As South Korea’s display industry is starting to revolve around OLED while it used to revolve around LCD, many within the industry are emphasizing the need for a “super-gap” in competitive edge in order for the industry to continue to lead the global display market. They believe that their industry needs to develop key technologies before other countries such as China and continue to widen the gap between them and foreign industries.

Electronics Industrial Skills Council (EISC) recently made diagnosis on trends within the global display market and tasks that South Korea’s display industry is currently facing through its report on “Seeing Next-Generation Display Industry through CES 2020”.

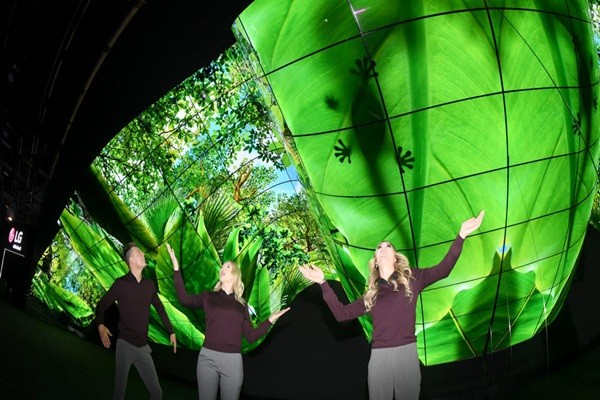

The report chose 8K, mini LED and microLED, and unrestricted form factor (appearance) as major topics of displays that were displayed during CES 2020. Although it did not see innovations similar to that of last year, it believes that the global display industry has entered a phase where it is able to commercialize products using new technologies that were introduced last year and has upgraded new technologies and performance.

EISC emphasized the need to secure “super-gap” technologies through strategic investments between the public and private sectors considering the fact that display technologies have become more advanced and that other countries’ pursuit after South Korea will become even more intense. Its belief is based on its confirmation from CES 2020 that China’s pursuit as a fast follower after South Korea has become even faster and that China’s technologies in display have progressed significantly.

“Many imitative products using panels from South Korean display makers were displayed and there were even companies that plagiarized concepts from the exhibition.” said the report. “We need to seriously be aware of intellectual property infringement by other countries and outflow of human resources.”

EISC emphasized that the display industry needs to secure high value added advanced technologies in all areas such as panel, materials, and equipment in order for South Korea to continue to lead the global display market. It calls upon government supports such as R&D support paired with panel makers’ roadmaps for their new businesses, expansion of tax exemption, and eased regulations.

It is also necessary to prepare nurturing systems that can provide outstanding individuals to materials, components, and equipment industries and programs that provide support for employment as soon as possible. According to the report, the percentage for lack of manpower in next-generation display industries in 2019 was higher than other industries.

EISC also pointed out that there is especially a lack of supply of professionals for introduction of new technologies, efficient processes, and development of fundamental technologies compared to demands. It also suggested a training for incumbents for the transition process from LCD to OLED and a retiree support program that can prevent an outflow of human resources to foreign countries.

“The government needs to carefully analyze demands from materials, components, and equipment makers related to display and provide a systematic education program to balance supply and demand in long term.” said EISC. “There is a need for expanding employment policies to provide R&D personnel for small and medium-size companies that are located outside of metropolitan cities.”

Staff Reporter Yoon, Heeseok | pioneer@etnews.com