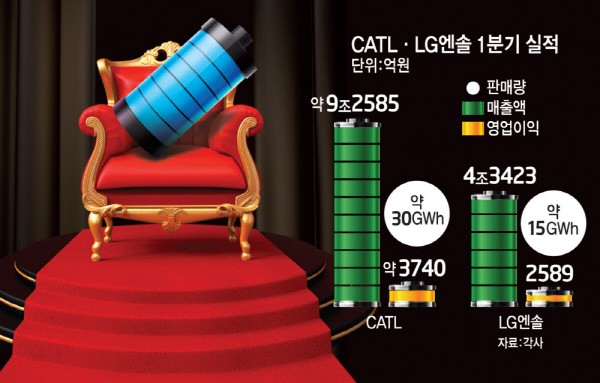

CATL’s battery sales volume and sales

Twice as much as LG Ensol

Impact of unstable supply for raw materials and semiconductors

Operating expenses increase and profit margins decrease

CATL, a Chinese company, sold about 30GWh of batteries in the first quarter which has the largest market share in the global battery market. They have doubled in sales and slightly higher operating profit than LG Energy Solutions, which sold 15GWh during the same period.

It is analyzed that CATL's margin structure is debased comparing to LG Energy Solution in a situation where the price of core materials such as lithium is rising suddenly.

CATL's sales were 48.678 billion CNY (about 9.2186 trillion KRW) in the first quarter of this year, an increase of 153.97% compared to the same period of the previous year. However, operating profit dropped 15.74% to 1.975 billion CNY (about 374 billion KRW).

LG Energy Solution's first quarter sales increased by 2.1% to 4.3423 trillion KRW compared to the same period of the previous year, and operating profit increased by 24.1% to 258.9 billion KRW.

CATL and LG Energy Solutions sold about 30GWh and 15GWh of batteries during the first quarter, therefore, CATL is about twice as much. Sales of CATL were about twice as much. However, the difference in operating profit between the two companies was 110 billion KRW, and CATL's operating profit rate was significantly lower than LG Energy Solution.

It seems that both companies were affected by the supply of raw materials and unstable supply for semiconductors for vehicles. However, CATL’s operating expenses in the first quarter were 41.628 billion CNY (about 7.9176 trillion KRW), an increase of 198.66% compared to the same period of the previous year. The company explained that not only did operating expenses increase with the increase in sales volume, but also the cost increased due to a sharp rise in the price of some raw materials.

CATL showed their intention to raise battery prices in the future by saying saying, "The lithium prices is going up too fast, so we have negotiated with customers to jointly deal with the pressure of rising costs."

On the other hand, from LG Energy Solution, demand for cylindrical batteries supplied to Tesla has steadily increased despite rising raw material prices and a shortage of automotive semiconductors.

An industry official said, "Since CATL is mainly sold in China, their operating profit is relatively low because price-linked contracts that cannot be compensated by customers when raw material prices rise."

By Staff Reporter Tae-jun Park (gaius@etnews.com)