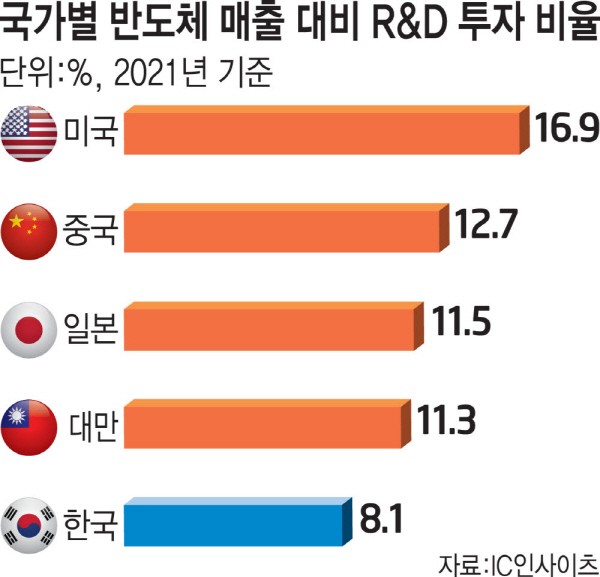

Last year's investment ratio was single digits with 8.1%

'Severely' large gap compared to the US, China and Taiwan

Focus on domestic fabless maturation process

Securing system semiconductor capabil

The ratio of R&D investment to sales of semiconductor companies in Korea was the only one among major countries that did not exceed 10%. This is being interpreted asa widening gap in semiconductor fabless, despite the small difference in R&D investment ratio in the manufacturing sector. It was pointed out that there may be difficulties in securing system semiconductor capabilities in the future, because the R&D ratio is small compared to the US, China, Japan, and Taiwan.

According to IC Insights, a market research firm, the ratio of R&D investment to sales of domestic semiconductor companies last year was 8.1%. This figure is far behind the US' 16.9%, China's 12.7%, Japan's 11.5% and Taiwan's 11.3%. It recorded the lowest R&D ratio among key players in the global semiconductor market.

In the semiconductor manufacturing field, the gap between foreign companies was not large. Samsung Electronics and SK Hynix's R&D ratios were 8.1% and 9.4%, respectively. Considering that Taiwan's TSMC, the world's largest foundry, was 8.5% and Micron, the third largest in the memory industry, was 9.1%, the difference was not significant. Only Intel recorded an R&D ratio of over 20% last year. This seems to be the result of intensive investment in advanced processes to close the technology gap between Samsung Electronics and TSMC.

Although the R&D ratios in the semiconductor manufacturing industry were similar, the low overall ratio in Korea is believed to be due to the ratio of R&D investments in system semiconductors such as fabless. Semiconductor fabless takes up a large proportion of R&D compared to other areas in developing semiconductor intellectual property (IP) and security related software (SW). This is confirmed when looking at the R&D ratios of the top three fabless companies in the world, with Qualcomm recording 17.5%, Nvidia 23.5%, and Broadcom 13.3%. Taiwan's Media Tek also invested more than 20% of its sales in R&D.

However, LX Semicon, Korea's representative fabless, had an R&D investment ratio of 9% last year. There is an explanation as to why the R&D ratio has decreased slightly as the sales volume has grown. However, compared to overseas companies, it is not a good enough excuse. Even among the top domestic companies in fabless sales, there were companies with R&D ratios of less than 1%. Since these top fabless companies had minor R&D investments, the overall R&D ratio of semiconductors was found to be low.

An official from the semiconductor fabless industry said, “The R&D ratio may be small compared to overseas companies since top-selling fabless in Korea are focused on mature process products rather than developing advanced semiconductors," furthermore, “The R&D ratio may have decreased as a result of including design support companies such as design houses that do not directly participate in product development."

In addition, the results of this survey do not include the R&D expenses of the government, public institutions, and universities. There are many small and medium-sized enterprises (SMEs) in domestic fabless, which frequently carry out public R&D projects. This means that if we exclude public R&D cost support, the R&D investment ratio by companies themselves may fall further.

An industry official said, “It is necessary to increase the R&D ratio in order to develop system semiconductor technology development capabilities centering on fabless," and emphasized that, "There is an urgent need for measures to secure competitiveness in R&D by the companies themselves.”

Meanwhile, the government recently announced their 'Strategy to Become a Semiconductor Superpower' and selected 30 domestic fabless companies as 'Star Fabless,' providing them with comprehensive support such as technology development and overseas market expansion. It plans to expand R&D support for next-generation semiconductors such as power semiconductors, automotive semiconductors, and artificial intelligence (AI) semiconductors.

By Staff Reporter Yoon-sub Song (sys@etnews.com)and Dong-joon Kwon (djkwon@etnews.com)