductor market was in a slump, they resorted to cancelling the order altogether in the 4th quarter.

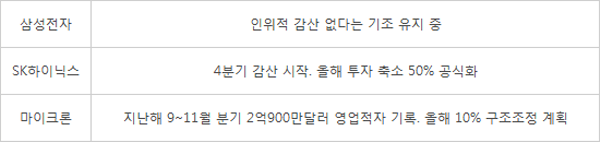

Multiple members of the semiconductor equipment industry said that, “We received many semiconductor equipment orders up to the first half of last year, but after numerous delays, they announced that they would reduce their equipment investments in 2023 by 50% and went on to cancel their order.” SK Hynix announced the reduction of investments in October, when they announced their 3rd quarter results, and cancellations began appearing then.

There is an emergency in the equipment industry. This is because it is difficult to recover the cost of equipment development and preparation for production. In order to complete a piece of equipment, they purchase the necessary parts and materials in advance. This is because the equipment must be delivered to the customer at the time they request.

In the past, even if the delivery date was delayed, semiconductor manufacturers compensated for losses, such as those incurred in development, to a certain extent by adding additional payment in their next equipment purchase. However, as semiconductor manufacturers are likely to turn losses as of late and it is unclear when orders will be placed again, increasing the likelihood of losses.

SK Hynix revealed that, “While it is true that the number of orders for new equipment has been reduced, we are continuing orders to switch over to next-generation processes and supplement existing equipment.”

The materials and parts industries, which has been doing relatively well, is also in a state of panic. When a semiconductor factory is in operation, the demand for materials and parts arises continuously. This is because production requires materials. However, if the utilization rate drops due to production cuts, the supply of materials and parts will be inevitably reduced. It has been said that the impact of volume reduction has already begun to appear in memory testing and post-processing.

Not only SK Hynix, who formalized investment and production cuts, but Micron has also gone into austerity management, with reduction in manpower following operating losses in the 4th quarter last year. The impact on upstream production is projected to grow. If Samsung Electronics, Korea’s biggest company and no.1 in memory, starts to cut production and reduce investments, the material, parts, and equipment industry will inevitably plunge further. As their production volume is higher than that of SK Hynix, their impact on their partners will be greater.

A CEO of a material company dealing with Samsung Electronics said that, “Though there are currently no big issues in the supply of memory materials, we are uncertain if this trend will continue,” and said that, “February~March will be a watershed for the industry.”

<Key Memory Company Reduction and Investment Plan Situation>

(Data : Industry Aggregation)

By Reporter Dongjoon Kwon djkwon@etnews.com